- United States

- /

- Electrical

- /

- NYSE:VRT

A Fresh Look at Vertiv Holdings (VRT) Valuation After New Caterpillar Partnership in Data Center Solutions

Reviewed by Simply Wall St

Vertiv Holdings (VRT) just revealed a new strategic partnership with Caterpillar, aimed at creating integrated power generation and cooling solutions for data centers. This collaboration is designed to address key data center energy challenges.

See our latest analysis for Vertiv Holdings Co.

Vertiv’s momentum has been hard to ignore, with a surge in demand for data center solutions fueling a 45% share price return year-to-date and standout results like a 28% jump over the last 90 days. Recent moves, such as this Caterpillar alliance and a hefty 67% dividend increase announced days ago, underscore how the company is building both operational strength and investor confidence for the long haul. This is reflected in an impressive 1-year total shareholder return of 36% and a staggering 3-year total return above 1100%.

If you’re interested in other innovators capitalizing on the explosive growth of next-gen technology, the tech and AI screener is a perfect place to find new opportunities — See the full list for free.

But with the stock’s rapid ascent and positive news momentum, is there still untapped value in Vertiv Holdings? Alternatively, could the market already be factoring in much of its future growth potential?

Most Popular Narrative: 11.6% Undervalued

With Vertiv's fair value pegged at $194.63 by the most popular narrative, the share price of $172.02 suggests more upside may still be on the table. This narrative frames Vertiv as a company on the brink of a major cycle in data center growth, making its current valuation look compelling based on forward assumptions.

Ongoing investments in R&D and engineering, highlighted by collaborations with industry leaders (e.g., CoreWeave, Dell, Oklo), position Vertiv to deliver next-generation solutions ahead of technology refresh cycles. This creates recurring upgrade opportunities and sustains top-line and earnings growth.

Could the fair value really be built on future-proof technology partnerships? The secret sauce of this valuation lies in just how much recurring revenue and profit expansion analysts see coming, much more than what a typical industrial stock might forecast. Want to discover which financial levers are being pulled to set such a high bar? Dive into the full narrative to uncover what’s fueling these ambitious projections.

Result: Fair Value of $194.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain disruptions or slower-than-expected margin improvements could present challenges for Vertiv in maintaining its current growth trajectory and strong valuation outlook.

Find out about the key risks to this Vertiv Holdings Co narrative.

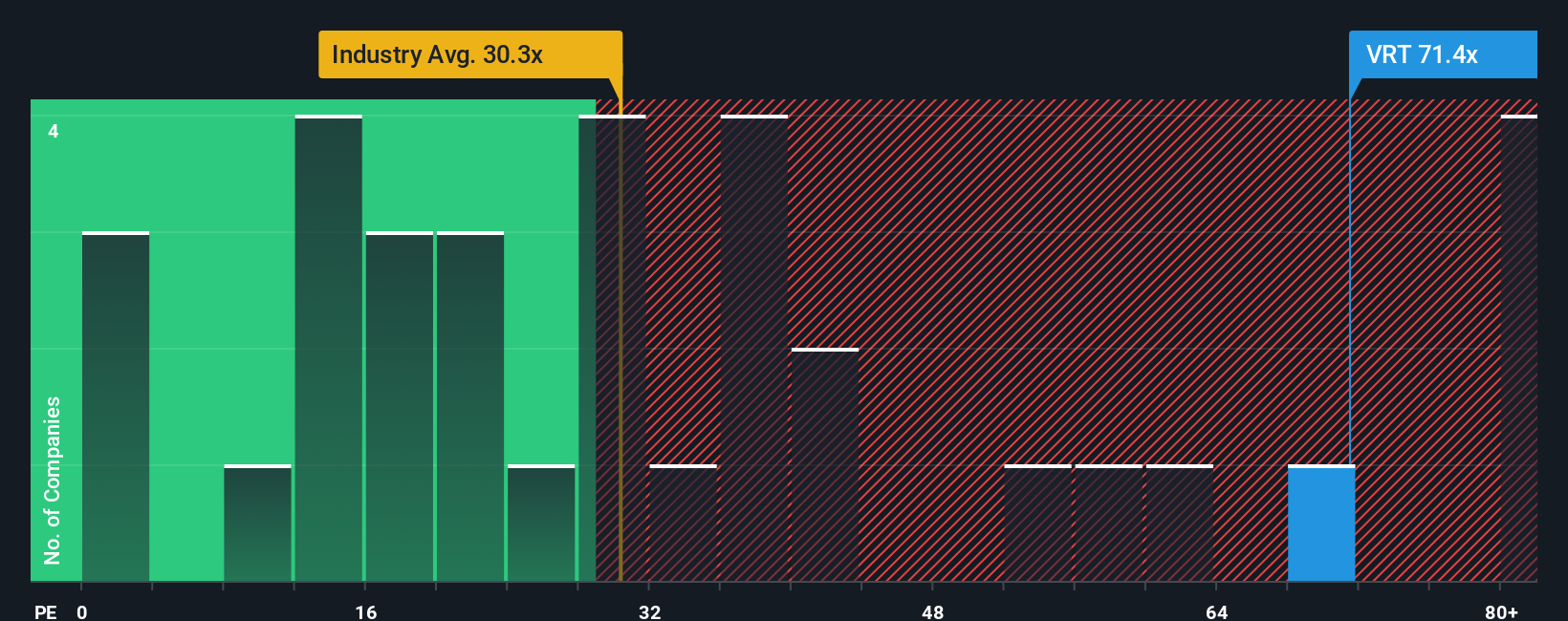

Another View: Looking at Valuation Ratios

Switching perspectives, Vertiv currently trades at a price-to-earnings ratio of 63.6x. This figure is well above both the US Electrical industry average of 30.8x and its peer average of 37x. Even the fair ratio, calculated at 62.5x, is slightly below Vertiv’s level. This highlights a premium valuation and raises questions about the margin for error if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertiv Holdings Co Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a few minutes to craft your own take on Vertiv Holdings. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertiv Holdings Co.

Looking for More Smart Investment Ideas?

Bring your portfolio up to speed with new opportunities. These handpicked lists can help you spot market trends before others catch on.

- Boost your passive income goals with higher-yield picks found through these 15 dividend stocks with yields > 3% that offer attractive returns and consistent payouts.

- Ride the momentum in artificial intelligence by targeting companies identified among these 25 AI penny stocks that are transforming industries right now.

- Tap into the potential for rapid growth with these 3578 penny stocks with strong financials positioned for a breakout thanks to strong financials and untapped markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success