- United States

- /

- Construction

- /

- NYSE:VMI

Valmont Industries (VMI): Assessing Valuation After Q3 Earnings Beat and Raised Outlook

Reviewed by Simply Wall St

Valmont Industries (NYSE:VMI) gained investor attention after reporting third-quarter results that exceeded both revenue and earnings expectations. Strong performance in the Infrastructure segment, along with double-digit growth in utility and telecom, drove these results.

See our latest analysis for Valmont Industries.

Momentum appears to be building for Valmont Industries after its strong Q3 results and raised outlook, with the past month’s 13.5% share price return pushing its year-to-date gain to nearly 37%. Over the last twelve months, total shareholder return stands at 32.9%. This is a clear sign that investors are responding positively to management’s focus on infrastructure growth, recent share buybacks, and new leadership in the finance team.

If Valmont’s consistent performance and recent guidance lifted your curiosity, consider broadening your watchlist and discover fast growing stocks with high insider ownership.

With shares near all-time highs and management raising its outlook, the key debate now is whether Valmont Industries is undervalued after this run or if the market has already priced in the company’s future growth.

Most Popular Narrative: 2.2% Undervalued

With the most popular narrative estimating fair value at $427.50, only modestly above Valmont Industries' $418 last close, the company currently trades near the consensus fair price range.

Infrastructure investment and the accelerating energy transition are driving unprecedented demand in utility and transmission, supported by record customer backlogs and industry-wide capacity constraints. Valmont's advanced investments in capacity, automation, and AI are expected to unlock between $350 and $400 million in incremental annual revenue and support higher earnings and margins as this multi-year cycle unfolds.

Ever wonder what powers a premium price for Valmont? This narrative’s central thesis combines bold earnings ambitions with shifting industry forces, and a projected financial transformation built on careful assumptions. Dive in to unpack the specifics and uncover the story behind these projections.

Result: Fair Value of $427.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing volatility in infrastructure spending or disruptive shifts in core markets could quickly challenge the assumptions that support this positive outlook.

Find out about the key risks to this Valmont Industries narrative.

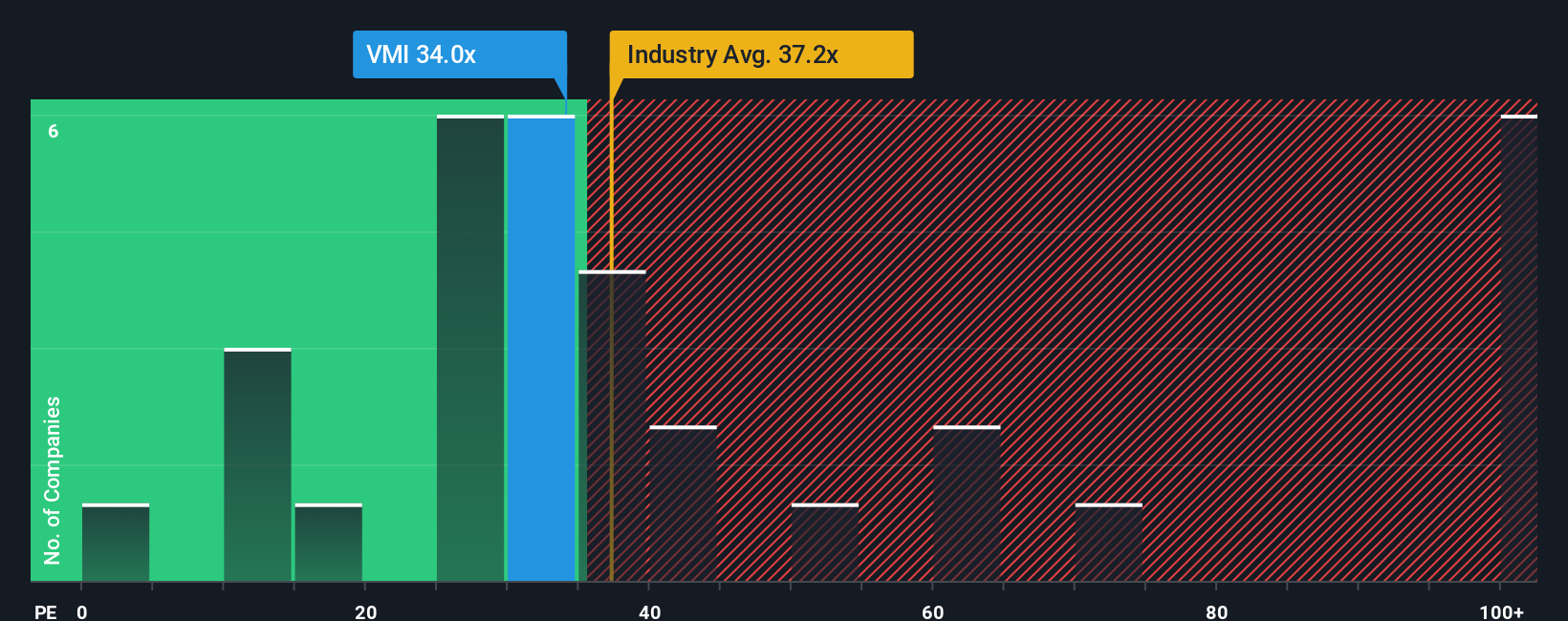

Another View: Gauging Value with Market Multiples

Looking at Valmont Industries through the lens of the price-to-earnings ratio paints a different picture. The company trades at 35.3x earnings, noticeably above both its peer average of 24.8x and the fair ratio of 27.7x that the market might eventually revert to. This premium suggests investors are paying up for future growth. However, if sentiment shifts or growth falls short, the stock could quickly lose its luster. Is this optimism justified, or does it heighten valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valmont Industries Narrative

If you’d rather draw your own conclusions or want to put the numbers to the test yourself, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Valmont Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Every savvy investor knows that opportunity rarely waits. Take charge and get ahead of the curve by acting on data-driven stock ideas that others might overlook.

- Accelerate your returns with steady income by targeting these 17 dividend stocks with yields > 3%, which offers robust yields above 3% for powerful compounding.

- Tap into cutting-edge possibilities in medicine by checking out these 33 healthcare AI stocks, fueling innovation at the intersection of healthcare and artificial intelligence.

- Capture breakout potential early by seeking out these 3567 penny stocks with strong financials, which shows strong fundamentals and is positioned for dramatic growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VMI

Valmont Industries

Operates as a manufacturer of products and services for infrastructure and agriculture markets in the United States, Australia, Brazil, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives