- United States

- /

- Trade Distributors

- /

- NYSE:URI

United Rentals (URI): Assessing Valuation After Analyst Upgrades, Buyback Boosts, and Higher Guidance

Reviewed by Kshitija Bhandaru

A fresh wave of analyst upgrades and renewed buyback plans have set the tone for United Rentals (URI) this week. Investor optimism has picked up, as the company increased its revenue guidance and short interest moved lower.

See our latest analysis for United Rentals.

United Rentals’ share price has gained meaningful momentum recently, with growing confidence in the rental sector and management’s improved outlook helping to lift sentiment. This comes after a year in which its total shareholder return reached 24%, and the latest wave of analyst upgrades and larger buybacks suggests optimism for longer-term growth is building.

If you’re watching how positive news can shift momentum, this is a chance to explore fast growing stocks with high insider ownership.

Yet with United Rentals’ stock near all-time highs following upbeat analyst upgrades and raised forecasts, investors now face the key question: Is there still value to unlock here, or has the market already priced in the next phase of growth?

Most Popular Narrative: 2.8% Overvalued

With United Rentals closing at $987.34, the most widely followed narrative calculates a fair value nearly $27 below the market price. This sets the stage for a debate about how much future growth is already built into the current share price.

The company is expanding its Specialty business through new cold starts, which grew 22% year-over-year and 15% pro forma. This growth is anticipated to positively impact both revenue and net margins as the business becomes a larger share of total sales.

Curious about the bold assumptions powering this valuation? The narrative hinges on sustained business expansion and a profit outlook that could surprise even seasoned investors. Want to discover exactly what key forecasts push the fair value above Wall Street’s consensus? Explore the narrative and see what sets this price apart from the crowd.

Result: Fair Value of $960.48 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, high capital expenditures and a slowdown in large project demand could quickly challenge this growth story if market conditions become less favorable.

Find out about the key risks to this United Rentals narrative.

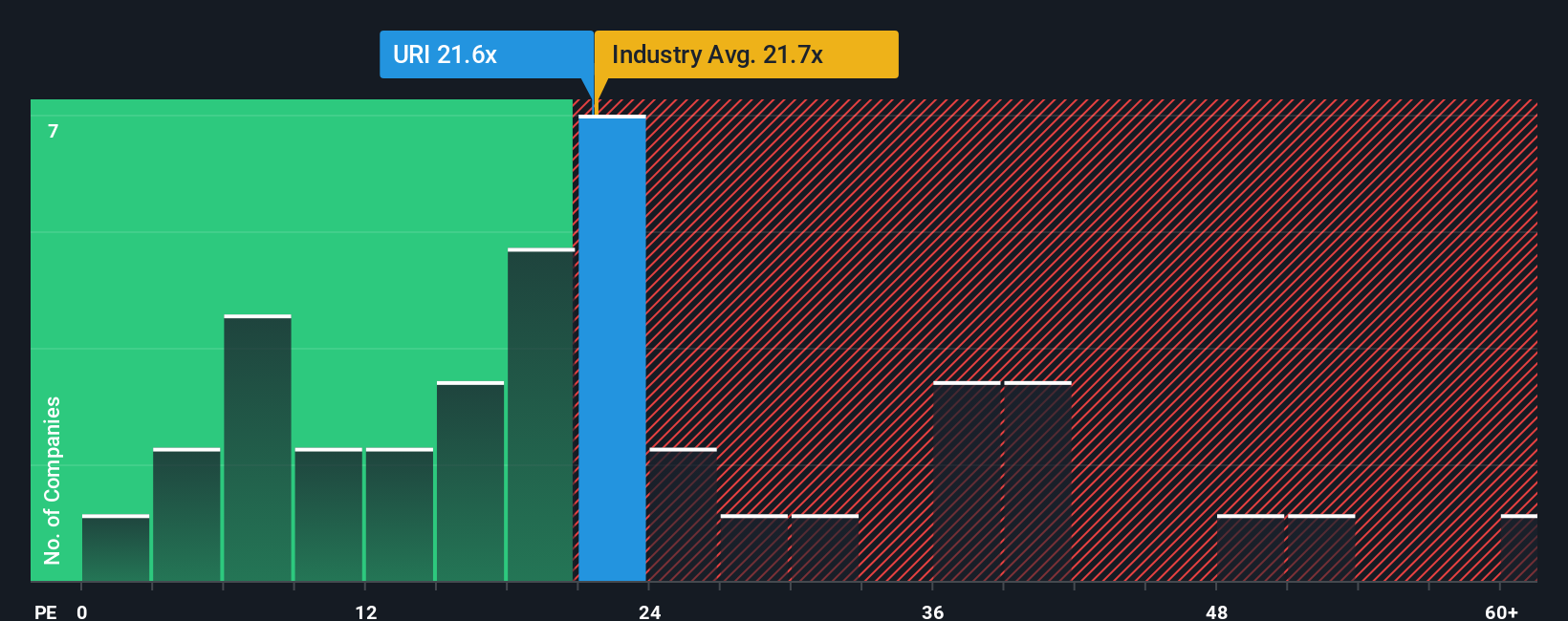

Another View: Multiples Tell a Different Story

Looking through a price-to-earnings lens, United Rentals trades at 25x earnings, which is just below the peer average of 25.2x but above the industry’s 22.7x. That means it is not especially cheap, despite being under the fair ratio of 31.7x, so valuation risk is still present. Will the gap to the fair ratio close, or will current premium pricing persist?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Rentals Narrative

If you see things differently or want to dig into the data on your own terms, it’s easy to build your own take in just a few minutes. Do it your way

A great starting point for your United Rentals research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Act on your advantage by uncovering stocks others overlook, positioning yourself early in tomorrow’s market leaders, and tapping into smart strategies before they go mainstream. Don’t miss these tailored opportunities:

- Spot high yields and steady returns when you review these 19 dividend stocks with yields > 3%, designed for income-focused investors seeking reliable payouts above 3%.

- Unlock the potential of advanced technology by examining these 26 quantum computing stocks, where forward-thinking companies are shaping the quantum computing era.

- Get ahead of market trends and find strong-value plays among these 894 undervalued stocks based on cash flows, allowing you to invest with confidence in stocks favored by healthy cash flow dynamics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:URI

United Rentals

Through its subsidiaries, operates as an equipment rental company.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives