- United States

- /

- Trade Distributors

- /

- NYSE:URI

Is United Rentals’ 41% Rally Justified After Recent Construction Boom?

Reviewed by Bailey Pemberton

If you have been eyeing United Rentals, you are certainly not alone. This has been a stock with serious momentum, and investors everywhere are weighing their next move. With shares closing at $978.22, United Rentals has delivered a remarkable 41.8% year-to-date return and soared an incredible 405.2% over the past five years. Even just this past week, the stock notched a tidy 5.0% lift. Moves like that make people wonder whether more gains are ahead or whether all the upside has already been priced in.

What is fueling all this energy? Part of the answer lies in the growing optimism around the equipment rental sector as businesses large and small ramp up spending. Market watchers have pointed to a favorable outlook across infrastructure and construction, both key industries for United Rentals, which has helped reduce perceived risk and boosted the company’s appeal among both new and long-term investors.

But the story does not end with price charts. Investors also want to know: with such explosive growth, is United Rentals still undervalued? To get a clearer read, analysts use several methods to score a company’s valuation. Right now, United Rentals earns a valuation score of 2 out of 6, signaling that it is considered undervalued by two of the key valuation checks.

Let us dig deeper into those valuation approaches and what each one says about United Rentals. And after that, I will share a smarter way to think about whether the stock is truly a bargain or not.

United Rentals scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: United Rentals Discounted Cash Flow (DCF) Analysis

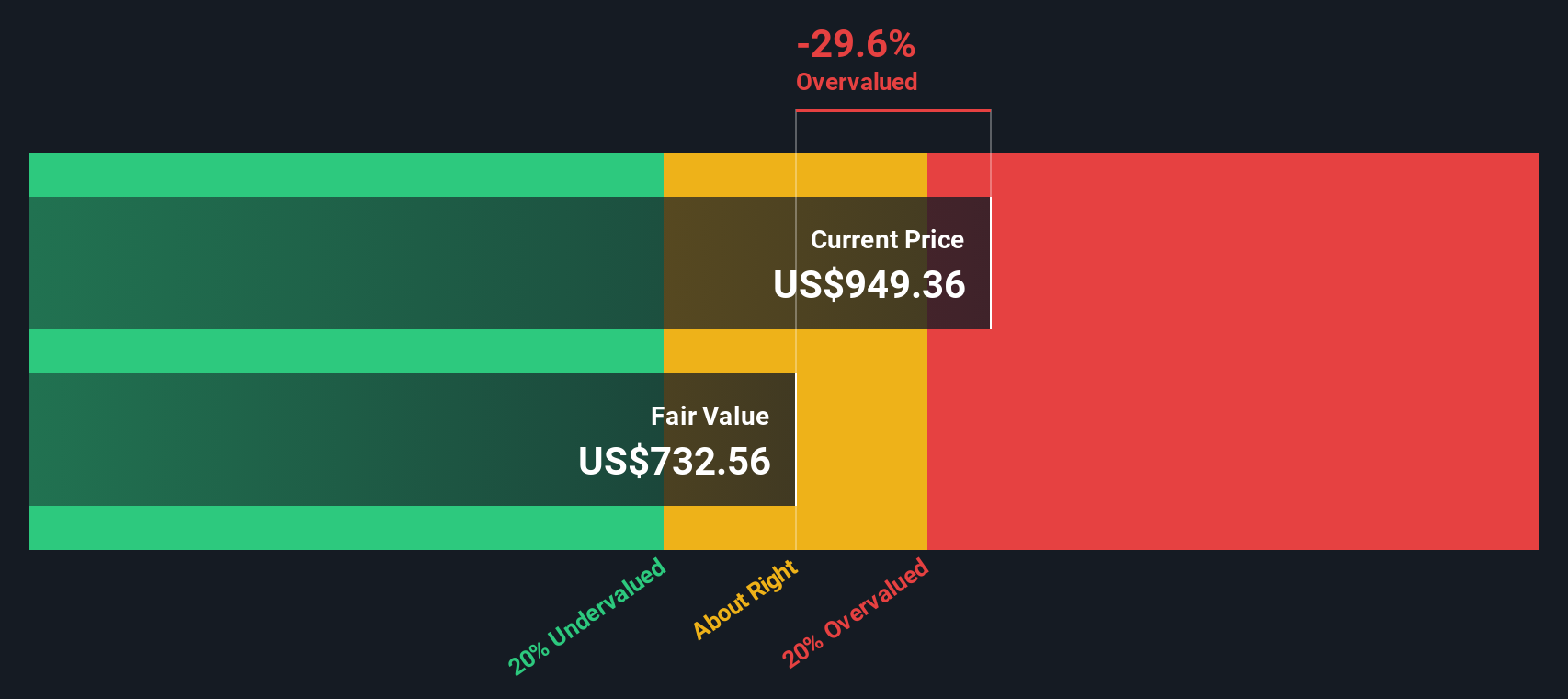

The Discounted Cash Flow (DCF) model estimates a company's worth by forecasting future cash flows and then discounting them to reflect their present value. This approach aims to pinpoint the intrinsic value of a business, using realistic assumptions about growth and profit over time.

For United Rentals, analysts begin with the latest reported Free Cash Flow (FCF) of $2.00 Billion. Projections over the next decade see FCF rising gradually, with analyst estimates available for the next five years and further years extrapolated by Simply Wall St. By 2029, United Rentals’ annual free cash flow is anticipated to reach roughly $3.03 Billion, before continuing to increase at a slower rate in subsequent years.

Based on these projections, the DCF model indicates an intrinsic value of $678.36 per share. With United Rentals’ shares currently trading at $978.22, the stock is estimated to be 44.2% overvalued according to this method. In other words, the model suggests that today’s price has run well ahead of the calculated fair value for the business.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Rentals may be overvalued by 44.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: United Rentals Price vs Earnings (PE)

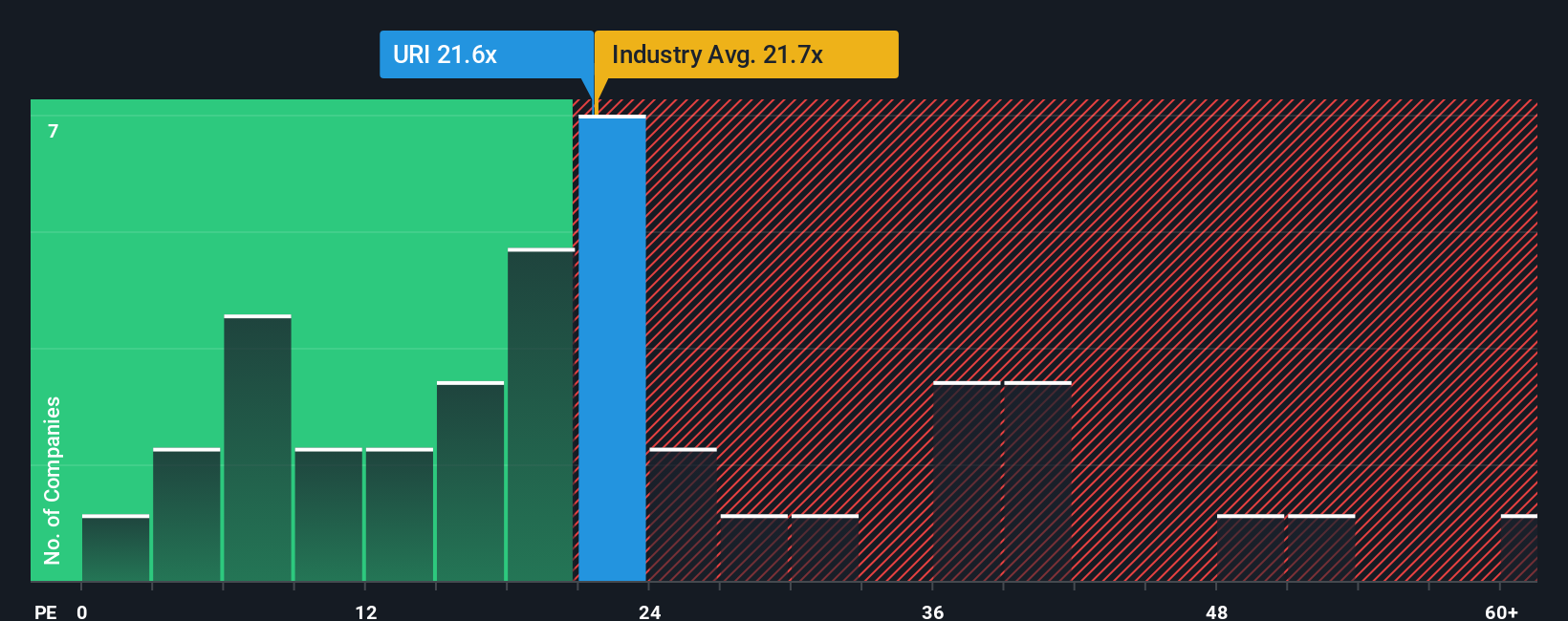

The Price-to-Earnings (PE) ratio is a go-to valuation metric for profitable companies like United Rentals because it tells us how much investors are willing to pay for each dollar of a company's earnings. Generally, a "normal" or "fair" PE ratio is influenced by how fast the company is expected to grow and the risks it faces compared to its peers and the broader market. Strong growth prospects and lower risk typically warrant a higher PE ratio, while higher risk or weak growth would call for a lower ratio.

Right now, United Rentals trades at a PE ratio of 24.8x. For context, the average PE among its industry peers is 25.2x. The broader Trade Distributors industry sits lower, averaging 22.8x. At first glance, this suggests the stock is reasonably valued compared to these benchmarks.

However, Simply Wall St’s proprietary “Fair Ratio” model dives deeper by incorporating United Rentals’ specific earnings growth rate, profit margins, industry, market cap, and unique risk profile. This model calculates a Fair PE Ratio of 31.6x for United Rentals, notably higher than its current 24.8x mark. This approach is a step above simple peer or industry comparisons because it is tailored to the company’s own financial outlook and risk-adjusted potential.

Comparing the Fair Ratio (31.6x) with the current PE (24.8x), United Rentals appears to be trading below what would be expected based on its own fundamentals and outlook. That points to the shares being undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Rentals Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your story about a company, describing what you expect for future growth, earnings, and margins, and how those assumptions lead to your own idea of a fair value, tying a company’s past and future directly to a price you believe is justified.

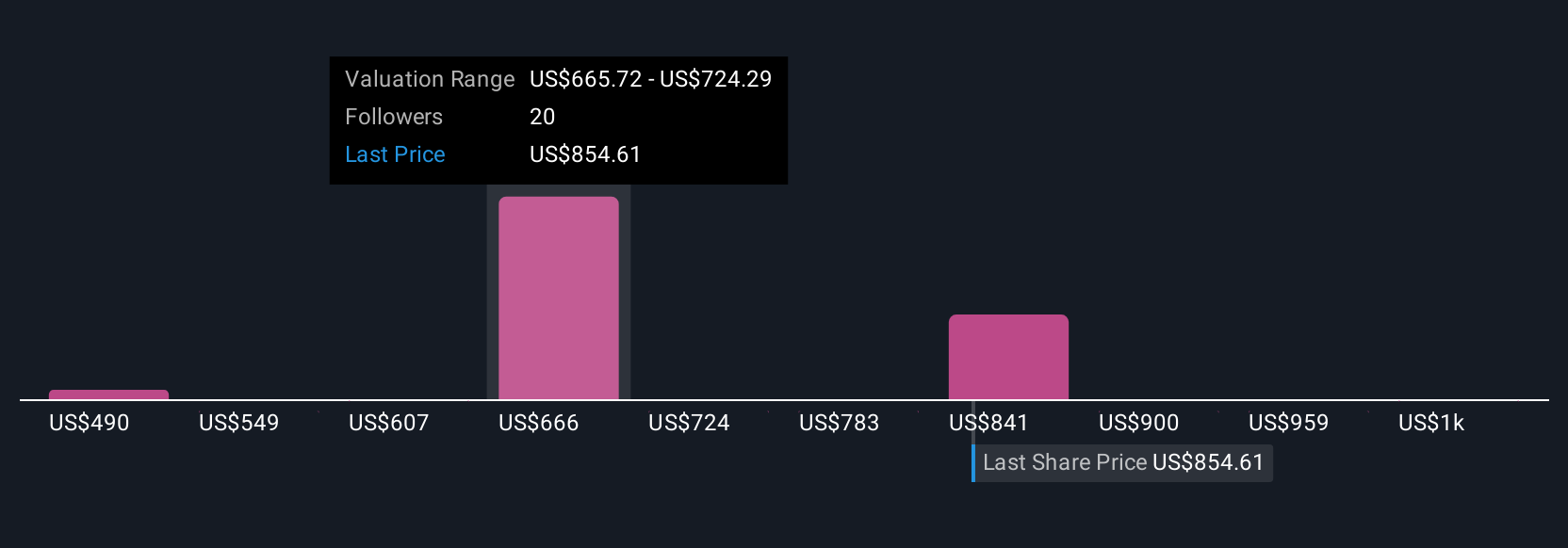

Unlike standard valuation models, Narratives connect the qualitative and the quantitative, empowering investors to link their personal insights about United Rentals (or any company) to a financial forecast and a confidently estimated fair value. On Simply Wall St’s Community page, millions of users can easily create Narratives that update automatically with new earnings or breaking news. This makes them a practical tool for tracking how your perspective compares to reality over time.

This means you can see, at a glance, where your view stands versus others and whether United Rentals’ current price justifies a buy, hold, or sell, since every Narrative directly compares Fair Value with the live market price. For example, depending on their outlooks, some investors see United Rentals’ fair value as high as $1,075 while others estimate a more cautious $592. This shows how Narratives adapt to each individual’s expectations and help guide smarter decisions as new data emerges.

Do you think there's more to the story for United Rentals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:URI

United Rentals

Through its subsidiaries, operates as an equipment rental company.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives