- United States

- /

- Building

- /

- NYSE:TT

Trane Technologies (TT) Margin Gains Reinforce Bullish Narrative Despite Rich Valuation

Reviewed by Simply Wall St

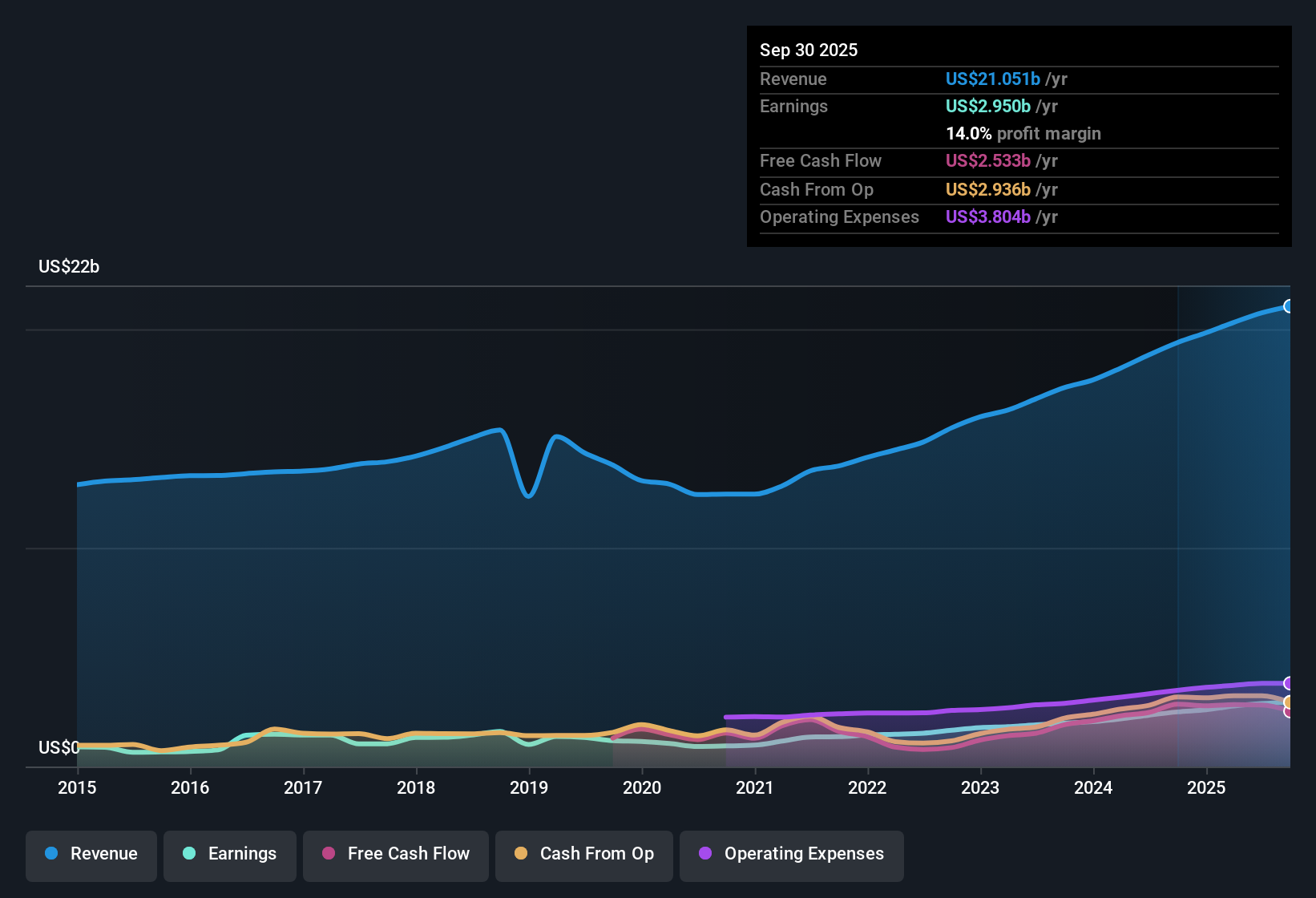

Trane Technologies (TT) posted a net profit margin of 13.9% this quarter, up from 12.5% last year, with EPS growth of 22.3% over the past year. This outpaced its five-year annual average of 21%. Currently trading at $446.37 per share, the stock is priced well above its calculated fair value of $333.39 and at a substantial premium to both industry and peer average multiples. With earnings forecast to grow at 9.7% per year alongside revenue growth of 7%, the company continues to deliver margin expansion, even as its forward growth may trail the broader US market.

See our full analysis for Trane Technologies.Next, we will examine how these headline numbers compare to the market narratives that shape sentiment around Trane Technologies and see which stories hold up, as well as which get tested by the latest results.

See what the community is saying about Trane Technologies

PE Ratio Leaps Past Industry Norms

- Trane Technologies is trading at a Price-To-Earnings ratio of 34.6x, comfortably above the US building industry average of 19.1x and the peer group’s 29.1x. This suggests the market is valuing its growth prospects at a significant premium.

- Analysts' consensus narrative flags that this premium may only be justified if Trane delivers on projected earnings growth and margin improvements.

- Forecast annual earnings growth is set at 9.7%, trailing broader US market averages. As a result, the 34.6x multiple puts pressure on management to exceed expectations over the coming years.

- Consensus notes that with profits expected to reach $3.7 billion by 2028, up from $2.9 billion, the stock must sustain both high growth and profitability to validate its current valuation premium.

- For a deeper dive on how valuation and growth expectations shape the consensus narrative, step inside the detailed analysis in the consensus view for Trane Technologies. 📊 Read the full Trane Technologies Consensus Narrative.

Strategic Focus Drives Margin Expansion

- Net profit margins have increased from 12.5% to 13.9% over the past year. This underlines a sustained trend of margin expansion linked to operational execution and pricing power.

- Consensus narrative highlights that the company’s focus on innovation, direct market engagement, and effective price realization has contributed to these higher margins.

- Diversified growth from sectors like data centers and healthcare has provided stability against sector-specific volatility. This allows Trane to maintain profitability even as certain verticals face headwinds.

- Productivity gains and proactive pricing strategies are believed to be offsetting inflation, supporting the consensus view that margin growth is unlikely to be a short-term spike.

Share Repurchases Add EPS Tailwind

- Analysts expect the number of shares outstanding to decline by 1.11% annually over the next three years. This signals ongoing buyback activity that could provide an incremental boost to earnings per share beyond organic profit growth.

- According to the consensus narrative, this capital allocation decision is seen as a disciplined strategy for enhancing shareholder value.

- By concentrating earnings per share through repurchases, Trane can amplify the impact of rising net profits and margin improvements. This may potentially support share price resilience even if top-line growth moderates.

- Consensus notes that while the core business fundamentals drive earnings, buybacks serve as a key lever for offsetting near-term market or industry slowdowns by improving EPS optics.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Trane Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to interpret the figures your way? It only takes a few minutes to transform your outlook into a custom narrative. Do it your way.

A great starting point for your Trane Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite recent profit gains, Trane Technologies faces questions around its high valuation premium and whether it can meet earnings growth expectations, which lag the broader market.

If you want alternatives with more attractive pricing and less valuation risk, explore these 834 undervalued stocks based on cash flows for companies the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Trane Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TT

Trane Technologies

Designs, manufactures, sells, and services of solutions for heating, ventilation, air conditioning, and custom and transport refrigeration.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion