- United States

- /

- Building

- /

- NYSE:TREX

Trex Company’s Q3 Earnings Growth: Is the Market Pricing TREX Shares Fairly?

Reviewed by Simply Wall St

Trex Company (TREX) just released its third quarter earnings, revealing sales and net income gains over last year. The results drew attention from investors, as they reflect solid improvement in core business operations.

See our latest analysis for Trex Company.

Despite solid earnings growth and recent moves to expand its distributor network, Trex Company’s short-term momentum has continued to fade, with a one-year total shareholder return of -34.9% and a year-to-date share price return of -31.1%. The stock’s three-year total return remains positive. However, recent declines suggest investors are weighing near-term challenges alongside long-term growth potential.

If you’re watching for the next breakout opportunity, now’s a great time to broaden your scope and discover fast growing stocks with high insider ownership

With shares trading at a steep discount to analyst targets despite solid earnings growth, the question now is whether Trex is undervalued or if the market is already accounting for its future prospects. Investors may consider whether there is a buying opportunity, or if expected growth is fully priced in.

Most Popular Narrative: 31.2% Undervalued

At $47.04, Trex Company’s last close sits well below the most popular narrative’s fair value estimate of $68.41. This gap comes as analysts weigh Trex's improving profitability outlook and resilience in a challenging sector.

Continuous manufacturing innovation, such as the rollout of Trex's new Arkansas facility and level-loaded production strategy, is already improving operational efficiency and is expected to result in structurally higher gross and EBITDA margins going forward.

Want to know why analysts think Trex’s future margins could rival elite manufacturers? The fair value is built on bold assumptions about revenue expansion, margin leaps, and rising earnings power. Uncover which financial forecasts push this narrative to a much higher target than today’s price.

Result: Fair Value of $68.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in core decking project demand and rising competition could challenge Trex's growth outlook and may temper current optimism in the market.

Find out about the key risks to this Trex Company narrative.

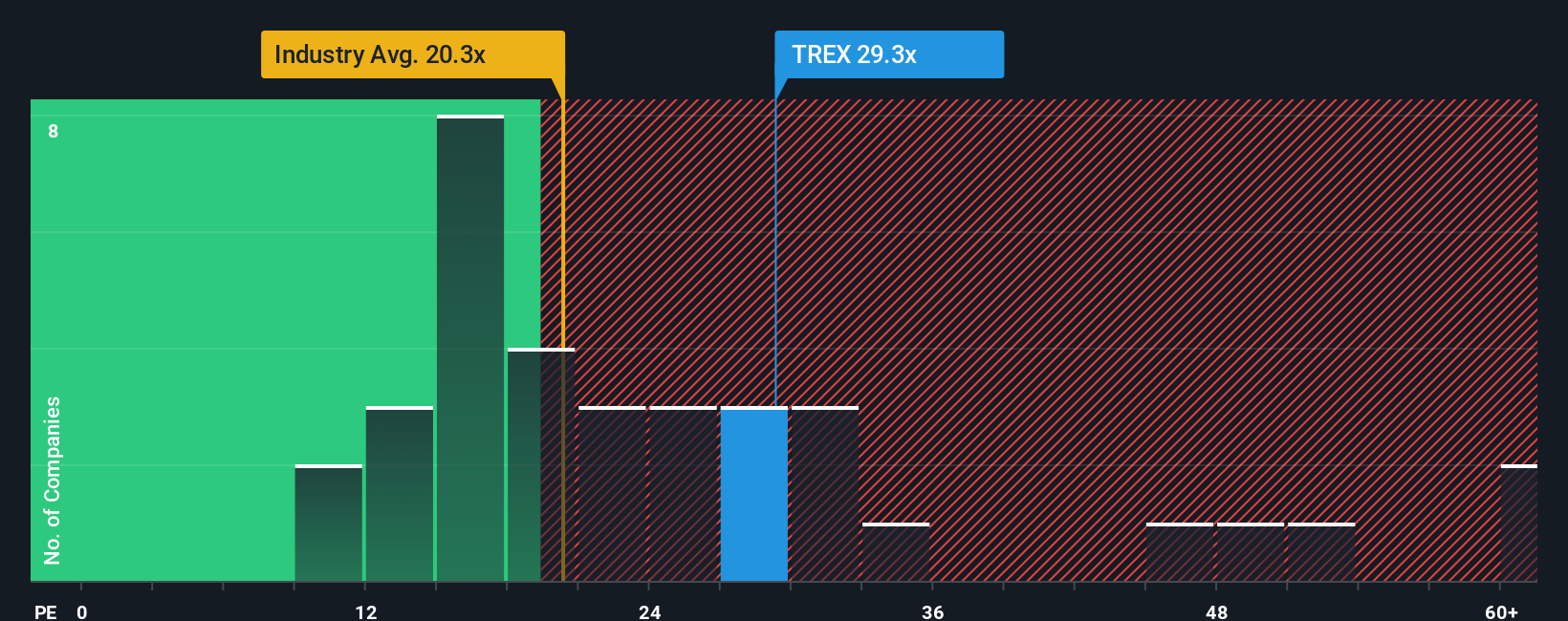

Another View: Looking at Valuation Multiples

While the earlier analysis pointed to Trex being undervalued, a closer look at its price-to-earnings ratio tells a different story. At 27x earnings, Trex is well above the US Building industry average of 20.8x and its peer group average of 21.1x. This suggests the stock may be expensive relative to the sector. Even the fair ratio points to a lower, more sustainable level of 28.7x. With this premium, is the market overestimating Trex’s future growth, or is there something unique about its business that justifies the higher multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trex Company Narrative

If you have a different take or want to dig deeper into the numbers yourself, you can easily shape your own Trex Company narrative in just a few minutes: Do it your way.

A great starting point for your Trex Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Expand your portfolio horizons with these compelling stock lists that spotlight tomorrow’s leaders, innovators, and value plays.

- Unlock the potential of under-the-radar companies by checking out these 3614 penny stocks with strong financials that stand out for solid financial strength and growth prospects.

- Capitalize on trends at the intersection of medicine and technology with these 33 healthcare AI stocks transforming patient care and healthcare infrastructure.

- Supercharge your income strategy by targeting these 20 dividend stocks with yields > 3% offering yields above 3% and consistent cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trex Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TREX

Trex Company

Manufactures and sells composite decking and railing products in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives