- United States

- /

- Building

- /

- NYSE:TREX

How Trex’s (TREX) Disappointing Q3 and Shareholder Investigations Will Impact Its Investment Outlook

Reviewed by Sasha Jovanovic

- Earlier in November 2025, Trex Company reported disappointing third quarter financial results, including a 12% drop in net income per share and a sharply lowered sales growth outlook for the year amid inventory reductions by channel partners.

- This update has raised concerns among investors, leading multiple law firms to launch investigations into potential securities law violations connected to Trex’s financial disclosures and practices.

- We’ll now look at how Trex’s revised sales outlook and ongoing shareholder investigations shape the company’s investment narrative and outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Trex Company Investment Narrative Recap

To remain a Trex shareholder, an investor needs to believe that long-term demand for eco-friendly composite decking will offset near-term pressures from cyclical market weakness and changing channel dynamics. The latest earnings miss and sharply reduced 2025 sales outlook bring near-term sales risk into sharper focus, especially as inventory reductions by channel partners temporarily suppress order flow, while new shareholder investigations add regulatory uncertainty that may weigh on sentiment in the months ahead.

One of the most relevant recent announcements is Trex’s lowered full-year sales guidance to flat versus 2024, after previously forecasting growth. This shift emerged alongside the Q3 earnings release and reflects wider inventory reductions and softer-than-expected activity in professional channels, directly impacting the key catalyst of market share gains in the replacement and remodel market. How successfully Trex can navigate this reset period will be important for rebuilding momentum after channel destocking abates.

By contrast, investors should be aware that the elevated risk of ongoing regulatory and legal reviews means the company’s disclosures could come under closer scrutiny...

Read the full narrative on Trex Company (it's free!)

Trex Company's outlook points to $1.5 billion in revenue and $333.1 million in earnings by 2028. This is based on an annual revenue growth rate of 10.2% and a $146.4 million increase in earnings from the current level of $186.7 million.

Uncover how Trex Company's forecasts yield a $43.74 fair value, a 41% upside to its current price.

Exploring Other Perspectives

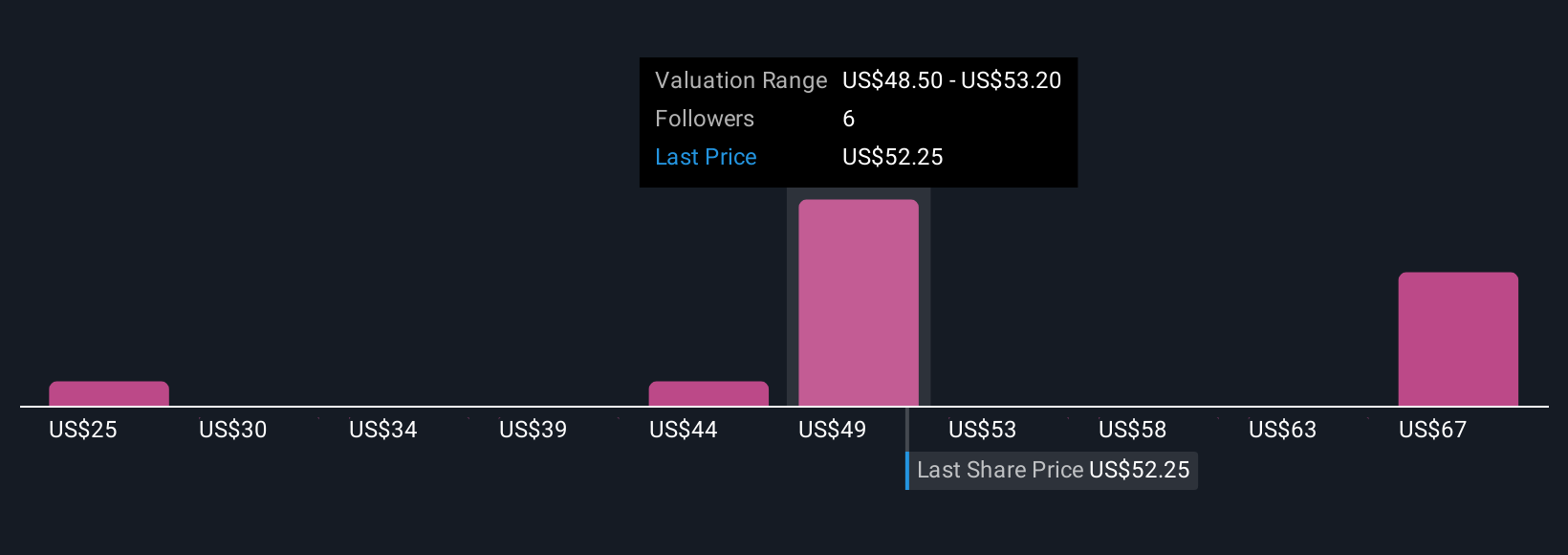

Four private users in the Simply Wall St Community estimate Trex’s fair value between US$25 and US$47.51 per share. With channel partner inventory reductions challenging near-term sales gains, these diverse viewpoints offer readers a window into how much opinions can differ on what Trex is truly worth.

Explore 4 other fair value estimates on Trex Company - why the stock might be worth 19% less than the current price!

Build Your Own Trex Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trex Company research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trex Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trex Company's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trex Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TREX

Trex Company

Manufactures and sells composite decking and railing products in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives