- United States

- /

- Construction

- /

- NYSE:TPC

Tutor Perini (TPC) Is Down 8.3% After Return to Profitability and Upbeat Growth Outlook - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Tutor Perini Corporation recently reported third quarter 2025 results, showing a return to profitability with sales rising to US$1.42 billion and net income of US$3.63 million, reversing losses from the previous year.

- Alongside the earnings, the company issued a positive outlook, noting both sustained business performance through 2025 and expectations for meaningfully higher revenue and earnings as new large construction projects enter the build phase in 2026 and 2027.

- Given Tutor Perini’s transition back to profitability and its optimistic guidance, we’ll now examine how this could reinforce its investment narrative centered around multi-year growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Tutor Perini Investment Narrative Recap

To be a Tutor Perini shareholder, you typically need confidence that the company can convert its record US$21.1 billion backlog into predictable multi-year growth, while minimizing historical pitfalls like cost overruns. The return to profitability and positive guidance for 2025–2027 support optimism, yet do not materially alter the biggest short-term catalyst, major project execution, or temper the leading risk: potential earnings volatility from large-scale job complexities. Among recent announcements, the Midtown Bus Terminal Redevelopment contract award stands out as highly relevant, directly feeding into the visible backlog growth fueling management’s upbeat multi-year outlook and reinforcing investor focus on future project ramp-ups. However, investors should also pay close attention to renewed execution risk if these mega-projects encounter unexpected cost or schedule hurdles...

Read the full narrative on Tutor Perini (it's free!)

Tutor Perini's outlook anticipates $7.1 billion in revenue and $515.9 million in earnings by 2028. Achieving this requires 14.2% annual revenue growth and a $648.2 million increase in earnings from the current level of -$132.3 million.

Uncover how Tutor Perini's forecasts yield a $85.75 fair value, a 38% upside to its current price.

Exploring Other Perspectives

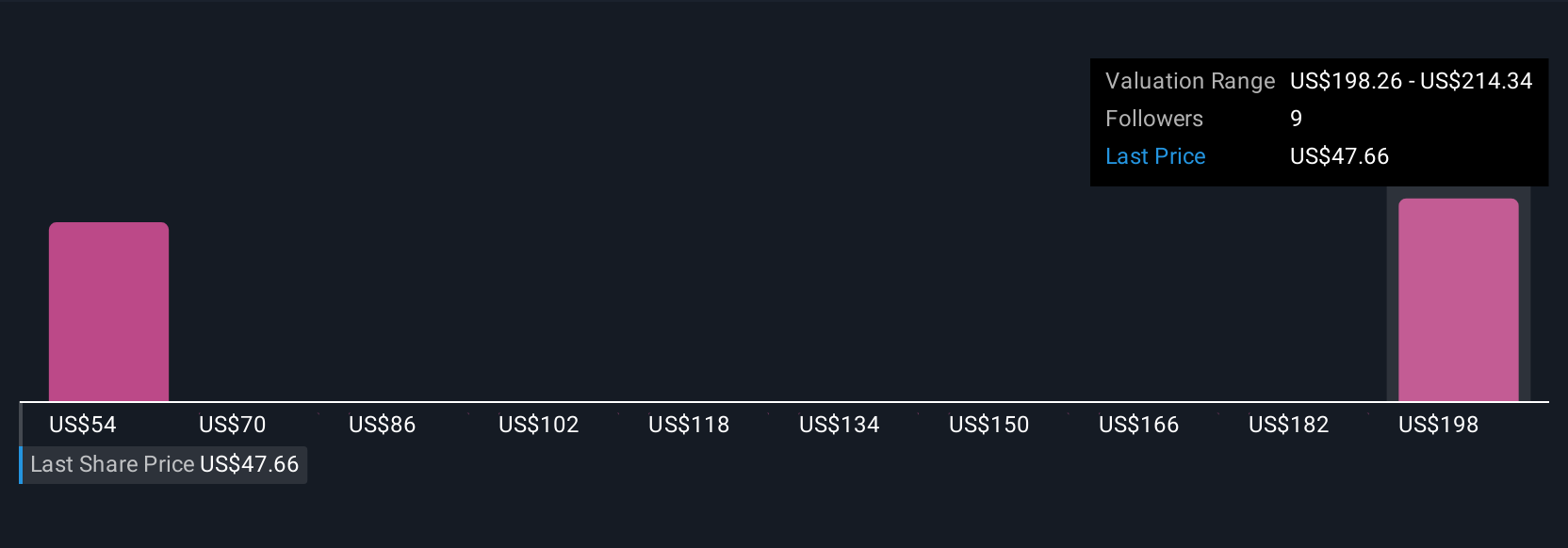

Five community members on Simply Wall St set fair values for Tutor Perini ranging from US$67 to US$90 per share. While backlog strength was identified as a key catalyst, execution risk remains front of mind for many, see what other market participants are factoring into their views.

Explore 5 other fair value estimates on Tutor Perini - why the stock might be worth as much as 45% more than the current price!

Build Your Own Tutor Perini Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tutor Perini research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tutor Perini research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tutor Perini's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tutor Perini might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPC

Tutor Perini

A construction company, provides diversified general contracting, construction management, and design-build services to private customers and public agencies worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives