- United States

- /

- Machinery

- /

- NYSE:TNC

Will the T360 Scrubber’s User-Friendly Design Shift Tennant’s (TNC) Equipment Strategy Narrative?

Reviewed by Sasha Jovanovic

- On October 14, 2025, Tennant Company launched the T360 mid-sized scrubber, featuring one-button controls, simplified maintenance, and up to three hours of cleaning from a maintenance-free GEL battery.

- This new model reflects Tennant's continued focus on user-friendly, productivity-oriented equipment designed for facility operators seeking convenience and effective cleaning solutions.

- We'll examine how the T360's ease of use and extended battery life could influence Tennant's overall investment narrative.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Tennant Investment Narrative Recap

To be a long-term Tennant shareholder, you need confidence in the company’s ability to innovate, maintain market share, and manage risks associated with input costs and regional sales exposure. While the T360 scrubber launch builds on Tennant’s focus on productivity and user-friendly solutions, it does not materially alter the primary near-term catalysts or the company’s most pressing risk: sustained volume and margin pressure in international markets, especially APAC and EMEA, given recent sales declines and a challenging macro backdrop.

Among recent announcements, the introduction of the Z50 Citadel Outdoor Sweeper in June stands out for its potential relevance to the current catalyst: expanding Tennant’s total addressable market. Both the Z50 and the new T360 reflect an ongoing effort to serve emerging customer needs and reinforce Tennant’s competitive position amid increasing global competition and evolving facility requirements.

However, while new products may attract some attention, keep in mind that ongoing softness in APAC and EMEA sales could still weigh heavily on results if...

Read the full narrative on Tennant (it's free!)

Tennant's outlook anticipates $1.5 billion in revenue and $138.4 million in earnings by 2028. This scenario depends on annual revenue growth of 5.2% and an increase in earnings of $77.7 million from the current $60.7 million.

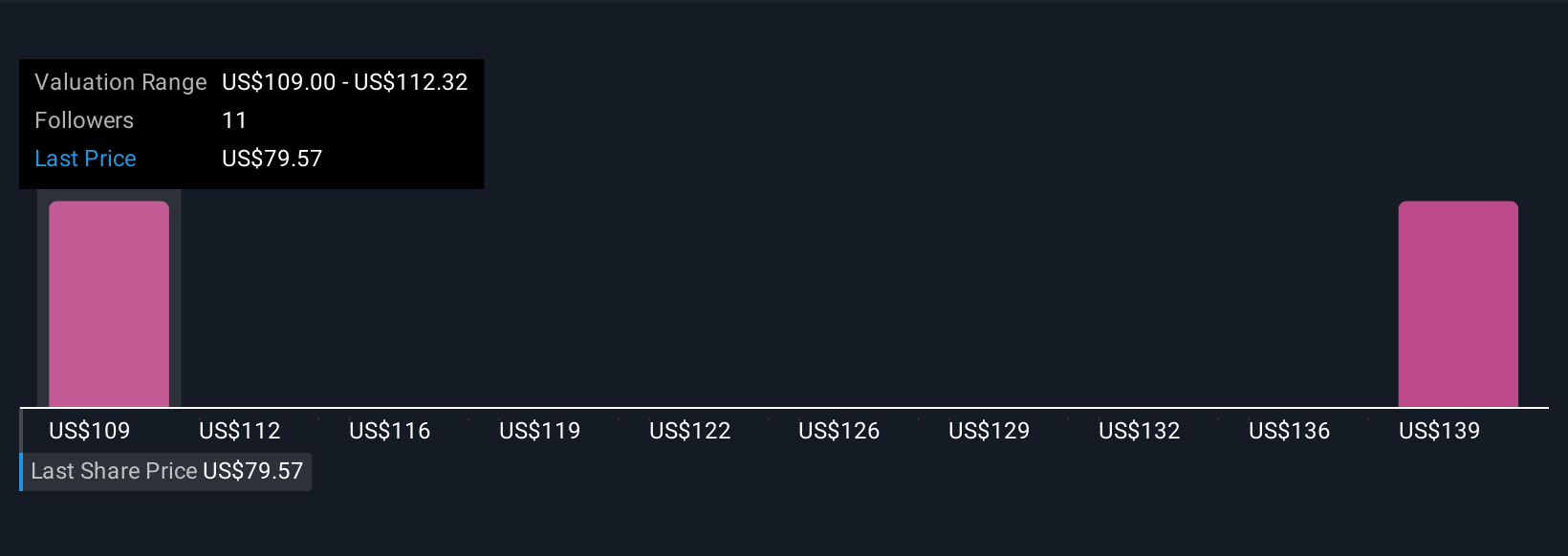

Uncover how Tennant's forecasts yield a $109.00 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Community estimates for Tennant’s fair value range widely from US$108.75 up to US$142.74 across three separate analyses from the Simply Wall St Community. While optimism around Tennant's growth initiatives persists, recent sales declines in international markets remain an important factor shaping many investor opinions.

Explore 3 other fair value estimates on Tennant - why the stock might be worth just $108.75!

Build Your Own Tennant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tennant research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Tennant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tennant's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tennant might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNC

Tennant

Designs, manufactures, and markets floor cleaning equipment in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives