- United States

- /

- Machinery

- /

- NYSE:TNC

Tennant (TNC): Assessing Valuation Following Lower Sales, Earnings and Persistent Guidance Challenges

Reviewed by Simply Wall St

Tennant (TNC) reported quarterly sales and earnings below last year’s results, with net income for the past nine months falling as well. The company reaffirmed annual guidance, highlighting persistent headwinds and continued pressure on demand.

See our latest analysis for Tennant.

After reaffirming guidance and reporting lower sales, Tennant’s share price has lost momentum, falling 9.27% over the past month and now posting a 1-year total shareholder return of -15.07%. Despite long-term gains in the three- and five-year timeframes, the recent trend shows fading momentum as persistent headwinds weigh on investor sentiment.

If Tennant’s challenges have you thinking about where future growth might come from, it could be worth broadening your search and exploring fast growing stocks with high insider ownership.

With shares now trading at a notable discount to analyst price targets and several metrics showing value appeal, is Tennant an undervalued opportunity? Or are investors right to hold back, pricing in further sluggish growth?

Most Popular Narrative: 33.8% Undervalued

At $72.19, Tennant’s shares trade well below the narrative fair value of $109, with analysts expecting future growth and margin improvements to play a pivotal role. The stage is set for a transformation as evolving technology, sustainability efforts, and operational discipline become increasingly central to Tennant’s valuation story.

Accelerated adoption of autonomous mobile robots (AMRs) and equipment-as-a-service programs is expanding Tennant's recurring revenue base, supported by robust customer demand amid labor shortages and higher labor costs. This is likely to drive both future revenue growth and margin expansion.

Is Tennant’s valuation built on bold growth assumptions, or operational discipline that the market doubts? Key analyst forecasts hidden in this narrative could point to a future profit multiple that’s a major departure from today’s sector norms. Peel back the numbers and find out what drives this valuation.

Result: Fair Value of $109 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued international underperformance or prolonged pricing pressure could challenge Tennant’s growth outlook and threaten its path to margin improvement.

Find out about the key risks to this Tennant narrative.

Another View: Market Ratios Point to a Different Story

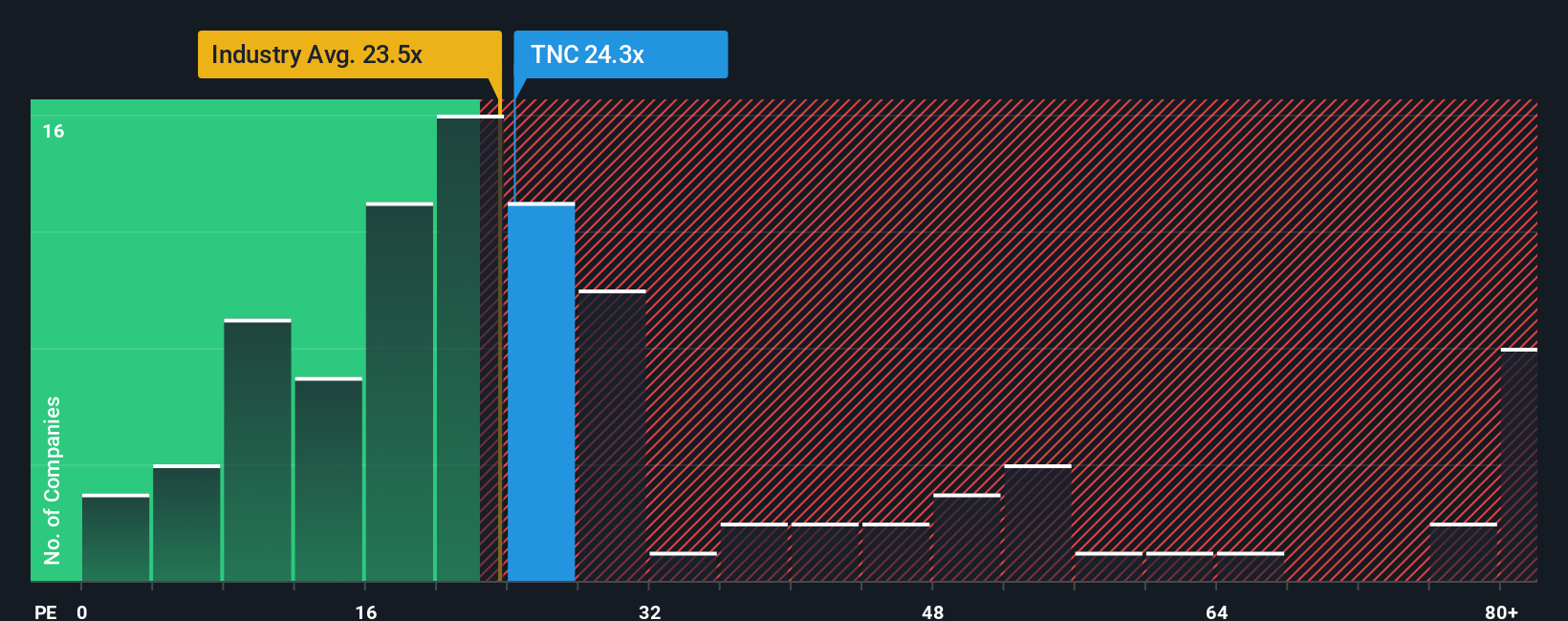

Tennant’s price-to-earnings ratio sits at 23.9x, matching the US Machinery industry average but looking much cheaper than its main peers at 41.7x. However, it trades slightly above the fair ratio of 22.7x, suggesting less room for error than it first appears. Does relying on sector averages mask hidden valuation risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tennant Narrative

If you see the story differently, or want to dive into the details yourself, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Tennant research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while others snap up the next big winners. With the right tools, you can uncover high-potential opportunities today.

- Target rapid growth by checking out these 3584 penny stocks with strong financials with strong financials, positioned for significant moves in emerging market segments.

- Secure steady income and minimize risk by reviewing these 16 dividend stocks with yields > 3%, which offers reliable yields above 3% for consistent returns.

- Catch the momentum in healthcare innovation by browsing these 32 healthcare AI stocks, which is transforming patient outcomes with the latest in AI-driven care and diagnostics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tennant might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNC

Tennant

Designs, manufactures, and markets floor cleaning equipment in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives