- United States

- /

- Machinery

- /

- NYSE:TNC

Tennant (TNC): Assessing Valuation as Growth Lags and Profitability Faces Ongoing Pressure

Reviewed by Kshitija Bhandaru

Recent attention has focused on Tennant (TNC) as the company’s sales growth trails sector peers, and its earnings per share have fallen for two years even with revenue gains. This pattern has raised fresh questions about Tennant’s long-term profitability.

See our latest analysis for Tennant.

Over the last year, Tennant’s share price hovered near steady levels. The 1-year total shareholder return slipped by 8.6% as capital intensity and profit pressures weighed on sentiment. Momentum appears to be fading, reflecting growing caution around the company’s fundamentals and future outlook.

If you’re watching how industrial stocks are shifting, this is an ideal moment to expand your perspective and explore fast growing stocks with high insider ownership

Given the combination of lagging growth and shrinking free cash flow, does Tennant now trade at a discount that rewards patient investors, or is the market already accounting for all the weakness and future uncertainty?

Most Popular Narrative: 24.9% Undervalued

With the fair value estimate significantly above Tennant’s last close, this narrative sets a much higher bar for what patient investors could expect. This perspective draws strength from long-term industry and product catalysts, rather than short-term market optimism.

Accelerated adoption of autonomous mobile robots (AMRs) and equipment-as-a-service programs is expanding Tennant's recurring revenue base, supported by robust customer demand amid labor shortages and higher labor costs. This is likely to drive both future revenue growth and margin expansion. The heightened focus on hygiene and cleanliness standards in facilities globally, especially post-pandemic, is enlarging Tennant's addressable market and supporting stronger order pipelines. These factors should translate into steady sales growth over time.

There are bold expectations built into this fair value: significant revenue gains, margin improvements, and a future earnings multiple that differs from today’s averages. Want to see which forecasts drive this bullish scenario? Uncover the key financial assumptions and ambitious projections directly in the full narrative.

Result: Fair Value of $109.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could shift quickly if international sales falter further or if Tennant's pricing power does not keep up with rising costs.

Find out about the key risks to this Tennant narrative.

Another View: Multiples Suggest a Premium

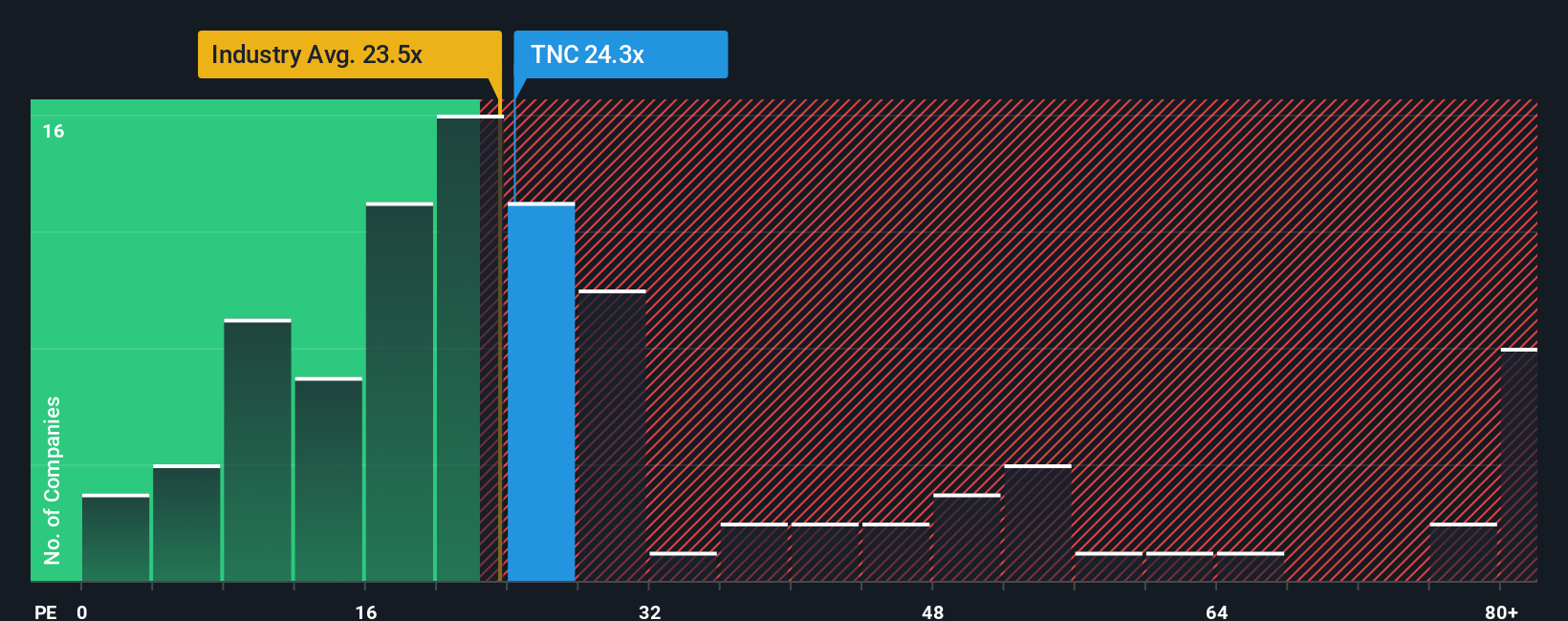

While many investors see Tennant as undervalued on future growth, the market’s standard valuation ratio tells a different story. Tennant trades at 24.9 times earnings, just above the US Machinery industry average of 24.1, but far below the peer group’s 51.7. Compared to its fair ratio of 22.4, this suggests the stock trades at a premium, which could reflect optimism or extra risk if growth targets are missed. Could the premium persist, or will reality catch up to expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tennant Narrative

If you see things differently or want to dive into the numbers yourself, it takes just a few minutes to craft your own perspective. So why not Do it your way?

A great starting point for your Tennant research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Staying ahead means always having fresh opportunities on your radar. Don’t let your next smart investment slip away when you can act with confidence right now.

- Tap into high potential returns by analyzing these 909 undervalued stocks based on cash flows, which offers robust cash flows that might be flying under the market’s radar.

- Capitalize on tomorrow’s breakthroughs by reviewing these 24 AI penny stocks, driving artificial intelligence innovation across multiple industries.

- Boost your income stream when you check out these 19 dividend stocks with yields > 3%, featuring strong yields above 3% for consistent, reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tennant might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNC

Tennant

Designs, manufactures, and markets floor cleaning equipment in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives