- United States

- /

- Building

- /

- NYSE:TGLS

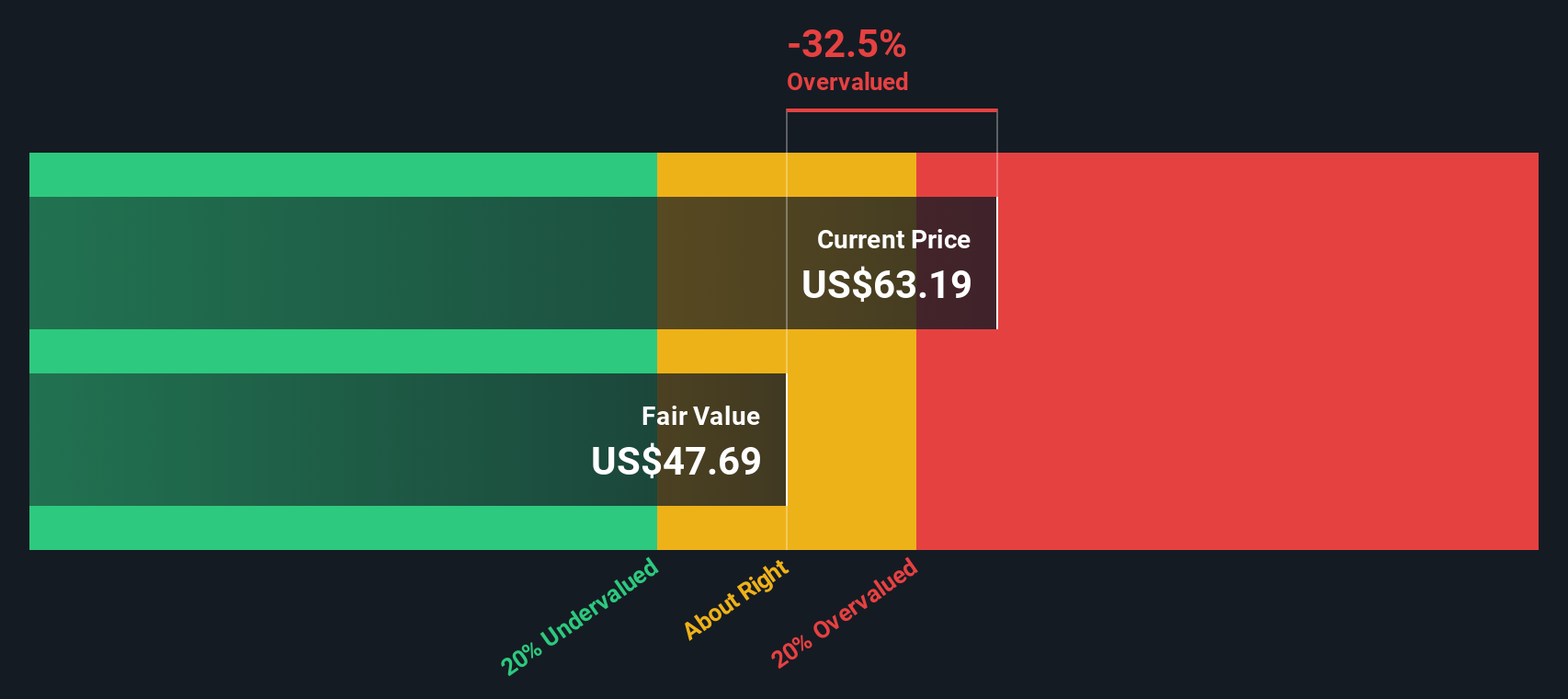

Tecnoglass (NYSE:TGLS): Assessing Valuation After Updated Earnings and 2025 Revenue Growth Guidance

Reviewed by Simply Wall St

Tecnoglass (NYSE:TGLS) just shared its latest earnings and updated revenue outlook, drawing attention from investors. The company posted higher quarterly and year-to-date sales and set expectations for approximately 10% revenue growth in 2025.

See our latest analysis for Tecnoglass.

Tecnoglass’s upbeat revenue outlook comes after a tough stretch for its share price, with a 1-month share price return of -28.9% and a year-to-date drop of 43%. Despite the recent sell-off, longer-term holders have still seen impressive gains. Tecnoglass has delivered a 54% total return over three years and a remarkable 691% over five years. This mix of sharp short-term volatility and robust multi-year performance suggests the market is reassessing the company’s growth prospects and risks, especially following fresh earnings news and guidance.

If you’re looking for more discovery opportunities in the industrial space, it could be the perfect time to check out See the full list for free.

With shares trading far below recent highs and the company forecasting strong revenue growth, investors are left to wonder: Is Tecnoglass undervalued at these levels, or is the market already pricing in future gains?

Most Popular Narrative: 50% Undervalued

Compared to Tecnoglass’s last close of $44.94, the most widely followed narrative estimates a fair value of $90.75, suggesting major upside based on growth and margin assumptions.

Ongoing urbanization and population migration trends in the Americas, combined with Tecnoglass's aggressive geographic expansion (notably into Western U.S. states and new commercial markets), are supporting strong visible volume growth and a record project backlog. This is likely to drive sustained top-line revenue growth for 2025 and beyond.

Curious what market dynamic could fuel such a lofty valuation? The fair value hinges on ambitious forecasts: rapid expansion and a leap in profitability. Want to see the granular growth drivers and bold profit forecasts that build this number? The next section reveals what analysts are counting on for Tecnoglass.

Result: Fair Value of $90.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising operational costs or a plateau in North American construction demand could quickly challenge these bullish growth expectations for Tecnoglass.

Find out about the key risks to this Tecnoglass narrative.

Another View: What Does Our DCF Model Say?

Taking a different angle, the SWS DCF model puts Tecnoglass’s fair value at just $29.41 per share, which is well below where the stock trades today. This suggests the current market price may be factoring in more optimistic growth and margin assumptions than the DCF method does. Which scenario will play out? Bullish multiples or conservative cash flow projections?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tecnoglass for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tecnoglass Narrative

Not convinced by these forecasts or want to dig deeper on your own? You can dive into the numbers and develop your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Tecnoglass.

Looking for More Smart Investment Ideas?

Don’t get left behind in today’s market. There are opportunities all around you, so make sure you’re equipped to spot the next breakout stock before everyone else does. Let the Simply Wall St Screener help you find your way.

- Capture income potential and boost your returns by checking out these 16 dividend stocks with yields > 3% offering yields above 3% and strong fundamentals.

- Spot emerging trends in healthcare technology by reviewing these 31 healthcare AI stocks set to transform patient outcomes and medical innovation.

- Ride the wave of tomorrow’s technology breakthroughs by targeting these 25 AI penny stocks positioned to disrupt industries and drive the next growth cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tecnoglass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TGLS

Tecnoglass

Manufactures, supplies, and installs architectural glass, windows, and associated aluminum and vinyl products for commercial and residential construction markets in Colombia, the United States, Panama, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives