- United States

- /

- Electrical

- /

- NYSE:TE

T1 Energy: Valuation Insights as CEO Meets with US Vice President and Ramps Up G2_Austin Solar Project

Reviewed by Simply Wall St

T1 Energy, led by CEO Dan Barcelo, is making headlines after a recent meeting with US Vice President JD Vance to discuss domestic energy goals and manufacturing. The company is moving quickly on its G2_Austin solar cell facility, which could have long-term implications for American clean energy production.

See our latest analysis for T1 Energy.

T1 Energy’s recent news comes on the back of eye-catching momentum: after rallying more than 51% over the past week and notching a 7% jump in just one day, the share price now sits at $4.12. Looking at the bigger picture, the company has nearly doubled total shareholder return over the last year, with action heating up in recent months. However, longer-term returns remain deep in the red.

If T1 Energy’s surge has you watching the broader landscape, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock still trading at a steep discount to average analyst targets and momentum building, the big question is whether T1 Energy represents a genuine buying opportunity or if the market is already pricing in future growth.

Most Popular Narrative: 36.6% Undervalued

With a fair value estimate of $6.50, the most widely followed narrative prices T1 Energy well above its last close. Investors are weighing whether the catalysts behind this premium can play out amid industry risks and big revenue assumptions.

The acceleration of domestic supply chain integration and the Corning partnership enable T1 to offer high U.S.-content, FEOC-compliant modules. This differentiates the company from competitors and allows customers to access valuable investment tax credits, which is expected to drive greater market share and revenue reliability through long-term contracts.

Wondering what numbers could justify such a high price target? The narrative points to aggressive top-line growth, a sharp turnaround in profit margins, and a valuation multiple that stands out from industry averages. Ready to uncover the calculations that drive this bold forecast?

Result: Fair Value of $6.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, T1 Energy's reliance on favorable U.S. policy and ongoing access to project financing could threaten growth if either support or funding falls short.

Find out about the key risks to this T1 Energy narrative.

Another View: Comparing Multiples

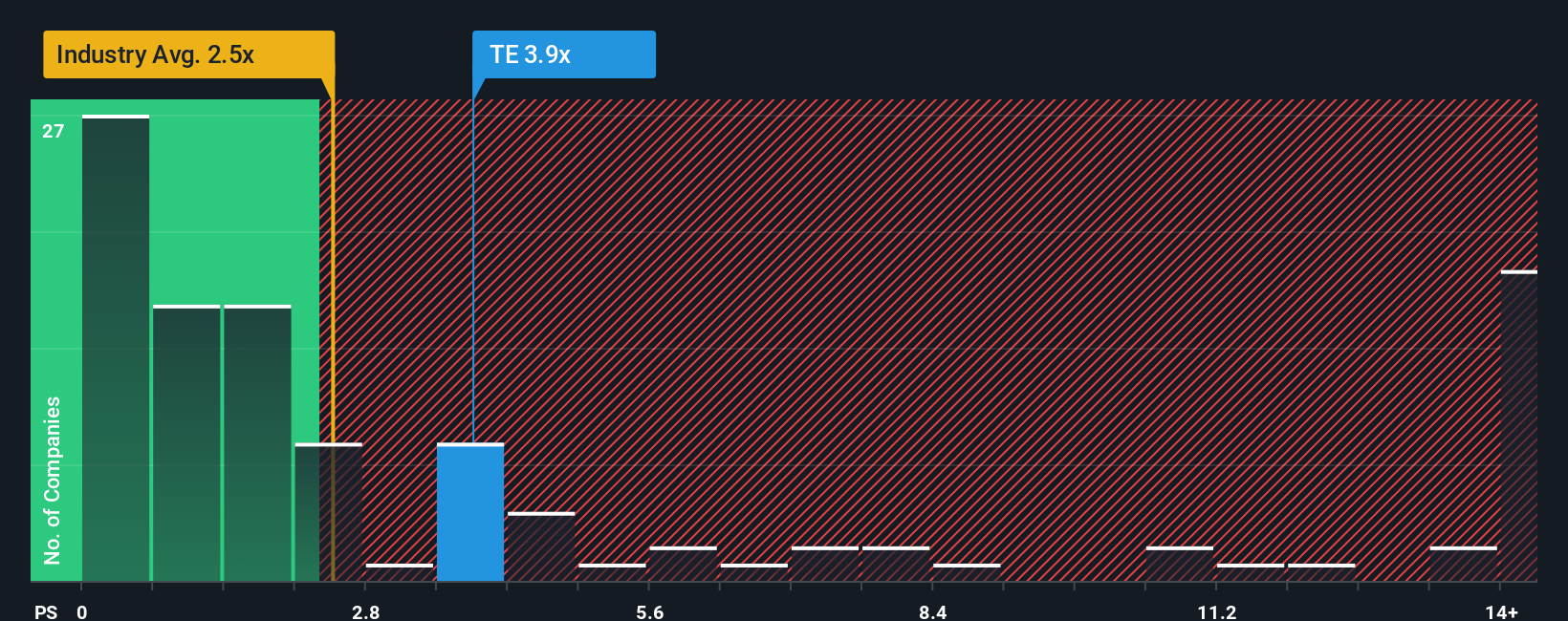

Looking through the lens of the price-to-sales ratio, T1 Energy trades at 2.2 times sales. That's a bit higher than the US electrical industry average of 2 times, but it’s far below its peer group’s average of 33 times and below the fair ratio of 2.8 times.

This gap could signal upside opportunity, but it also raises questions about valuation risk. Will the market close the discount, or are investors right to be cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own T1 Energy Narrative

If you want to dig into the details for yourself or develop your own perspective, you can create your own T1 Energy narrative in under three minutes. Do it your way

A great starting point for your T1 Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize your chance to get ahead with smart, actionable stock ideas. We don’t want you to miss out on tomorrow’s breakout opportunities, so take your pick now.

- Uncover high-potential companies at great prices by starting with these 914 undervalued stocks based on cash flows, helping you find opportunities before the crowd catches on.

- Tap into the unstoppable momentum of artificial intelligence by sorting through these 25 AI penny stocks. These innovators are pushing boundaries in every sector imaginable.

- Pursue steady income and reliable gains by reviewing these 15 dividend stocks with yields > 3%, making it simple to spot companies offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T1 Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TE

T1 Energy

Provides energy solutions for solar and batteries in the United States and Norway.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026