- United States

- /

- Aerospace & Defense

- /

- NYSE:TDG

Did Strong 2025 Results and Major Capital Returns Just Shift TransDigm Group's (TDG) Investment Narrative?

Reviewed by Sasha Jovanovic

- TransDigm Group recently reported its fourth quarter and full-year 2025 results, posting increases in sales and net income, and provided guidance for fiscal 2026 revenue between US$9.75 billion and US$9.95 billion.

- The company returned a very large amount of capital to shareholders through a special dividend and share repurchases, while also funding acquisitions as part of its capital deployment strategy.

- In light of TransDigm's updated earnings guidance and strong capital returns, we will examine what this means for the company’s investment case.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

TransDigm Group Investment Narrative Recap

Owning shares of TransDigm Group means believing in the continued strength of global air travel and the company's ability to benefit from recurring aftermarket demand, as well as resilience in defense and proprietary aerospace components. The company’s latest earnings and 2026 guidance, which show strong sales growth but anticipate a modest dip in net income due to higher interest expenses, do not materially alter the primary short-term catalyst, OEM production normalization, and reinforce the risk posed by rising interest costs from ongoing debt-funded capital returns.

Of the recent company announcements, the US$5.2 billion special dividend distributed in fiscal 2025 is most relevant, as it illustrates both the scale of capital return to shareholders and the reliance on new debt financing that is now impacting guidance for net income. This move aligns with the company’s capital deployment strategy and reflects the balance between rewarding shareholders and managing leverage, which is directly tied to the company's most pressing risk factor in the year ahead.

However, it is important to keep in mind that, while cash returns have been substantial, the risk from increased interest expenses now affecting profit guidance for 2026 is something investors should be aware of, especially if ...

Read the full narrative on TransDigm Group (it's free!)

TransDigm Group's narrative projects $10.8 billion in revenue and $2.5 billion in earnings by 2028. This requires 8.0% yearly revenue growth and a $0.7 billion earnings increase from $1.8 billion today.

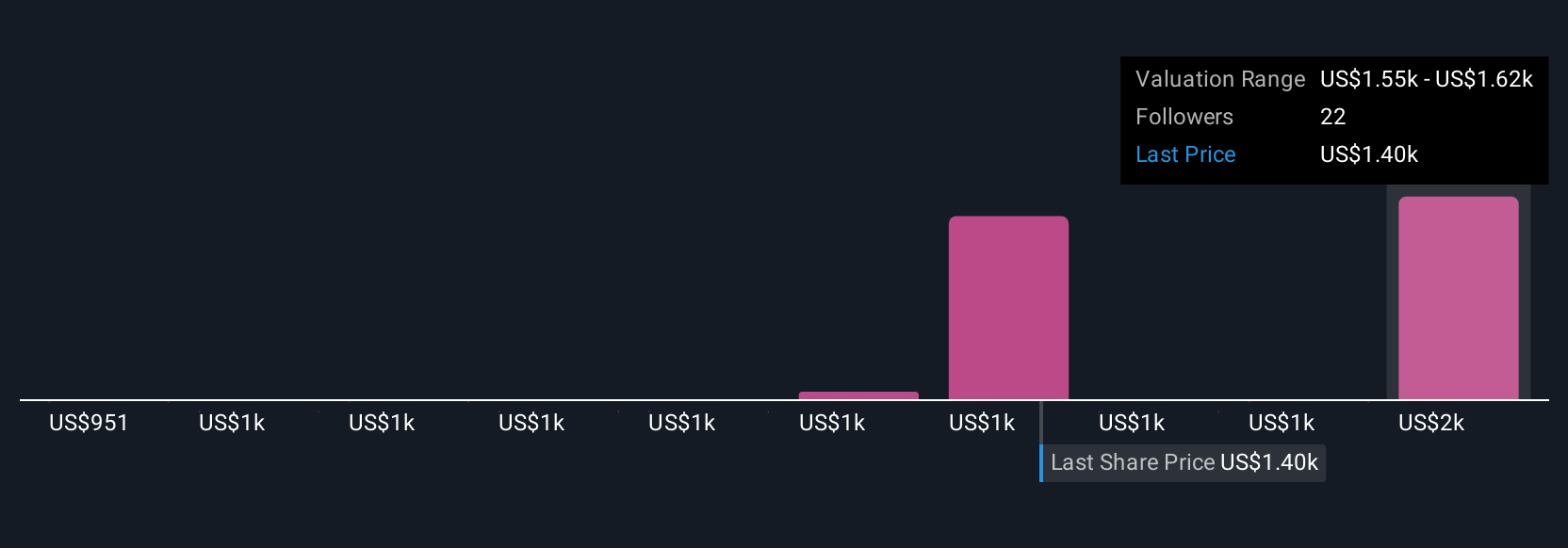

Uncover how TransDigm Group's forecasts yield a $1558 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have produced five fair value estimates for TransDigm Group ranging from US$1,121 to US$1,558 per share. With higher leverage following large capital returns, the effect of rising interest costs remains a key factor for future performance and expectations, see how different investors weigh the balance in their forecasts.

Explore 5 other fair value estimates on TransDigm Group - why the stock might be worth as much as 19% more than the current price!

Build Your Own TransDigm Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TransDigm Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TransDigm Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TransDigm Group's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransDigm Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDG

TransDigm Group

Designs, produces, and supplies aircraft components in the United States and internationally.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives