- United States

- /

- Machinery

- /

- NYSE:SWK

Stanley Black & Decker (SWK): Valuation Insights Following Momentum From Q3 Margin Gains and Free Cash Flow Improvement

Reviewed by Simply Wall St

Stanley Black & Decker (SWK) just notched its fifth consecutive day of stock gains, delivering a 16% return as investors responded to strong Q3 numbers and positive operational updates.

See our latest analysis for Stanley Black & Decker.

The stock’s recent rally stands out against a tougher backdrop, with Stanley Black & Decker’s 1-year total shareholder return sitting at -16.9%. The upbeat response to Q3 results has brightened the near-term mood, but momentum remains in recovery mode after a challenging year for long-term holders.

If you’re watching how investors react to operational turnarounds, this is the perfect moment to broaden your scope and discover fast growing stocks with high insider ownership

With Stanley Black & Decker rallying on margin gains and cost cuts, the key question now is whether this recent optimism leaves the stock undervalued or if markets are already factoring in the company's next stage of growth.

Most Popular Narrative: 16.2% Undervalued

Stanley Black & Decker's most widely followed narrative sets a fair value of $85.30, notably higher than the recent closing price of $71.52. The narrative signals that analysts broadly view today's price as offering meaningful upside relative to future growth, and there is a pivotal catalyst at the heart of this outlook.

The ongoing global trend of urbanization and rising home ownership in emerging markets, coupled with the company's sharpened focus on international sales and targeted local market initiatives, is expected to drive sustained demand for Stanley Black & Decker's tools and fastening solutions, supporting top-line revenue growth in the long term.

Curious how this narrative justifies such a gap between the current share price and fair value? Hint: bold forecasts for margin expansion and a sharp rebound in profitability, along with a future valuation multiple below the industry norm, are at play. Discover the hidden levers powering this perspective when you explore the complete story.

Result: Fair Value of $85.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently weak demand in key segments and limited pricing power could quickly undermine the optimism behind the current undervalued narrative.

Find out about the key risks to this Stanley Black & Decker narrative.

Another View: Multiples Tell a More Cautious Story

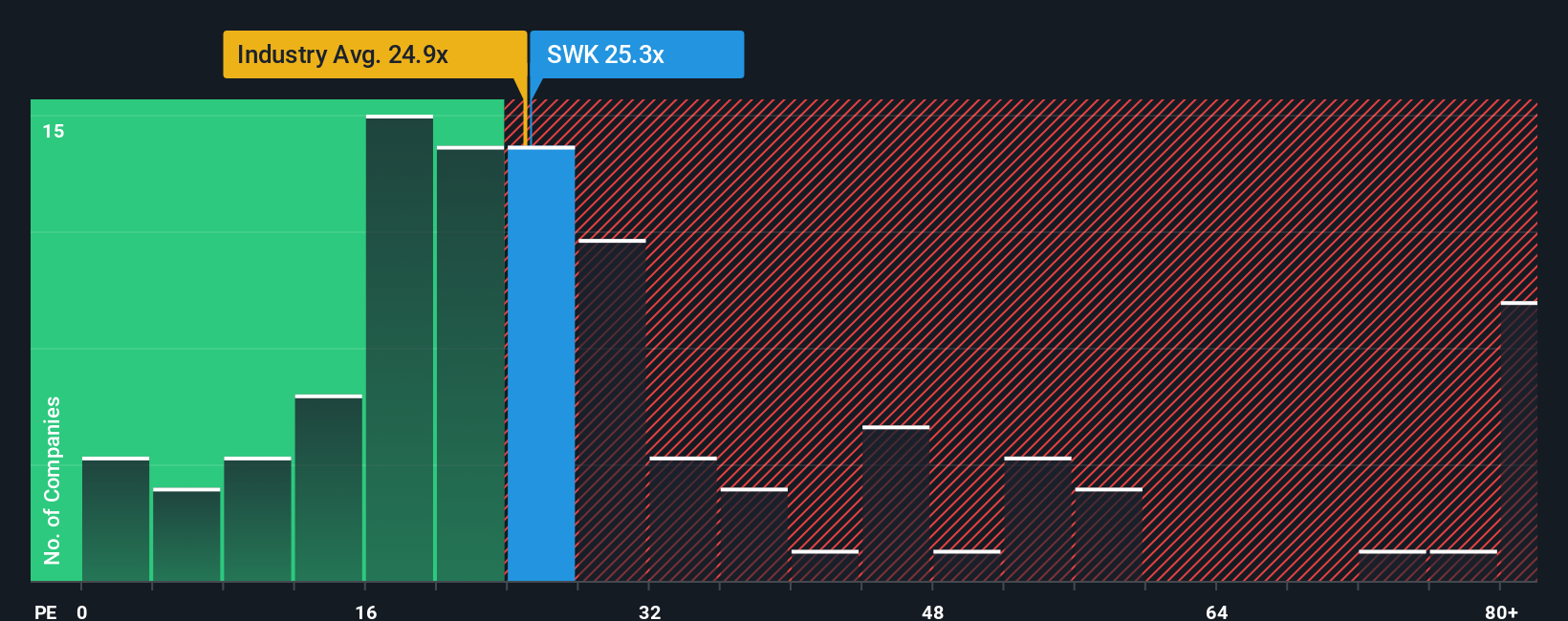

While the popular narrative points to Stanley Black & Decker being undervalued, a quick look at its price-to-earnings ratio sends a more cautious signal. The current P/E ratio of 25.3x is higher than the US Machinery industry average of 24.9x, suggesting the stock is not inexpensive on this metric. However, compared to similar peers at 26.2x and a fair ratio target of 46.9x, the shares appear less risky than they might initially seem. Are investors right to trust this multiple or is the true value found elsewhere?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stanley Black & Decker Narrative

Whether you’re skeptical or just keen on a hands-on approach, tapping into your own analysis only takes a couple of minutes. Do it your way.

A great starting point for your Stanley Black & Decker research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Winning Opportunities?

Don’t stop your research here; you could be overlooking incredible stocks waiting for their breakout moment. Let Simply Wall Street’s tools guide your next moves.

- Uncover hidden value by pinpointing these 916 undervalued stocks based on cash flows with strong cash flow potential and attractive entry points.

- Boost your income strategy by shortlisting these 15 dividend stocks with yields > 3% offering robust yields above 3% and consistent payouts.

- Tap into the future of computing by adding these 28 quantum computing stocks racing ahead in quantum breakthroughs to your watchlist today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWK

Stanley Black & Decker

Provides hand tools, power tools, outdoor products, and related accessories in the United States, Canada, Other Americas, Europe, and Asia.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026