- United States

- /

- Building

- /

- NYSE:SSD

Simpson Manufacturing (SSD): Valuation Perspective After Strong Analyst Support and Upbeat Q2 Results

Reviewed by Simply Wall St

If you’ve been watching Simpson Manufacturing (SSD) lately, you might have noticed some fresh momentum building. The company just posted second quarter results that beat forecasts thanks to better-than-expected sales in North America and a pricing strategy that’s clearly paying off. Add in some encouraging analyst updates and upward revisions to earnings estimates, and it’s not surprising investors are taking a closer look at where SSD goes from here.

Over the past year, Simpson Manufacturing’s stock is up 7%, outpacing much of the construction sector and showing real staying power after a three-year run where shares more than doubled. Recent gains—about 19% in the past month and 25% over the past 3 months—suggest that positive sentiment is building, helped along by rising net income and revenue growth even as the broader market mood becomes more cautious. The company’s performance this year stands out against a challenging backdrop for the industry.

So is this recent rally a signal that Simpson Manufacturing is still undervalued, or is the market already recognizing future growth? Let’s dig into the numbers to see what’s really behind the move.

If you’ve been watching Simpson Manufacturing (SSD) lately, you might have noticed some fresh momentum building. The company just posted second quarter results that beat forecasts, thanks to better-than-expected sales in North America and a pricing strategy that is clearly paying off. With encouraging analyst updates and upward revisions to earnings estimates, it is not surprising investors are taking a closer look at where SSD goes from here.

Over the past year, Simpson Manufacturing’s stock is up 7%, outpacing much of the construction sector and showing real staying power after a three-year run in which shares more than doubled. Recent gains include approximately 19% in the past month and 25% over the past three months. This trend suggests that positive sentiment is building, supported by rising net income and revenue growth even as the broader market mood becomes more cautious. The company’s performance this year stands out against a challenging backdrop for the industry.

This recent rally raises the question of whether Simpson Manufacturing is still undervalued, or if the market is already factoring in future growth. A closer look at the numbers can provide more insight into what is driving this move.

Most Popular Narrative: Fairly Valued

According to community narrative, Simpson Manufacturing is considered fairly valued, with the analyst consensus price target sitting just 1% below the current share price. Analysts believe the stock’s current valuation reflects a realistic outlook based on its projected earnings growth, profit margins, and risk factors.

"International expansion, particularly in Europe, is helping to diversify revenue streams beyond the cyclical U.S. housing market. Positive local currency performance and operating margin improvement in Europe indicate progress towards geographic earnings stability and support long-term revenue and income growth."

Looking for the inside story on why analysts see Simpson Manufacturing’s valuation as about right? The key factors behind this view include bold profit margin goals, ambitious international growth plans, and an earnings trajectory that could surprise even seasoned investors. Want to see the numbers and trends that inform this balanced outlook? Delve into the full narrative for the details that power this fair value call.

Result: Fair Value of $190 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in housing starts or unexpected raw material cost spikes could put pressure on Simpson Manufacturing’s growth outlook and challenge its fair valuation narrative.

Find out about the key risks to this Simpson Manufacturing narrative.

Another View: Discounted Cash Flow Perspective

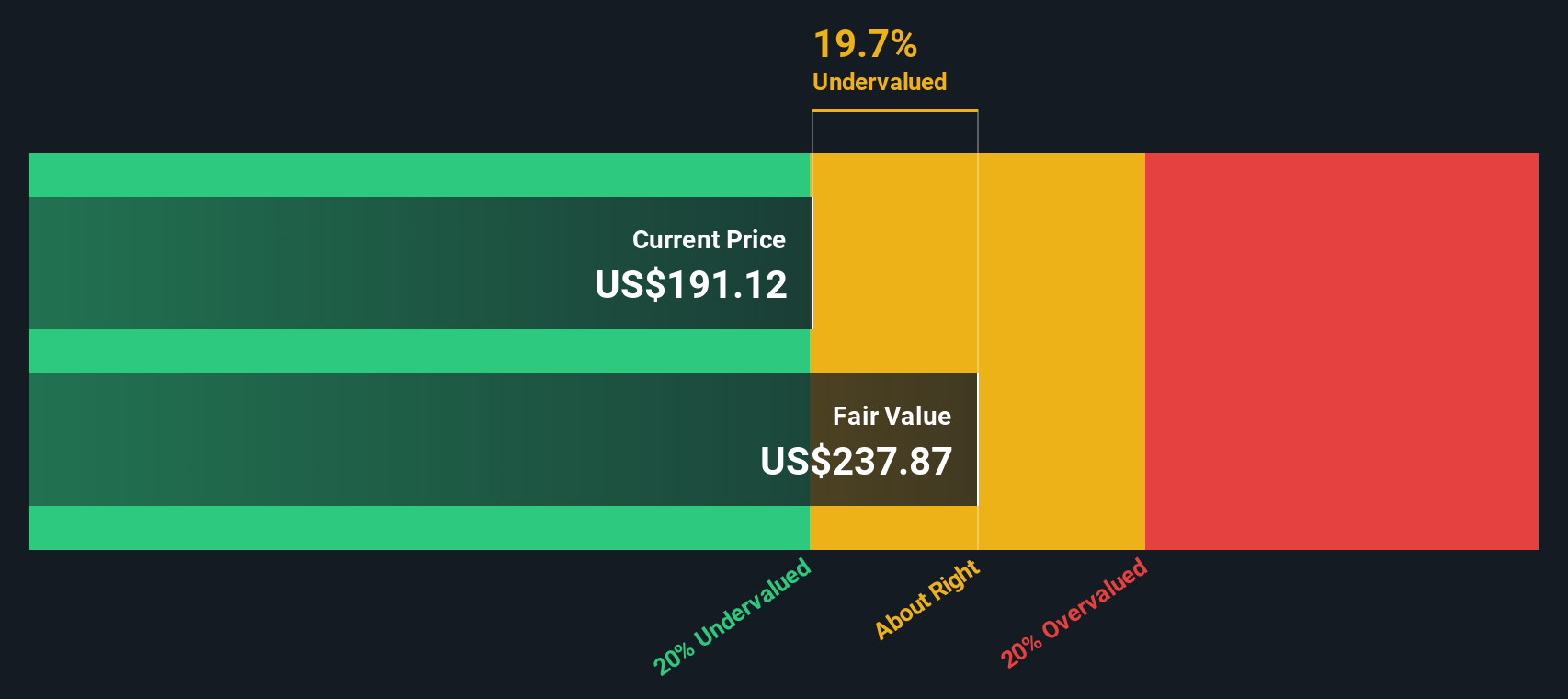

While analysts view the current price as fair based on earnings forecasts, our DCF model provides a different perspective and indicates that the stock may actually be undervalued. Is this approach capturing something that others might be overlooking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Simpson Manufacturing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Simpson Manufacturing Narrative

If you want to dig deeper or have a different take, you can quickly explore the data and craft your own viewpoint in just a few minutes. do it your way .

A great starting point for your Simpson Manufacturing research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Staying ahead means always keeping an eye on fresh ideas. Broaden your investment universe and give yourself the edge by checking out these hand-picked opportunities, each offering its own potential for growth, stability, or a powerful mix of both. Don’t let these promising stocks pass you by.

- Target stable earnings and passive income growth by searching for dividend stocks with yields > 3% with above-average yields and solid track records.

- Spot hidden bargains and unlock potential gains by evaluating undervalued stocks based on cash flows where the market may be missing underlying value.

- Capitalize on innovation and the next wave in healthcare by checking out cutting-edge healthcare AI stocks pushing boundaries in medicine and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SSD

Simpson Manufacturing

Through its subsidiaries, designs, engineers, manufactures, and sells structural solutions for wood, concrete, and steel connections in North America, Europe, and the Asia Pacific.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives