- United States

- /

- Building

- /

- NYSE:SSD

Simpson Manufacturing (SSD): Assessing Valuation After Q3 Earnings Beat and New Cost-Saving Initiatives

Reviewed by Simply Wall St

Simpson Manufacturing (SSD) delivered better-than-expected third quarter results, with both revenue and earnings rising even as the housing market remained challenging. The company credited smart pricing moves and favorable foreign exchange for its performance.

See our latest analysis for Simpson Manufacturing.

Simpson Manufacturing’s proactive strategy has fueled renewed interest among investors, especially with robust buyback activity, a fresh $0.29 dividend, and updated guidance for 2025. While the share price has climbed 7% over the past month and is up more than 9% year-to-date, momentum has cooled compared to the explosive 121% total shareholder return seen over the past three years. Recent cost-saving moves and capital returns signal management’s confidence in steering through near-term industry headwinds while also laying the groundwork for long-term gains.

If you’re looking to expand your search beyond one strong performer, now is the perfect chance to discover fast growing stocks with high insider ownership.

With the share price near all-time highs and recent upgrades to analyst targets, the key question now is whether the recent rally has left limited room for upside or if Simpson Manufacturing’s fundamentals point to a fresh buying opportunity.

Most Popular Narrative: 9% Undervalued

With the narrative’s fair value estimate set at $197.33 and Simpson Manufacturing’s recent close at $179.49, the story centers on analysts seeing more room to run. The opinion is shaped by updated assumptions and realigned financial forecasts that reflect optimism around key growth drivers.

“Product innovation, code-compliance leadership, and digital solutions are strengthening market position, driving margin expansion, and supporting sustained revenue and earnings growth. Geographic diversification and investment in automation are improving supply chain resilience, operating stability, and long-term profitability.”

Curious about which financial levers analysts believe could supercharge Simpson’s valuation? The narrative is built on compelling long-term profit forecasts and bold margin expansion assumptions that set this story apart from the crowd. See what numbers are fueling such confidence in the future.

Result: Fair Value of $197.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on the housing cycle and rising steel costs could dampen momentum and challenge Simpson Manufacturing's optimistic growth narrative.

Find out about the key risks to this Simpson Manufacturing narrative.

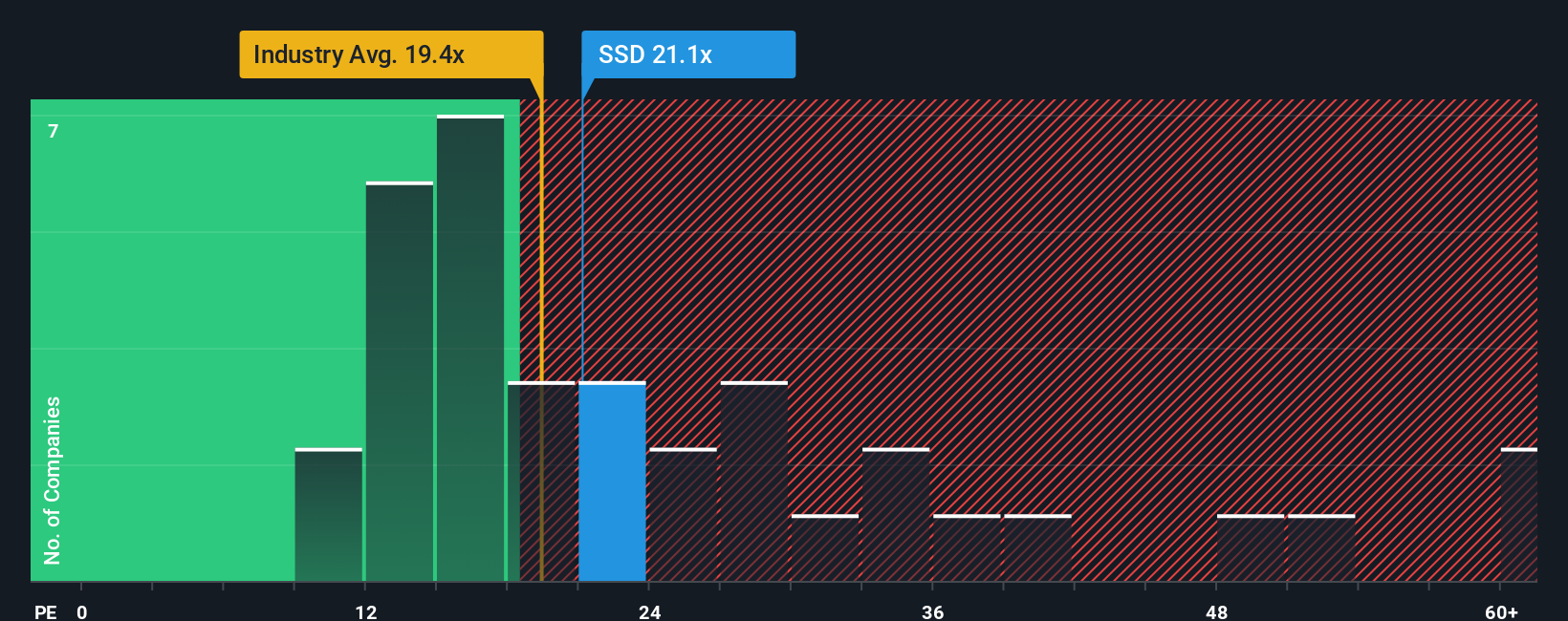

Another View: Multiples Paint a Mixed Picture

Looking at valuation through the lens of price-to-earnings, Simpson Manufacturing trades at 21.7x, just above its fair ratio of 21x. This also puts it above the industry average, but below peer groups. Such a positioning suggests shares are not outright cheap, but perhaps not expensive either. What might prompt a repricing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Simpson Manufacturing Narrative

If you want to dig beyond these perspectives or trust your own analysis, in just a few minutes you can craft your own story. Do it your way

A great starting point for your Simpson Manufacturing research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Ideas?

Don't limit your portfolio to just one standout. The smartest investors stay ahead by seeking out opportunities across emerging themes and proven performers, all in one place.

- Grow your passive income stream by checking out these 21 dividend stocks with yields > 3%, offering yields above 3% for reliable return potential.

- Jump into the world of rapid innovation with these 26 AI penny stocks, where artificial intelligence is transforming entire industries.

- Catch value before the crowd by finding these 853 undervalued stocks based on cash flows, which trade below their true worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SSD

Simpson Manufacturing

Through its subsidiaries, designs, engineers, manufactures, and sells structural solutions for wood, concrete, and steel connections in North America, Europe, and the Asia Pacific.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives