- United States

- /

- Electrical

- /

- NYSE:SMR

Is NuScale Power Worth a Look After Its European Utility Partnership and Recent 31% Price Drop?

Reviewed by Bailey Pemberton

- Wondering if NuScale Power’s current share price is a rare bargain, or if there is more risk than meets the eye? You are not alone. Let’s break down what is happening beneath the surface.

- The stock has been on a wild ride lately, down 31.5% over the past week and 42.3% for the month, but still up 46.6% since the start of the year and 134.1% over three years.

- Recent headlines have been buzzing about NuScale’s partnerships to advance small modular reactor deployment, including an agreement with a major European utility that boosted optimism just days before the sell-off. Meanwhile, sector shifts and renewed debate over clean energy policy may have added volatility to the stock’s dramatic swings.

- According to our valuation scorecard, NuScale Power scores just 1 out of 6 on key checks for undervaluation. Next, we will weigh this result against several common valuation approaches. Plus, there is an even smarter way to think about fair value coming up at the end of the article.

NuScale Power scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NuScale Power Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach aims to determine what NuScale Power should be worth based on expected earnings, rather than current market sentiment.

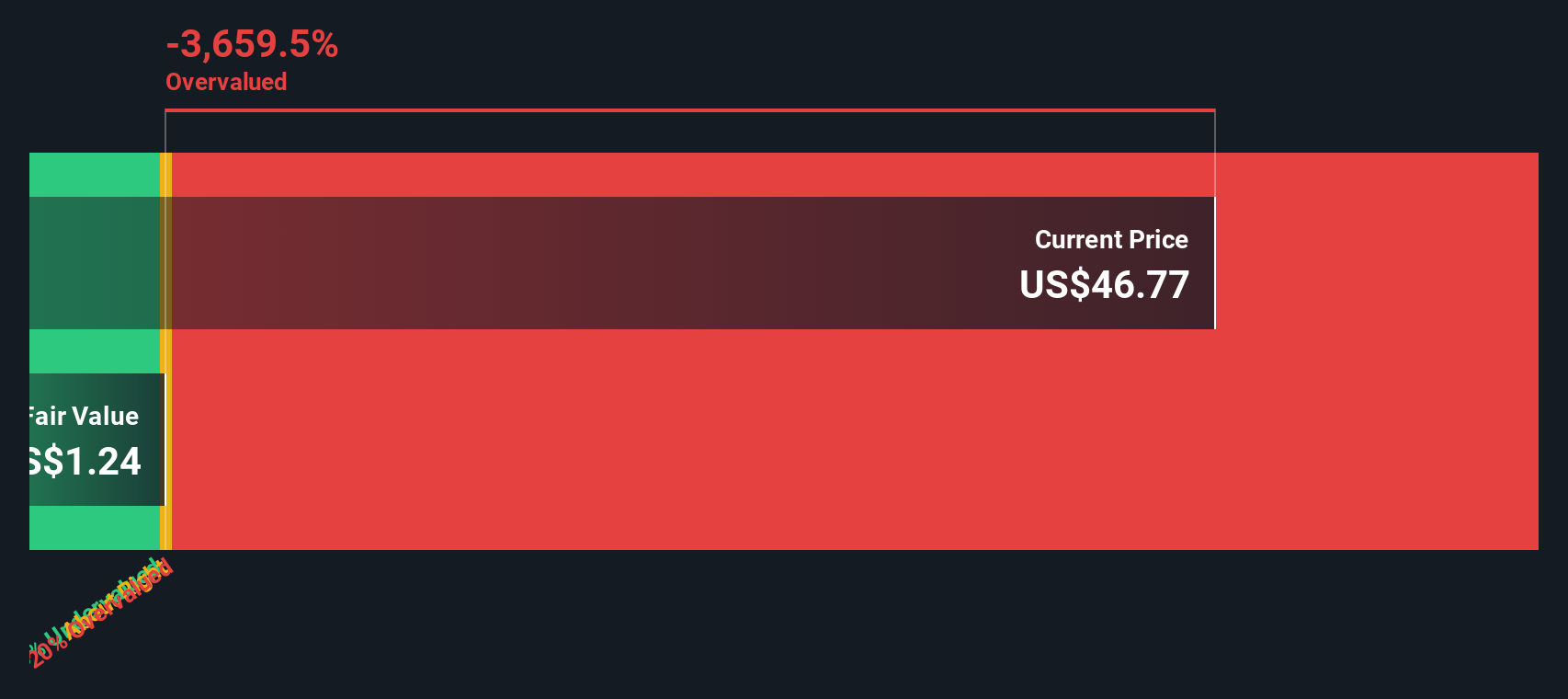

NuScale Power reported last twelve months Free Cash Flow (FCF) of -$284 million, reflecting ongoing investments and negative cash generation at this stage. Looking ahead, analysts project continued negative cash flows over the next few years, including -$246 million in 2026 and -$67 million in 2027. The DCF forecast turns positive by 2029, with projected FCF of about $10 million. Beyond this, Simply Wall St extrapolates further double-digit million-dollar annual improvements through 2035.

Once all projected and extrapolated cash flows are discounted to present value using this model, NuScale Power’s estimated intrinsic value comes out to $0.62 per share. This is significantly lower than the current share price, suggesting the stock trades at a notable premium. In fact, the implied discount shows NuScale is 4,069.4% overvalued according to DCF.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NuScale Power may be overvalued by 4069.4%. Discover 883 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: NuScale Power Price vs Book

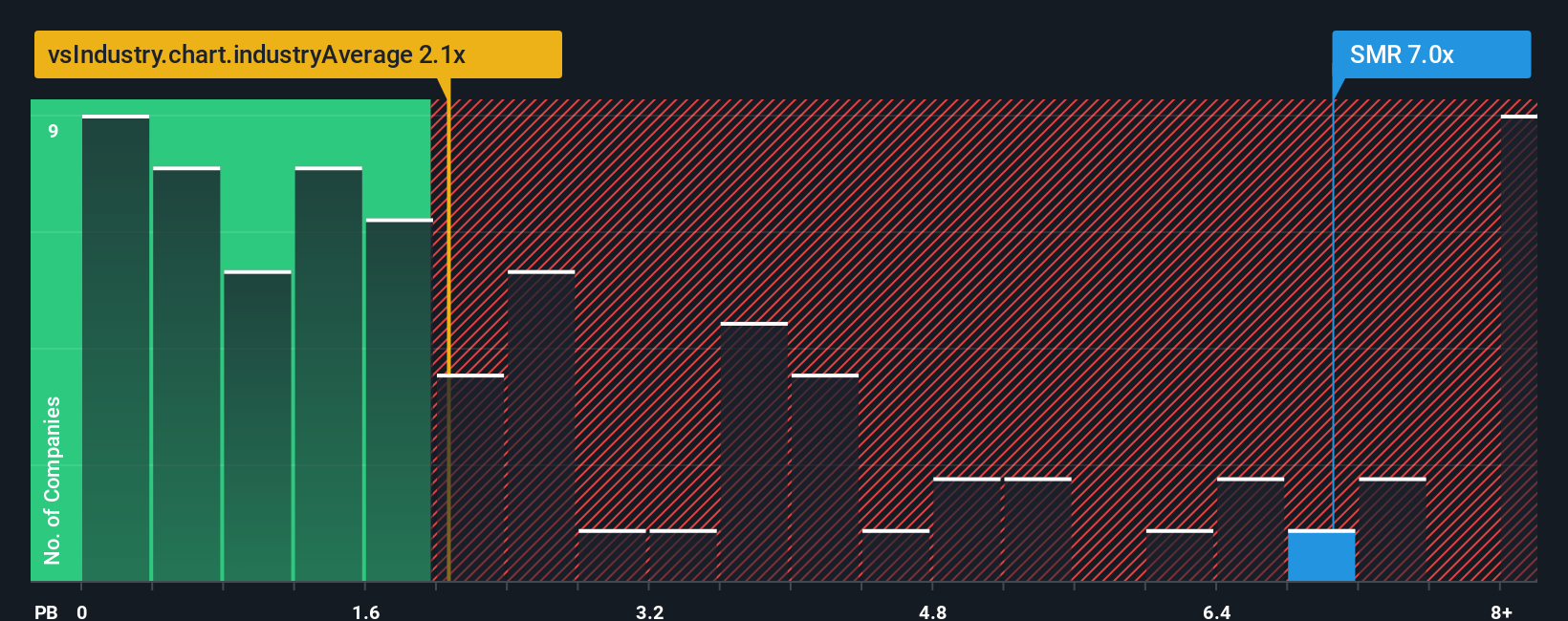

The Price-to-Book (PB) ratio is often preferred for valuing companies that are not yet profitable, such as NuScale Power. Since the firm has negative earnings and cash flow while still in early growth phases, the PB ratio provides a more stable yardstick by comparing the stock price to the value of assets on the balance sheet.

Growth expectations and risk play a big role in what is considered a “normal” PB ratio. Companies with strong asset growth or lower risk profiles usually justify higher PB ratios, while those with uncertainty or slower asset growth will trade closer to or even below their book value.

Right now, NuScale Power trades at 8.7x book value. That is more than three times the Electrical industry average of 2.7x and well above the peer group average of 20.3x. On the surface, this signals investors are pricing in hefty upside or strategic value despite ongoing losses.

Simply Wall St’s “Fair Ratio” provides a deeper perspective. The Fair Ratio is a proprietary multiple derived from factors such as company-specific growth prospects, industry dynamics, profit margins, market capitalization, and risk. Unlike simple peer or industry comparisons, the Fair Ratio reflects what an informed investor might actually pay, taking the business’s unique strengths and risks into account.

Comparing NuScale Power’s current PB ratio to its Fair Ratio, the gap suggests investors are assigning a valuation premium that is difficult to justify purely on asset value and outlook. This analysis implies NuScale Power stock is overvalued on a PB basis.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NuScale Power Narrative

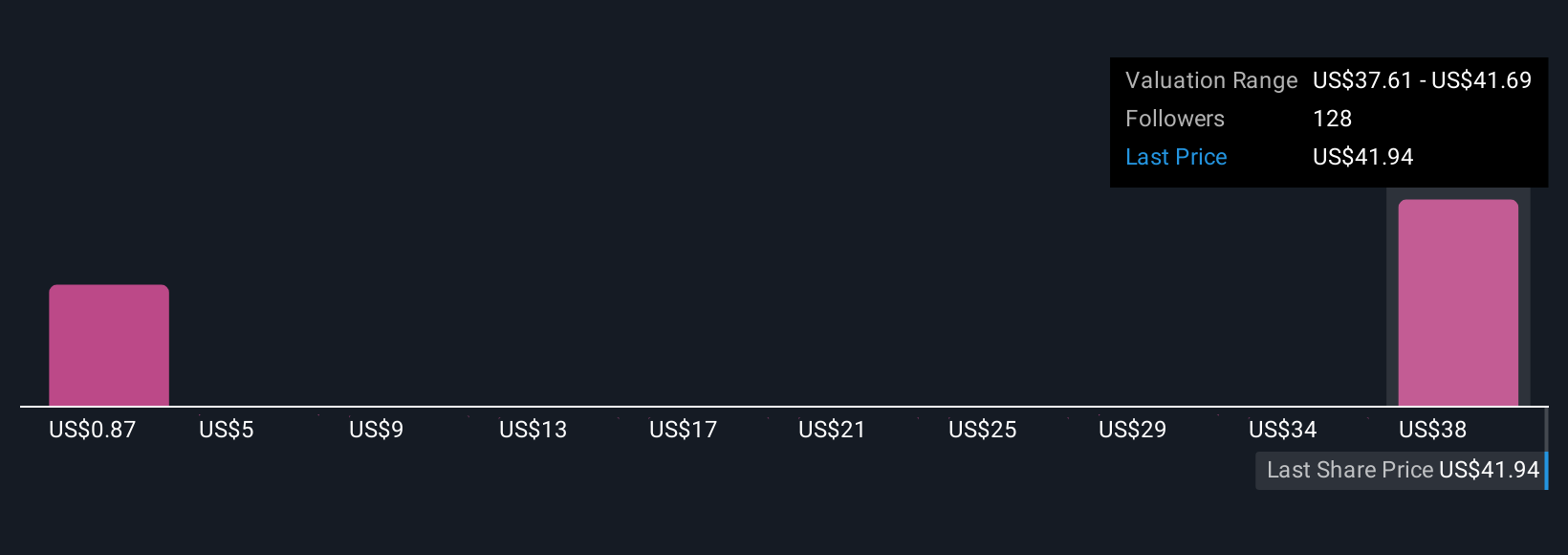

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your own story about what you believe a company’s future holds, backed up by the numbers you think are realistic, such as expected revenue, profit margins, or risks that could impact its fair value.

Rather than just accept a single fair value estimate, Narratives let you frame your investment view as a story that links the company’s strengths or challenges to projected financials, which then flow through to a personal fair value calculation. On Simply Wall St’s Community page, millions of investors use Narratives to quickly create and share their perspective on where a stock is headed and why.

These Narratives make it easy to compare your own fair value to the market price, helping you decide when the stock looks attractive to buy or when it might be time to sell. Plus, as new news, earnings, or events happen, Narratives are updated automatically so your valuation always reflects the latest information.

For example, some NuScale Power Narratives see massive upside due to rapid commercialization and analyst price targets as high as $29.00. Others focus on funding and execution risks, placing fair value as low as $17.00. This shows how different perspectives result in vastly different investment decisions.

Do you think there's more to the story for NuScale Power? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives