- United States

- /

- Aerospace & Defense

- /

- NYSE:SARO

Investors Still Aren't Entirely Convinced By StandardAero, Inc.'s (NYSE:SARO) Revenues Despite 25% Price Jump

StandardAero, Inc. (NYSE:SARO) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

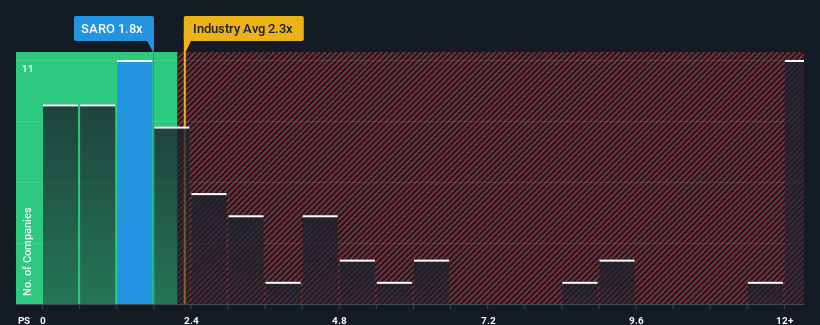

Although its price has surged higher, you could still be forgiven for feeling indifferent about StandardAero's P/S ratio of 1.8x, since the median price-to-sales (or "P/S") ratio for the Aerospace & Defense industry in the United States is also close to 2.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We've discovered 2 warning signs about StandardAero. View them for free.Check out our latest analysis for StandardAero

How Has StandardAero Performed Recently?

Recent times have been advantageous for StandardAero as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on StandardAero.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like StandardAero's to be considered reasonable.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. The latest three year period has also seen an excellent 50% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 11% per annum as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 8.0% per year, which is noticeably less attractive.

In light of this, it's curious that StandardAero's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From StandardAero's P/S?

StandardAero appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that StandardAero currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware StandardAero is showing 2 warning signs in our investment analysis, and 1 of those is concerning.

If these risks are making you reconsider your opinion on StandardAero, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SARO

StandardAero

Provides aerospace engine aftermarket services for fixed and rotary wing aircraft in the United States, Canada, the United Kingdom, Rest of Europe, Asia, and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives