- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

RTX (RTX): Exploring Valuation After Recent Share Price Pullback and Long-Term Gains

RTX (RTX) has shown a mixed performance recently, with the stock posting a gain of 8% over the past 3 months but dipping 0.6% in the latest session. Long-term investors have seen the stock nearly double its value over the past 5 years, which signals some consistency in returns despite short-term swings.

See our latest analysis for RTX.

After a strong climb year to date, with a nearly 48% share price return and a hefty 45% total shareholder return over the past 12 months, RTX’s recent pullback is seen more as a breather than a reversal, especially given its steady long-term momentum and ongoing growth outlook.

If you’re interested in companies showing both robust growth and committed insiders, now is a great time to discover fast growing stocks with high insider ownership

With steady earnings growth and a recent pullback, some investors are considering whether RTX’s strong long-term returns suggest undervaluation or if the market has already priced in future gains. Is this a true buying opportunity?

Most Popular Narrative: 10.4% Undervalued

With RTX's fair value estimated at $192.06, compared to the latest closing price of $172.15, the most widely followed narrative signals meaningful upside, driven by growing defense contracts and strategic execution across segments.

Robust and growing backlog, highlighted by a 1.86 quarter book-to-bill ratio, $236 billion backlog (up 15% year-over-year), and major new international contracts (e.g., EU, MENA, Asia-Pacific) indicate RTX is well-positioned to benefit from sustained increases in global defense spending and heightened geopolitical tensions, setting up strong visibility for future revenue growth.

Want to uncover the full story behind this bullish outlook? See which aggressive growth assumptions and bold future profit margins the narrative is banking on. Industry-shaking forecasts are hiding in the fine print. Could RTX’s future numbers upend expectations?

Result: Fair Value of $192.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent jet engine cost overruns or sudden shifts in defense budgets could quickly unsettle RTX’s otherwise bullish outlook. This may make future results less predictable.

Find out about the key risks to this RTX narrative.

Another View: Comparing with Fair Ratio

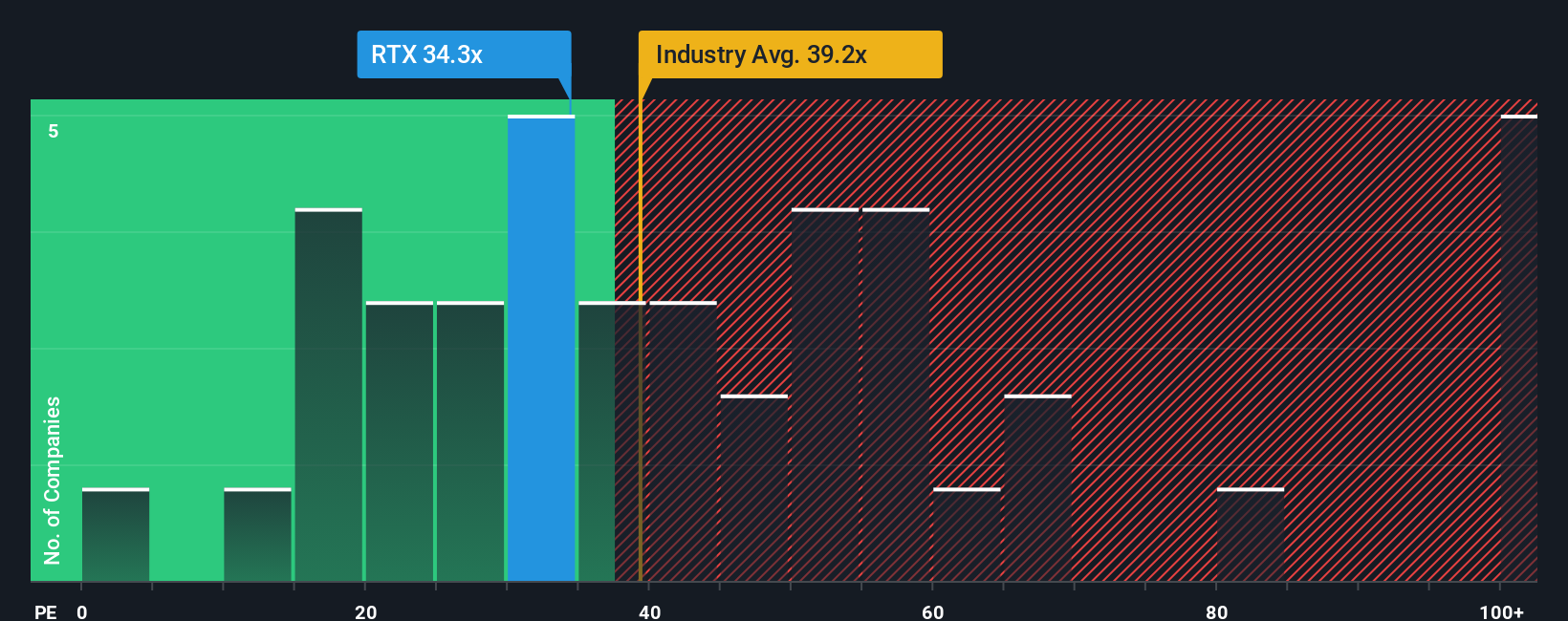

While some see RTX as undervalued when projecting future earnings and growth, it's important to note that its current price-to-earnings ratio stands at 35x. This is slightly below the Aerospace & Defense industry average of 38.1x, approximately in line with its peer average of 35.4x, and closely matches the fair ratio of 34.9x that the market could trend toward.

What does this slim gap between the current ratio and the fair ratio suggest about valuation risk or upside for RTX? Could the stock’s price already reflect much of the anticipated growth, or is there still room for a meaningful re-rating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RTX Narrative

If you’re looking to dive deeper into the numbers or want to challenge this perspective, you’re just a few clicks away from building your own vision for RTX. Do it your way.

A great starting point for your RTX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye on fresh trends, rewarding opportunities, and sectors with massive growth ahead. Don’t miss out on the stocks capturing attention right now. Consider exploring these standout themes today:

- Spot market inefficiencies as you browse these 932 undervalued stocks based on cash flows to find potential opportunities supported by sound fundamentals.

- Catch the next wave in healthcare as artificial intelligence transforms diagnostics, treatments, and patient outcomes through these 30 healthcare AI stocks.

- Unlock passive income potential with these 14 dividend stocks with yields > 3%, which highlights stocks offering attractive yields and consistent payouts for long-term wealth building.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for commercial, military, and government customers worldwide.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.