- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

Does RTX's Rocket Motor Venture and Digital Fleet Win Reinforce Its Long-Term Growth Story? (RTX)

Reviewed by Sasha Jovanovic

- Earlier this month, Raytheon signed a Memorandum of Understanding with Avio to help establish a new solid rocket motor facility in the United States, securing preferred production capacity to meet future defense demand, while Collins Aerospace, an RTX business, was chosen by Qatar Airways to provide predictive analytics for its Boeing 787 fleet using the Ascentia™ solution.

- These agreements highlight RTX's expanding presence in both commercial aerospace technology and advanced defense manufacturing, supported by strong quarterly results and a record-high backlog reflecting broad customer demand.

- We’ll examine how RTX’s partnership to expand domestic rocket motor manufacturing capacity could influence its long-term growth potential.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

RTX Investment Narrative Recap

RTX appeals to investors who believe in sustained growth from robust defense demand and ongoing innovation in aerospace and missile systems. The Raytheon-Avio partnership to expand U.S. rocket motor capacity underscores a potential long-term catalyst, but is not expected to materially influence the key short-term driver: execution against rising input costs and supply chain challenges, which remain the most pressing risk for the business at present.

Among recent announcements, the Shield AI partnership is especially relevant, as it highlights RTX’s focused push toward advanced autonomy and digital technologies in defense. This aligns closely with catalysts driving the stock’s outlook, namely increased spending on modern defense platforms and the company’s efforts to enhance high-margin, tech-enabled offerings across its portfolio.

However, investors should be aware that ongoing margin pressures from input-cost inflation may still pose a risk, especially if...

Read the full narrative on RTX (it's free!)

RTX's outlook anticipates $97.7 billion in revenue and $8.9 billion in earnings by 2028. This forecast is based on 5.3% annual revenue growth and a $2.8 billion increase in earnings from the current $6.1 billion.

Uncover how RTX's forecasts yield a $192.06 fair value, a 10% upside to its current price.

Exploring Other Perspectives

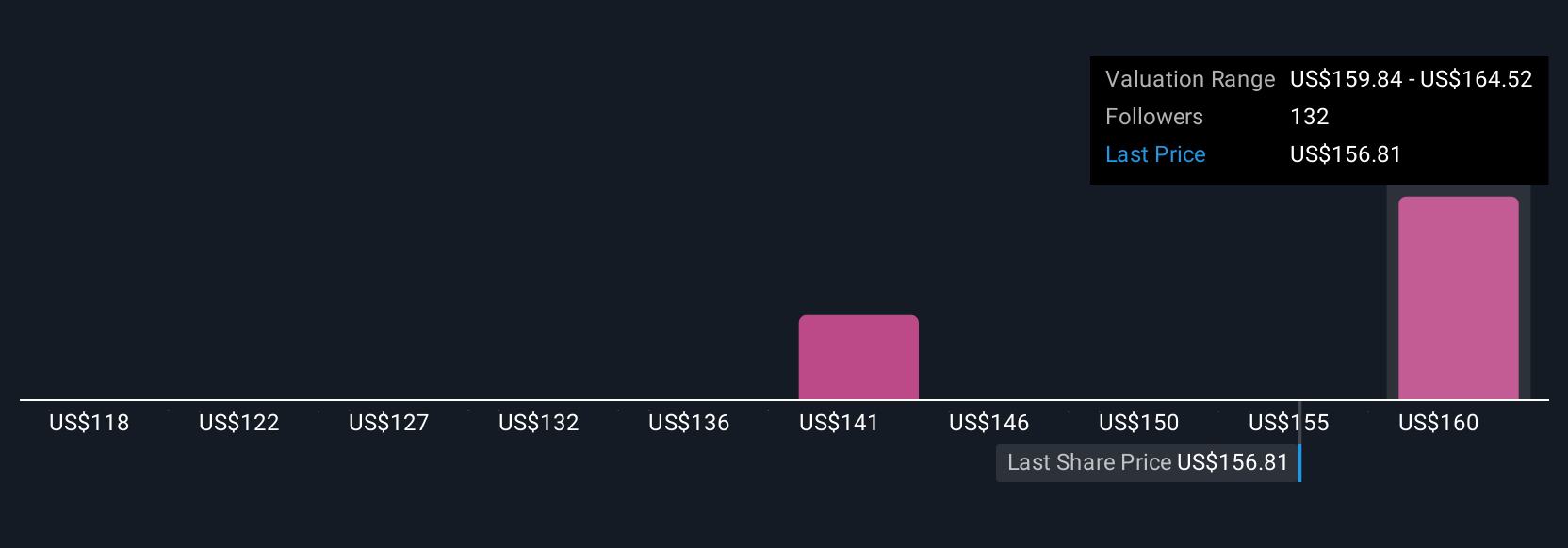

Individual fair value estimates from the Simply Wall St Community range from US$131.81 to US$192.06 across 8 submissions. While RTX’s expanding backlog and recent partnerships improve visibility, supply chain and margin risks could create a wide gap between expectations and reality, explore the full range of viewpoints above.

Explore 8 other fair value estimates on RTX - why the stock might be worth as much as 10% more than the current price!

Build Your Own RTX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RTX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free RTX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RTX's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives