- United States

- /

- Electrical

- /

- NYSE:RRX

Will Regal Rexnord's (RRX) Data Center Ambitions Reshape Its Long-Term Growth Story?

Reviewed by Sasha Jovanovic

- Regal Rexnord presented at the Baird 55th Annual Global Industrial Conference on November 12, 2025, in Chicago, highlighting its operations and future outlook to industry leaders and investors.

- The company revealed significant order growth driven by increased exposure to fast-growing sectors like data centers, medical technology, and automation, with expectations for its data center business to double over the next two years.

- We’ll explore how these developments, especially the doubling forecast for the data center business, affect Regal Rexnord’s investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Regal Rexnord Investment Narrative Recap

To own Regal Rexnord as a shareholder, you need to see potential in its pivot toward higher-growth markets such as data centers and automation, while accepting that the company's recent track record has been mixed. The latest news, highlighting expectations to double the data center business, reinforces management’s focus on growth catalysts, but does not materially change the immediate risk: softness and destocking in core markets continue to limit organic growth and earnings momentum in the near term.

Among recent developments, the company's revised 2025 earnings guidance, lowered after its Q3 report, stands out. This shift serves as a reminder that while new order growth from areas like data centers is encouraging, it has yet to fully offset persistent weakness across mature sectors. Investors are left weighing fresh growth opportunities against ongoing execution and demand headwinds.

Yet, with this new focus, investors should watch for unresolved risks in ...

Read the full narrative on Regal Rexnord (it's free!)

Regal Rexnord's outlook suggests revenues will reach $6.5 billion and earnings $695.5 million by 2028. This is based on an assumed annual revenue growth rate of 3.5% and represents an increase in earnings of about $445 million from current earnings of $250.4 million.

Uncover how Regal Rexnord's forecasts yield a $177.73 fair value, a 38% upside to its current price.

Exploring Other Perspectives

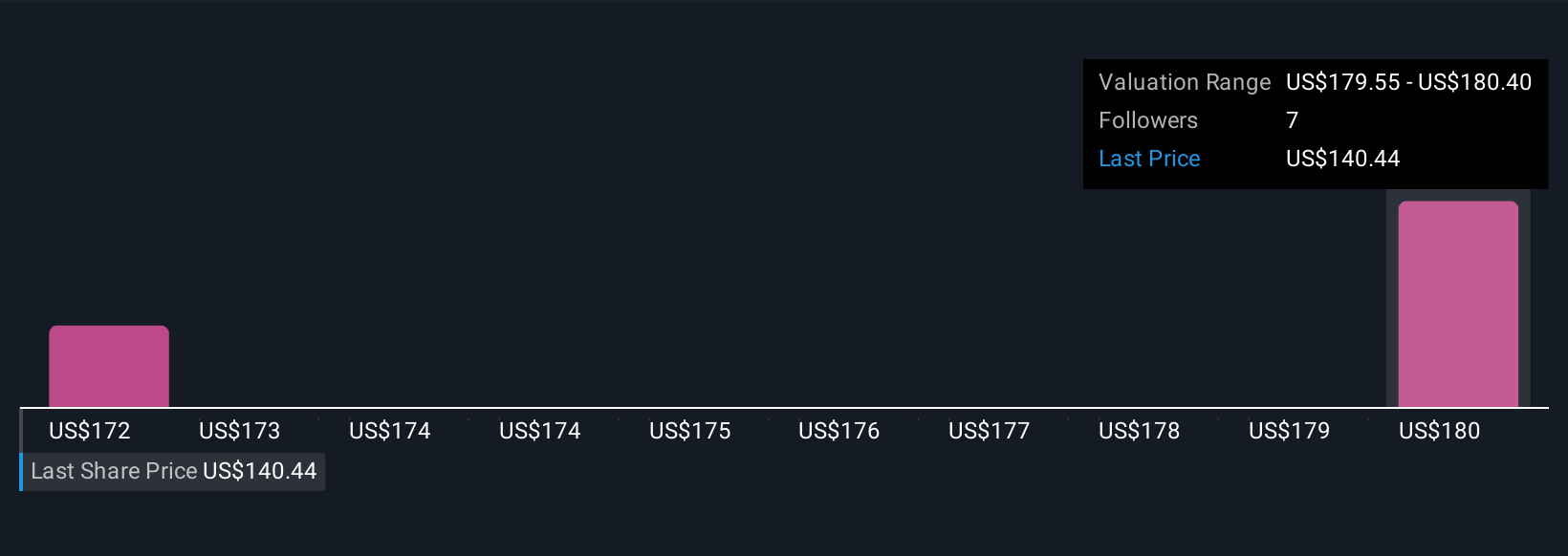

Simply Wall St Community members estimated Regal Rexnord’s fair value between US$166.86 and US$177.73, drawing on two unique perspectives. These varying views sit alongside the ongoing challenge of sustaining organic growth, which continues to shape expectations for future profit improvement.

Explore 2 other fair value estimates on Regal Rexnord - why the stock might be worth as much as 38% more than the current price!

Build Your Own Regal Rexnord Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regal Rexnord research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Regal Rexnord research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regal Rexnord's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRX

Regal Rexnord

Provides sustainable solutions for power, transmit, and control motion products in the North America, Asia, Europe, and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives