- United States

- /

- Electrical

- /

- NYSE:RRX

What Regal Rexnord (RRX)'s CEO Search and Lowered Profit Outlook Mean for Shareholders

Reviewed by Sasha Jovanovic

- In late October 2025, Regal Rexnord Corporation reported strong third-quarter order growth led by US$195 million in data center bookings, while simultaneously lowering its full-year earnings guidance and launching a CEO succession search as current CEO Louis Pinkham prepares to depart.

- This combination of robust demand in a key segment alongside margin pressures and leadership transition introduces a complex backdrop for the company's near-term outlook.

- Next, we'll examine what Regal Rexnord's CEO transition and revised profit outlook mean for its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Regal Rexnord Investment Narrative Recap

To be a Regal Rexnord shareholder means believing in its ability to capitalize on surging demand in electrification, motion control, and especially data centers, while managing headwinds like input cost inflation and trade-related supply chain risk. The recent CEO succession search and lowered full-year profit guidance don't fundamentally change the powerful near-term catalyst: robust data center project wins and a deep pipeline. The key near-term risk remains potential margin pressure if rare earth magnet supply challenges worsen, though management's operational moves appear to mitigate the immediate impact.

Among recent announcements, the Board's confirmation of a smooth CEO transition underscores a recurring business strength: disciplined succession planning. With outgoing CEO Louis Pinkham having overseen substantial increases in enterprise value and market position, a transparent transition may reassure investors that execution on high-growth initiatives, notably in data center infrastructure, can remain on track even as leadership changes.

However, against this backdrop, investors should not underestimate how supply chain turmoil in rare earth magnets could still pose...

Read the full narrative on Regal Rexnord (it's free!)

Regal Rexnord's outlook forecasts $6.5 billion in revenue and $695.5 million in earnings by 2028. This is based on a projected 3.5% annual revenue growth rate and an earnings increase of $445 million from the current $250.4 million.

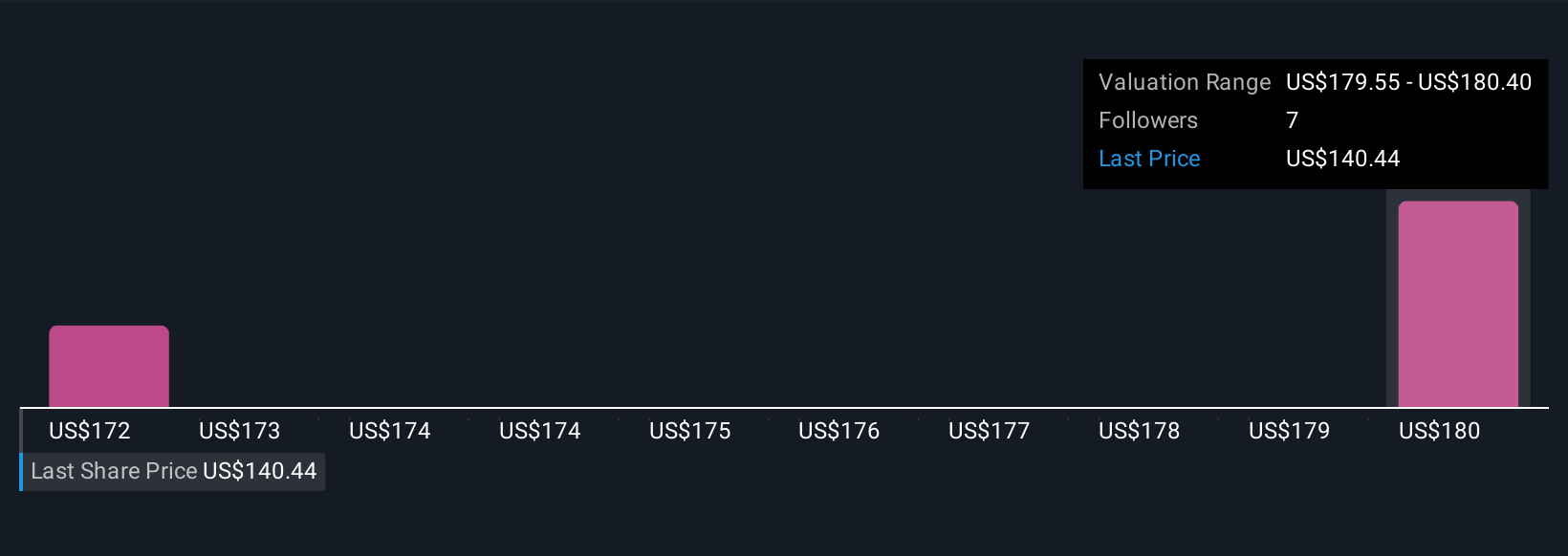

Uncover how Regal Rexnord's forecasts yield a $177.73 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Private investors in the Simply Wall St Community estimate Regal Rexnord’s fair value in a tight US$167 to US$178 range from two analyses. With recent data center order momentum, the company’s exposure to rare earth magnet supply chains could make a material difference to these outlooks. Explore different viewpoints and consider how shifting supply risks might influence future forecasts.

Explore 2 other fair value estimates on Regal Rexnord - why the stock might be worth as much as 26% more than the current price!

Build Your Own Regal Rexnord Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regal Rexnord research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Regal Rexnord research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regal Rexnord's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRX

Regal Rexnord

Provides sustainable solutions for power, transmit, and control motion products in the North America, Asia, Europe, and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives