- United States

- /

- Electrical

- /

- NYSE:RRX

Regal Rexnord (RRX): Exploring the Valuation Story Behind Recent Share Price Volatility

Reviewed by Simply Wall St

Regal Rexnord (RRX) shares have experienced moderate fluctuations over the past month, reflecting the broader industrials sector as investors weigh recent trends in revenue and net income growth. The company’s results have drawn renewed attention to its long-term performance.

See our latest analysis for Regal Rexnord.

Regal Rexnord’s share price has drifted lower since the start of the year, now trading at $145.07, and the one-year total shareholder return is down 12.01%. While momentum has faded recently, the stock’s three- and five-year total returns of 33% and 48% indicate there is still a longer-term growth story behind the recent volatility.

If you’re weighing your next move in the industrials space, this is the perfect time to discover fast growing stocks with high insider ownership.

With shares currently trading well below analyst targets and solid underlying growth, the question facing investors is whether Regal Rexnord is now undervalued or if the market has already priced in any upside potential.

Most Popular Narrative: 19.6% Undervalued

Regal Rexnord’s most widely followed narrative sees significant upside, with the estimated fair value well above the latest closing price of $145.07. This sets the stage for a bold outlook driven by the company’s expansion into rapidly growing electric and automation markets.

Surging investment in smart manufacturing, industrial automation, and data center buildouts is leading to a significant backlog in power management and motion control projects. Recent large data center wins and a robust order funnel highlight this trend. This future conversion of backlog to sales, especially in longer-cycle projects, is expected to support top-line expansion and margin enhancement into 2026.

Curious what financial forecasts justify this optimistic outlook? This narrative hinges on aggressive margin expansion, earnings momentum, and ambitious revenue assumptions. Want to see which number unlocks Regal Rexnord’s hidden value? The details might surprise you.

Result: Fair Value of $180.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential supply chain shocks or prolonged weakness in core markets could challenge Regal Rexnord’s upside if these issues are not managed effectively.

Find out about the key risks to this Regal Rexnord narrative.

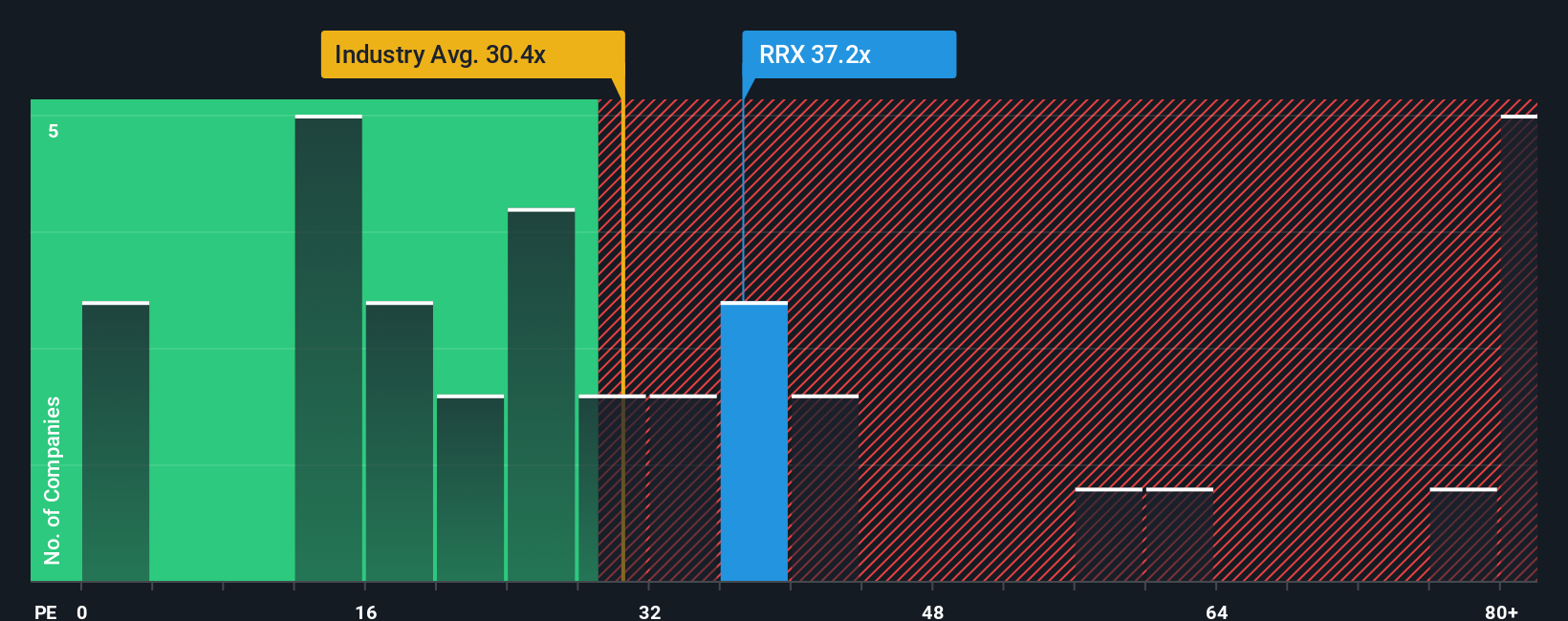

Another View: Gauging Value by Price Ratios

Looking beyond future growth models, Regal Rexnord’s price-to-earnings ratio sits at 37.5x, above the US Electrical industry’s average of 29.4x and matching its peer group. However, our analysis shows the fair ratio could be as high as 53x, suggesting the stock is not stretched by historical standards. Does this gap reveal untapped value, or is the premium a potential warning?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Regal Rexnord Narrative

If you see Regal Rexnord’s story differently or want to dig into the numbers yourself, you can quickly build your own perspective from scratch by using Do it your way.

A great starting point for your Regal Rexnord research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Great investors never stop searching for tomorrow’s winners. Give yourself an edge by checking out these unique stock ideas. You could spot the best opportunities before the crowd.

- Find your next income champion and step up your cash flow with these 24 dividend stocks with yields > 3%, offering reliable yields above 3%.

- Capitalize on market inefficiencies and seize bargains in plain sight through these 848 undervalued stocks based on cash flows, based on strong cash flows.

- Ride the AI innovation wave and position your portfolio at the forefront with these 26 AI penny stocks, pushing boundaries in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRX

Regal Rexnord

Provides sustainable solutions for power, transmit, and control motion products in the North America, Asia, Europe, and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives