- United States

- /

- Electrical

- /

- NYSE:ROK

Rockwell Automation’s Valuation Examined After 34.8% Stock Surge and New Partnerships

Reviewed by Bailey Pemberton

- Thinking about whether Rockwell Automation is worth its current price? If you have ever wondered if now is a good entry point or time to lock in profits, you are in the right place.

- The stock has climbed an impressive 34.8% year to date, with gains of 6.2% over the last month. This hints at plenty of shifting sentiment around growth potential and risk.

- Momentum has recently picked up following news of Rockwell's expansion efforts in industrial automation and digital transformation partnerships. Announcements of new collaborations are fueling excitement among investors looking for long-term, tech-driven opportunities.

- Before jumping into more detailed analysis, it is worth noting that Rockwell Automation’s valuation score currently stands at 0 out of 6. This suggests plenty of curiosity about how to judge its value. We will unpack the usual valuation approaches in a moment, but keep an eye out for a perspective at the end that adds even more insight.

Rockwell Automation scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rockwell Automation Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. For Rockwell Automation, this model uses a two-stage Free Cash Flow to Equity method. It takes analyst cash flow forecasts for the next five years and then extrapolates the remaining years using more generalized assumptions.

Currently, Rockwell Automation generates free cash flow of $1.36 billion. Analyst projections suggest this figure could grow to approximately $1.89 billion by 2029, with estimates for the next decade reflecting steady, ongoing growth. The projections beyond 2029 are derived from broad industry and company-level estimates, which adds a layer of uncertainty as the timeline extends.

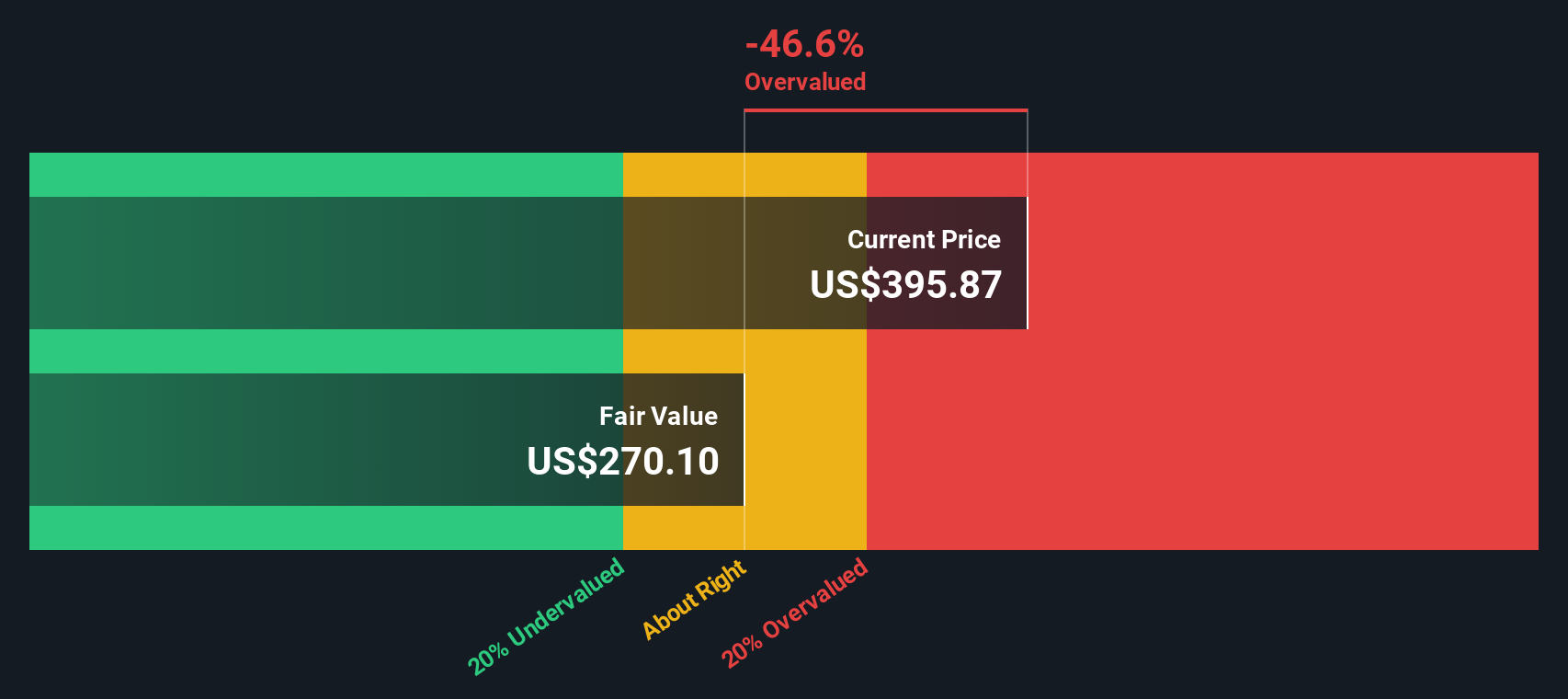

Based on these cash flow projections, the DCF model calculates an intrinsic value of $264.70 per share for Rockwell Automation. This figure is significant because it implies the current stock price is trading at a 43.1% premium to what the DCF model suggests is fair value.

In summary, Rockwell Automation stock appears markedly overvalued according to the DCF analysis, as its market price is well above its intrinsic value as calculated by projected future cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rockwell Automation may be overvalued by 43.1%. Discover 917 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Rockwell Automation Price vs Earnings

The Price-to-Earnings (PE) ratio is widely recognized as a reliable way to value profitable companies, as it expresses what investors are willing to pay today for a dollar of the company's current earnings. For established firms with consistent profitability, the PE ratio signals investor expectations, balancing anticipated growth against perceived risks.

What is seen as a “fair” PE ratio depends largely on future growth prospects and the risks associated with the business. Companies expected to grow faster or operate with greater stability typically deserve higher PE multiples, while those with slower growth or more uncertainty tend to trade at a discount.

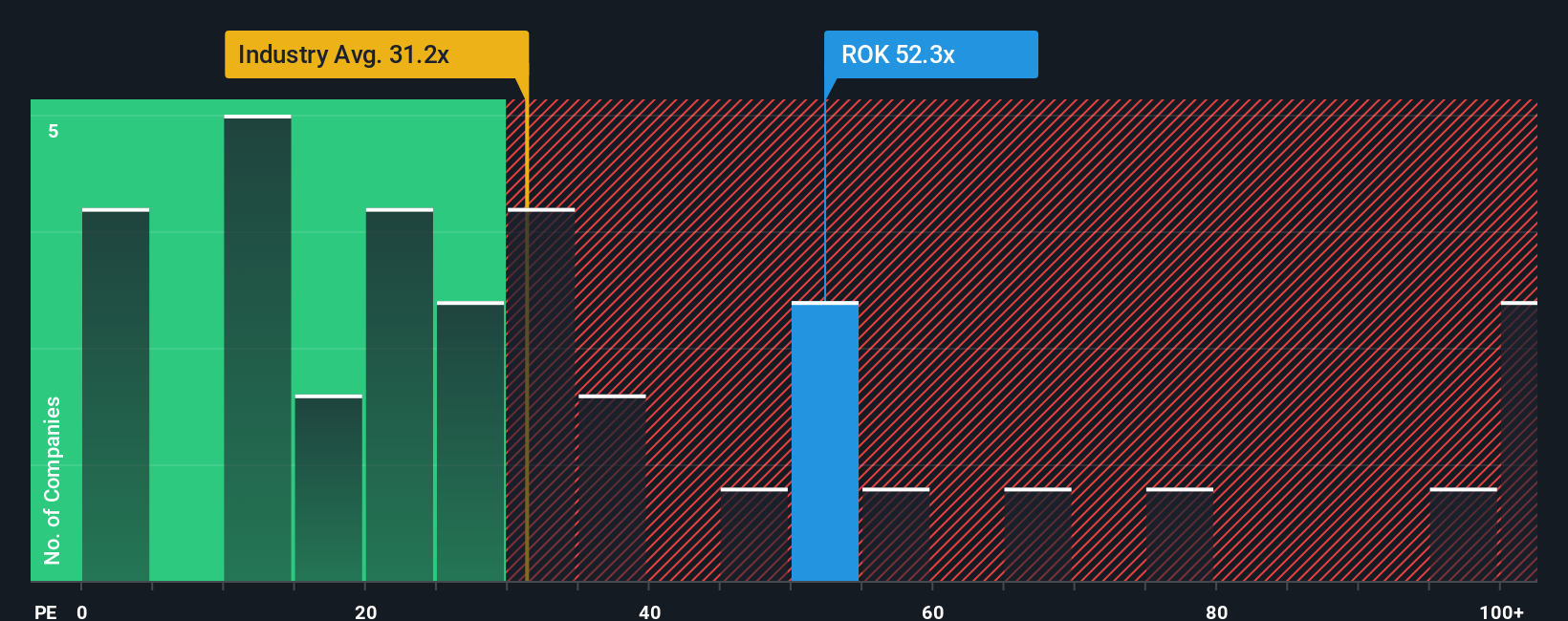

Currently, Rockwell Automation’s PE ratio stands at 49.0x, which is noticeably higher than its industry average of 30.6x and the average among key peers at 36.8x. This signals investors are willing to pay a substantial premium versus the broader sector.

To put this into sharper perspective, Simply Wall St’s proprietary Fair Ratio for Rockwell Automation is 33.6x. This figure is calculated using a detailed assessment of the company's earnings growth, profit margin, market size, sector, and risks. Unlike simple peer or industry comparisons, the Fair Ratio incorporates the full financial context of Rockwell Automation’s business, offering a more tailored benchmark for fair value.

With a current PE of 49.0x against a Fair Ratio of 33.6x, Rockwell Automation appears overvalued based on this metric as investors are paying much more than what is justified by its growth and risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rockwell Automation Narrative

Earlier we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. In simple terms, a Narrative is your investment story—an explicit explanation of how you believe Rockwell Automation will perform in the future, including your assumptions around its fair value, revenue growth, earnings, and profit margins.

Narratives go beyond the numbers displayed in conventional ratios. They link the company’s story to a financial forecast and, ultimately, to a specific fair value. This helps you connect what you know about the business to what you believe it is worth. Anyone can create and share their Narrative using Simply Wall St's Community page, a feature trusted and used by millions of investors worldwide.

This means you are not limited to standard, static valuations. Instead, you can compare your views and the underlying numbers with others, and clearly see if Rockwell Automation’s market price lines up with your perspective of fair value. This makes it easier to judge when to buy or sell.

Because Narratives are updated automatically when news or earnings come out, they always reflect the latest information. For example, some investors’ Narratives expect as much as $410.0 per share for Rockwell Automation, based on optimism around automation and margin growth. Others take a more cautious stance and see fair value closer to $229.0, reflecting risks like delayed projects or global uncertainty.

Do you think there's more to the story for Rockwell Automation? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROK

Rockwell Automation

Provides industrial automation and digital transformation solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives