- United States

- /

- Electrical

- /

- NYSE:ROK

Rockwell Automation (ROK): Evaluating Valuation After $2B Wisconsin Expansion Announcement

Reviewed by Simply Wall St

Rockwell Automation (ROK) just revealed plans for a massive new manufacturing campus in Southeastern Wisconsin, kickstarting a $2 billion investment. The company aims to expand its facilities, advance its technology, and reinforce its leadership in industrial automation.

See our latest analysis for Rockwell Automation.

Rockwell Automation’s bold new investment comes on the heels of a year marked by robust performance. The company’s 1-year total shareholder return stands at 35.2%, outpacing many industry peers. Momentum has picked up recently, with a 9.7% three-month share price return, even as shares faced a short-term dip last week. Strategic initiatives like the upcoming SecureOT™ suite launch and this major expansion project are fueling optimism about growth and resilience ahead.

If this move has you thinking bigger, now could be the perfect moment to see what’s happening across the industry and discover fast growing stocks with high insider ownership

With the stock climbing and ambitious expansion plans underway, investors are left wondering whether Rockwell Automation is trading at a compelling value or if the market has already priced in the company’s next phase of growth.

Most Popular Narrative: 3% Undervalued

Rockwell Automation’s most widely followed narrative puts fair value at $384.12, slightly above the last close of $372.48. This suggests the company’s bullish future drivers have just edged ahead of the recent share price.

Substantial investment, $2 billion over the next 5 years, in plants, digital infrastructure, and talent is aimed at building competitive capacity, operational efficiency, and supporting higher-margin growth areas. This lays the groundwork for future margin expansion and long-term EPS growth.

Curious how these aggressive investments could unlock higher earnings power? The roadmap includes surprising growth levers and financial assumptions not yet obvious in the rear-view mirror. See which projections have analysts raising their bets and how shifting profit margins shape this premium valuation.

Result: Fair Value of $384.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delayed customer spending and persistent geopolitical uncertainty could easily undermine the bullish outlook for Rockwell Automation in the years ahead.

Find out about the key risks to this Rockwell Automation narrative.

Another View: Multiples Point to Stretch

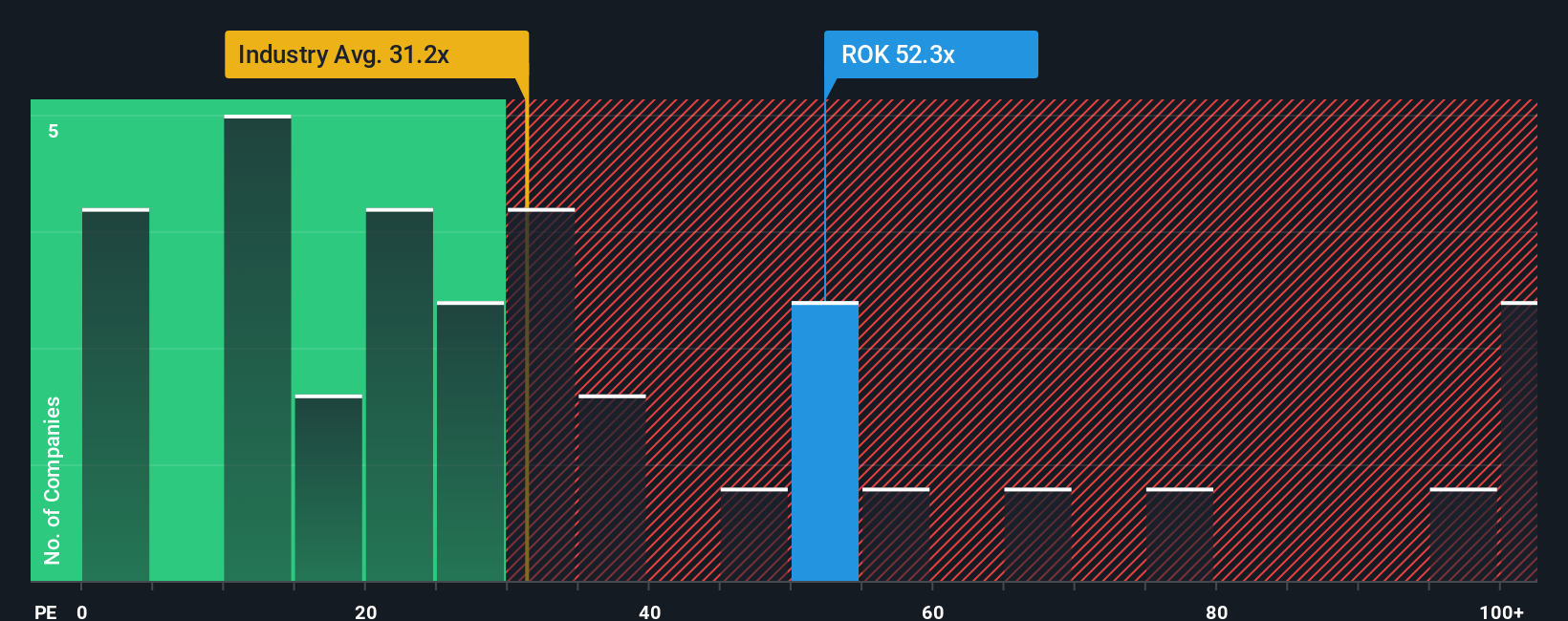

While many see promise in Rockwell Automation’s future earnings growth, a quick look at price-to-earnings ratios tells a different story. The company trades at 48.2x earnings, which is far higher than peers (37.6x) and the US Electrical industry average (26.7x), and well above its fair ratio of 34.3x. That sizable premium means investors are paying up for growth. Is it justified, or does it raise the stakes if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rockwell Automation Narrative

If your perspective differs or you enjoy digging into the numbers yourself, you can build your own narrative for Rockwell Automation in just minutes, starting with Do it your way.

A great starting point for your Rockwell Automation research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Want to outpace the crowd? Handpick your next opportunity by targeting stocks built for long-term growth and breakthrough trends using these high-impact ideas:

- Uncover overlooked value plays with potential for outsized gains by starting your research with these 897 undervalued stocks based on cash flows.

- Supercharge your watchlist by targeting unique dividend opportunities. See what sets these payouts apart with these 15 dividend stocks with yields > 3%.

- Capitalize on the AI revolution by tracking innovation frontrunners. Stay tuned in with these 27 AI penny stocks before the market fully wakes up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROK

Rockwell Automation

Provides industrial automation and digital transformation solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives