- United States

- /

- Electrical

- /

- NYSE:ROK

Rockwell Automation (NYSE:ROK) Declares US$1.31 Dividend for Shareholders

Reviewed by Simply Wall St

Rockwell Automation (NYSE:ROK) recently reaffirmed its commitment to shareholder value through the declaration of a $1.31 per share quarterly dividend. Over the last quarter, Rockwell's share price increased by 27%, a movement that may also reflect response to its consistent dividend policy amidst broader market trends. The company's price performance is notable as major indices like the S&P 500 rallied, nearing record highs, which suggests that Rockwell's actions, including showcasing product innovations and updated fiscal guidance, could have added confidence during a period marked by generally strong corporate earnings and economic data.

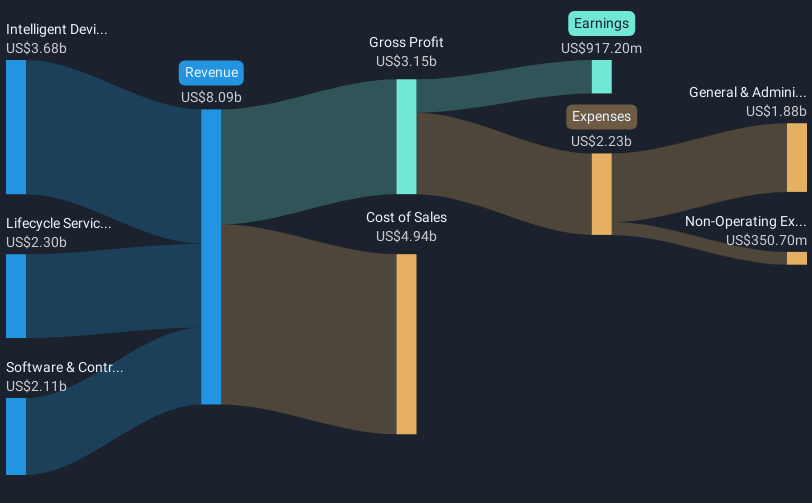

Rockwell Automation's recent decision to maintain a US$1.31 per share quarterly dividend signals a strong commitment to returning value to shareholders, potentially reinforcing long-term investment confidence. Over the past five years, Rockwell's total shareholder return, combining share price appreciation and dividends, was 67.39%, illustrating solid performance over this period. This supports the narrative that strategic initiatives, such as reshaping production and sourcing strategies, may be effectively addressing market uncertainties, thereby bolstering the company's overall resilience and attractiveness to investors.

Over the last year, Rockwell's stock matched the US Electrical industry's return, both at 24%, but surpassed the broader US market return of 12.8%. This relative outperformance underscores its capacity to maintain competitiveness despite broader economic challenges. The reaffirmation of dividends, alongside product innovations, could potentially enhance revenue and earnings forecasts by strengthening customer trust and supporting continued market expansion.

The current share price of US$253.05 represents a modest discount to analyst consensus price targets, with the market pricing in some uncertainty. Analysts anticipate revenue growth driven by the company's strategic moves and product innovations, potentially translating into increased earnings in the coming years. Therefore, while the present stock price reflects some caution, the long-term potential may align with the higher price target of US$278.97, suggesting room for future growth in line with analyst expectations.

Assess Rockwell Automation's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROK

Rockwell Automation

Provides industrial automation and digital transformation solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives