- United States

- /

- Machinery

- /

- NYSE:REVG

REV Group (REVG): Assessing Valuation Following Recent Share Price Retreat

Reviewed by Simply Wall St

See our latest analysis for REV Group.

Even after yesterday’s pullback, REV Group’s share price is still up over 61% year-to-date. This shows strong momentum alongside recent profit-taking. With a one-year total shareholder return of nearly 96% and a 676% gain over five years, long-term holders have seen substantial value growth.

If this kind of big-picture outperformance has you thinking about where momentum and growth could go next, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

The key question for investors is whether REV Group’s impressive gains leave room for further appreciation or if the market has already priced in the company’s growth prospects. This could make it harder to find an undervalued opportunity.

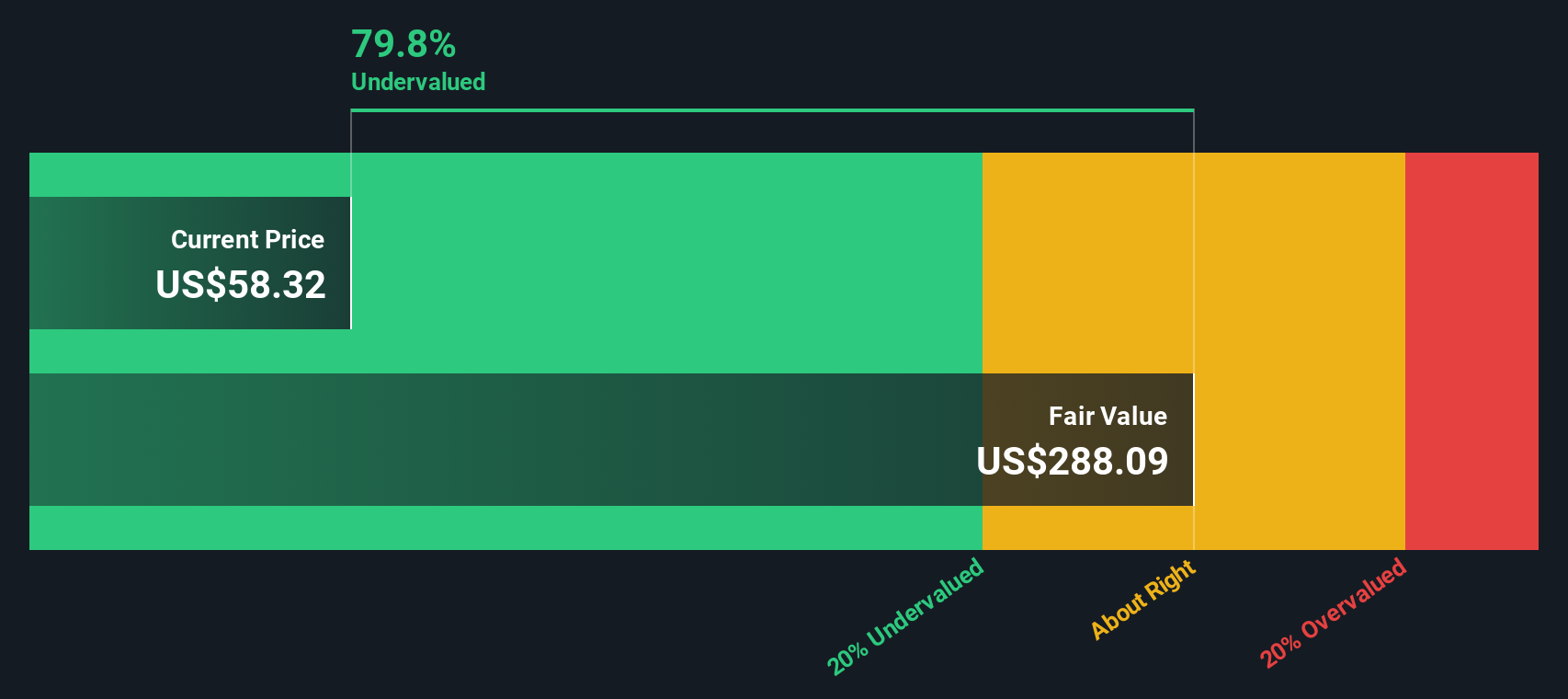

Most Popular Narrative: 22% Undervalued

With the current share price at $51.27 and the most widely followed narrative estimating fair value at $65.75, the valuation signals a sizable gap. This discrepancy prompts a closer look at the drivers and assumptions shaping expectations for future growth.

Early-cycle, scalable investments in technology and green solutions (including upcoming expansions in EV production and partnerships for electrification) are set to benefit from the impending transition of public transit and emergency services toward electrified fleets. This aligns with policy-driven demand and paves the way for incremental revenue growth and improved long-term earnings quality.

What does it take to get to that nearly $66 target? Behind the bold price projection are ambitious growth forecasts, margin expansion, and game-changing strategic moves. Want to know which expectations push this valuation miles above the current price? See what else drives the most popular narrative.

Result: Fair Value of $65.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation or a slowdown in fire and RV demand could undermine margin gains and the company’s growth outlook.

Find out about the key risks to this REV Group narrative.

Another View: Discounted Cash Flow Suggests Overvaluation

While analyst price targets see upside, our SWS DCF model gets a different result. It indicates that at $51.27, REV Group is trading above its fair value estimate of $41.56. This model, which is based on long-term cash flows, challenges the optimism of multiples-based forecasts. Which view reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out REV Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own REV Group Narrative

If you see the story differently or want to dive deeper into the numbers, you can quickly build your own narrative in just a few minutes and Do it your way

A great starting point for your REV Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t put all your eggs in one basket. By using the Simply Wall St platform, you open the door to standout stocks overlooked by most investors. Get ahead of the curve and make your next move with confidence. The right idea could be just a click away.

- Uncover rare up-and-comers by checking out these 3583 penny stocks with strong financials with robust financials and growth potential.

- Tap into market-beating yields when you scan these 22 dividend stocks with yields > 3% offering consistent returns above 3%.

- Jump into the future with these 26 AI penny stocks, focusing on pioneers at the leading edge of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REVG

REV Group

Designs, manufactures, and distributes specialty vehicles, and related aftermarket parts and services in North America and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives