- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

Redwire (RDW): Valuation Insights Following New European Defense UAS Partnership Announcement

Reviewed by Simply Wall St

Redwire (NYSE:RDW) is making moves in the defense sector after its subsidiary, Edge Autonomy, signed a Memorandum of Understanding with UXV Technologies. The partnership focuses on uncrewed aerial systems and European defense collaboration.

See our latest analysis for Redwire.

Redwire’s shares have had a turbulent ride. The latest defense partnership news arrives after a 53.8% year-to-date decline in the share price, even though the three-year total shareholder return stands at an eye-catching 197%. Recent momentum is mixed, but long-term investors are still firmly in the black.

If the push into advanced aerospace caught your interest, there are even more defense innovators to explore. See who else is making waves with our See the full list for free.

With fresh partnerships and growing revenue, Redwire appears to be trading well below analyst targets. Does this mark a genuine buying opportunity, or is the market already factoring in all the future growth ahead?

Most Popular Narrative: 56.4% Undervalued

Redwire’s last close of $7.87 sits well below the narrative’s fair value estimate of $18.06, highlighting a dramatic disconnect between price and analyst-driven expectations. This gap raises big questions about what is powering such a bullish outlook.

Redwire is positioned to benefit from accelerated global investment in space exploration and defense, evidenced by new commitments from NATO allies, significant funding initiatives in the U.S. (such as Golden Dome and NASA Gateway), and increasing space budgets in allied countries. These trends are likely to drive robust top-line revenue growth and future contract backlogs.

This narrative is not built on wishful thinking. Beneath the surface are bold revenue growth projections, game-changing profit margin assumptions, and a future valuation multiple that would make any investor do a double take. Want to see the precise triggers and hidden analyst logic fueling this price target? Read on and discover the numbers that make this view so provocative.

Result: Fair Value of $18.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent volatility in government contracts or surprises from costly new ventures could quickly shift the story and challenge today's bullish outlook.

Find out about the key risks to this Redwire narrative.

Another View: Market Multiples Tell a Different Story

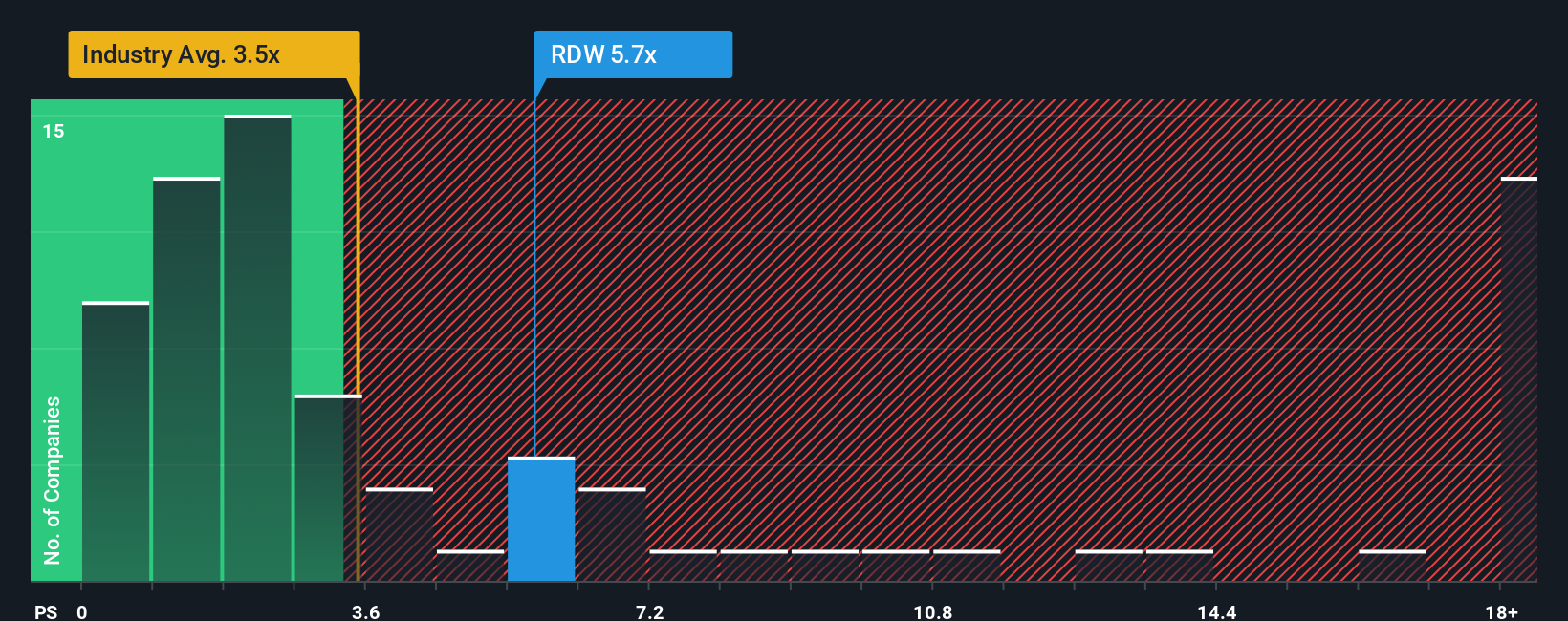

Looking beyond fair value estimates, Redwire’s price-to-sales ratio stands at 5x, significantly higher than the US Aerospace & Defense industry average of 3x and peers at 1.8x. The fair ratio, which is what the market could eventually calibrate to, sits at a lower 2.4x. This suggests there may still be valuation risk if prices revert toward more typical industry standards. Do market multiples give us a reason for caution despite optimistic forecasts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Redwire Narrative

If you want to follow your own instincts or dig deeper into the numbers, you can build your version of Redwire's story in just minutes. Do it your way

A great starting point for your Redwire research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit yourself to just one opportunity when the market is brimming with potential. Make your next move by investigating more handpicked stocks tailored to your style and goals.

- Capture the advantage of explosive early-stage growth by targeting these 3580 penny stocks with strong financials before they hit the mainstream radar.

- Enhance your search for reliable income streams by selecting these 22 dividend stocks with yields > 3% showing consistent yields above 3%.

- Seize the opportunities at the forefront of digital finance by reviewing these 81 cryptocurrency and blockchain stocks and explore which companies are redefining the intersection of finance and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives