- United States

- /

- Machinery

- /

- NYSE:RBC

RBC Bearings (RBC) Margin Growth Reinforces Bull Case Despite Premium Valuation

Reviewed by Simply Wall St

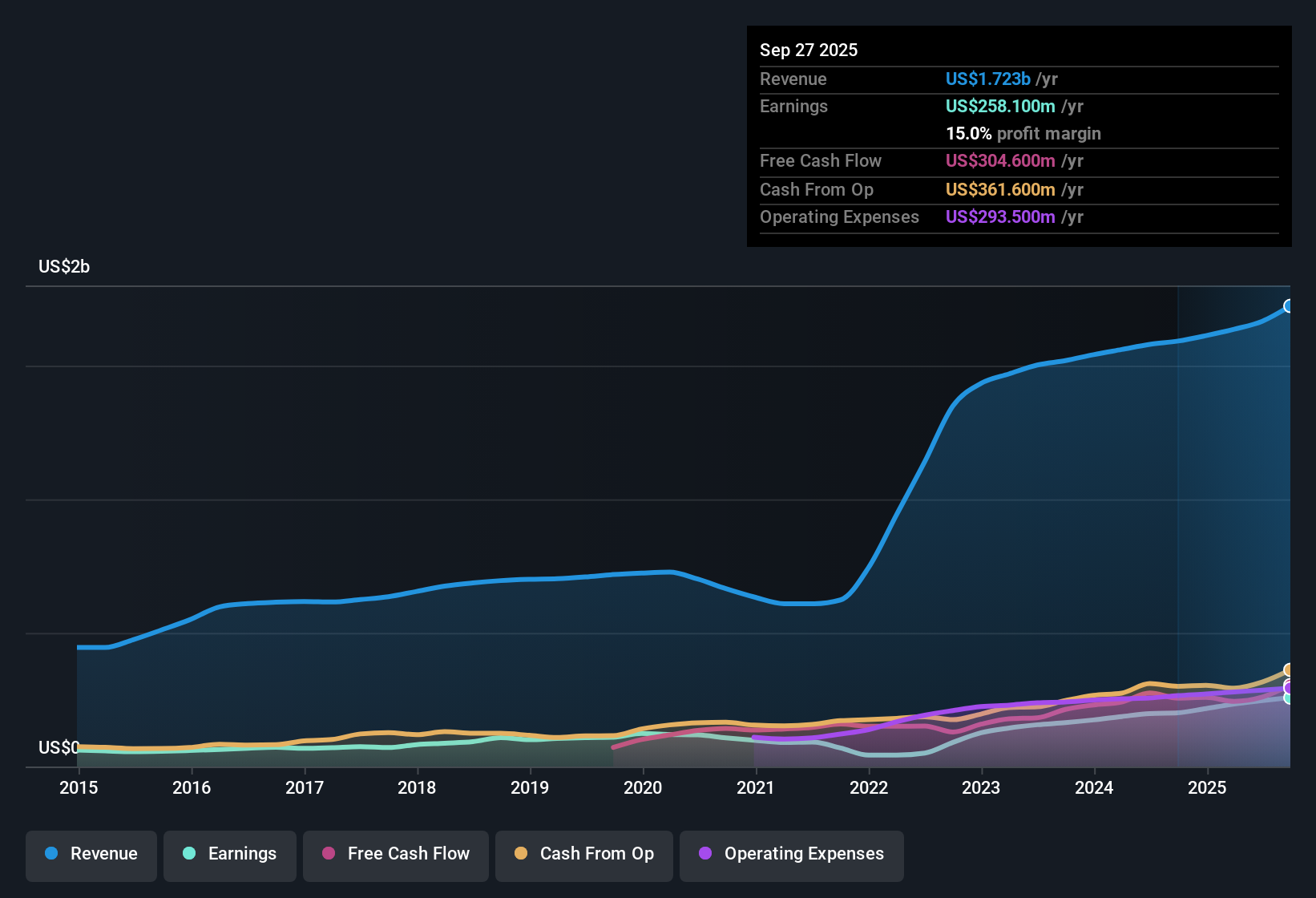

RBC Bearings (RBC) delivered earnings growth of 24.4% over the past year, just shy of its five-year annual average of 28%. The company’s net profit margin climbed to 14.8% from 12.5% a year ago, while its price-to-earnings ratio now sits at 54.6x, which is more than double the US machinery industry average. Looking ahead, earnings are forecast to increase by 20.7% per year, topping broader market profit growth and supporting an upbeat operational outlook, even as revenue growth is expected to lag the wider US pace.

See our full analysis for RBC Bearings.Next, we'll see how these numbers compare with the most widely followed narratives among investors and analysts, examining where the data fits and where it challenges expectations.

See what the community is saying about RBC Bearings

Backlog Now Exceeds $1 Billion

- RBC's record $1 billion-plus order backlog in aerospace components is driven by robust multi-year increases in defense spending, supported by global tensions and fleet modernization.

- Analysts' consensus view underscores that this unprecedented order book positions RBC for durable top-line growth and long-term contract visibility.

- Defense and aerospace backlog, bolstered by big US infrastructure investments and incentives, signals stronger recurring revenue as long-term contracts take effect.

- Consensus also notes these large contracts should support sustained revenue and margin expansion, even while industrial customer demand remains somewhat uneven.

- To see how RBC's backlog strength ties into future growth and market sentiment, analysts point to the key trends in their latest balanced outlook. 📊 Read the full RBC Bearings Consensus Narrative.

Profit Margin Set to Climb Higher

- Profit margins are forecast to rise from 14.8% to 19.5% within three years, as analysts expect capacity expansion and operational improvements to steadily boost earnings quality.

- Consensus narrative notes that margin expansion is likely as recent acquisitions, like VACCO, are integrated and new capital expenditures increase factory efficiency.

- This drive for higher margins is closely linked to rising demand for technically advanced bearings and motion control, suggesting upcoming earnings could see further upside if pricing power persists.

- At the same time, persistent customer concentration in aerospace and the risk of integration delays could threaten the expected margin improvement if not managed carefully.

Valuation Premium Remains Significant

- At $428.53 per share, RBC trades at 54.6x earnings, more than double the US machinery industry average of 24x and well above the peer group’s 27.5x. This also exceeds the estimated DCF fair value of $316.90 per share.

- Consensus narrative stresses that while the premium valuation underscores bullish confidence in durable growth, it does increase pressure for RBC to deliver on ambitious forecasts.

- The current price is above the consensus analyst target of $455.83, leaving a narrower upside and requiring sustained outperformance on margin and backlog to justify the premium multiples.

- Market risks include potential disruptions from supply chain bottlenecks and reliance on a handful of major aerospace customers, both of which could impact the high multiples should growth waver.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for RBC Bearings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the figures? Share your viewpoint and build a data-driven story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding RBC Bearings.

Explore Alternatives

Despite RBC's robust backlog, revenue growth is expected to trail the broader US market. Its lofty valuation also amplifies pressure to maintain constant outperformance.

Prefer better value and less valuation risk? Use these 832 undervalued stocks based on cash flows to quickly spot companies trading below intrinsic value with stronger upside potential now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBC

RBC Bearings

Manufactures and markets engineered precision bearings, components, and systems in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives