- United States

- /

- Construction

- /

- NYSE:PWR

Should Investors Rethink Quanta Services After 35% Rally and New Project Wins?

Reviewed by Bailey Pemberton

- Ever wondered if Quanta Services is fairly valued these days? With so many investors eyeing the stock's long climb, now is a great time to dig deeper into what its price really means.

- The stock recently closed at $426.93 and while it dipped 3.6% over the last week, it is still up an impressive 35.3% year-to-date and 32.0% over the last year, reflecting strong long-term gains.

- Some of this price action has been punctuated by industry headlines highlighting Quanta's expanding role in energy infrastructure, as the company has secured new large-scale project contracts in the electrical grid and renewable sectors. These developments help explain both renewed optimism and some heightened volatility in recent weeks.

- On the surface, Quanta Services scores a 0 out of 6 on our valuation checks, suggesting little undervaluation by standard metrics. But valuation is more than numbers and ratios alone, so let’s dig into the usual methods. At the end of the article, we will reveal an even more holistic approach.

Quanta Services scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Quanta Services Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting its future cash flows and then discounting those projections back to today's value. This approach helps investors look beyond short-term market noise by focusing on long-term fundamentals.

For Quanta Services, the current Free Cash Flow stands at $1.21 Billion. Based on analyst forecasts and further extrapolations, this figure is expected to rise steadily to $2.90 Billion in 2029 and even higher over the following years. While analyst estimates only go out five years, Simply Wall St extends these projections for a fuller long-term view.

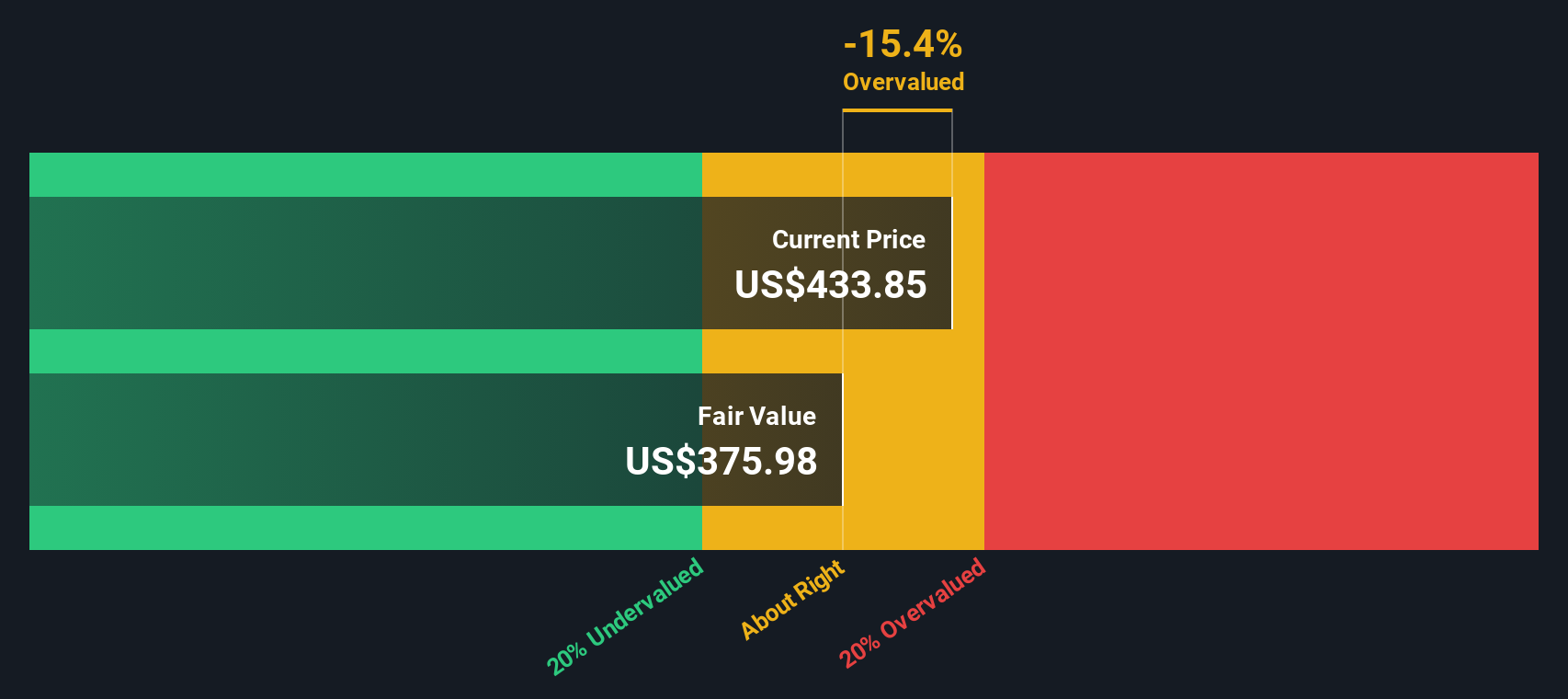

Applying these cash flow forecasts, the DCF analysis determines an intrinsic fair value of $362.10 per share. With the stock currently trading at $426.93, this suggests Quanta Services is about 17.9% overvalued based on its projected cash generation.

If you rely on the DCF method, Quanta Services is trading above what its cash flows might justify today. Investors should consider this premium when evaluating potential risk or upside.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Quanta Services may be overvalued by 17.9%. Discover 868 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Quanta Services Price vs Earnings (PE)

For established, profitable companies like Quanta Services, the Price-to-Earnings (PE) ratio is one of the most widely used metrics to assess valuation. It reflects what investors are willing to pay for each dollar of earnings and is especially useful for companies with stable and growing profits.

Growth expectations and risk play a key role in shaping a “normal” or “fair” PE ratio. Fast-growing companies typically command a higher PE because investors expect future earnings to rise. On the other hand, higher perceived risks tend to drag the ratio down.

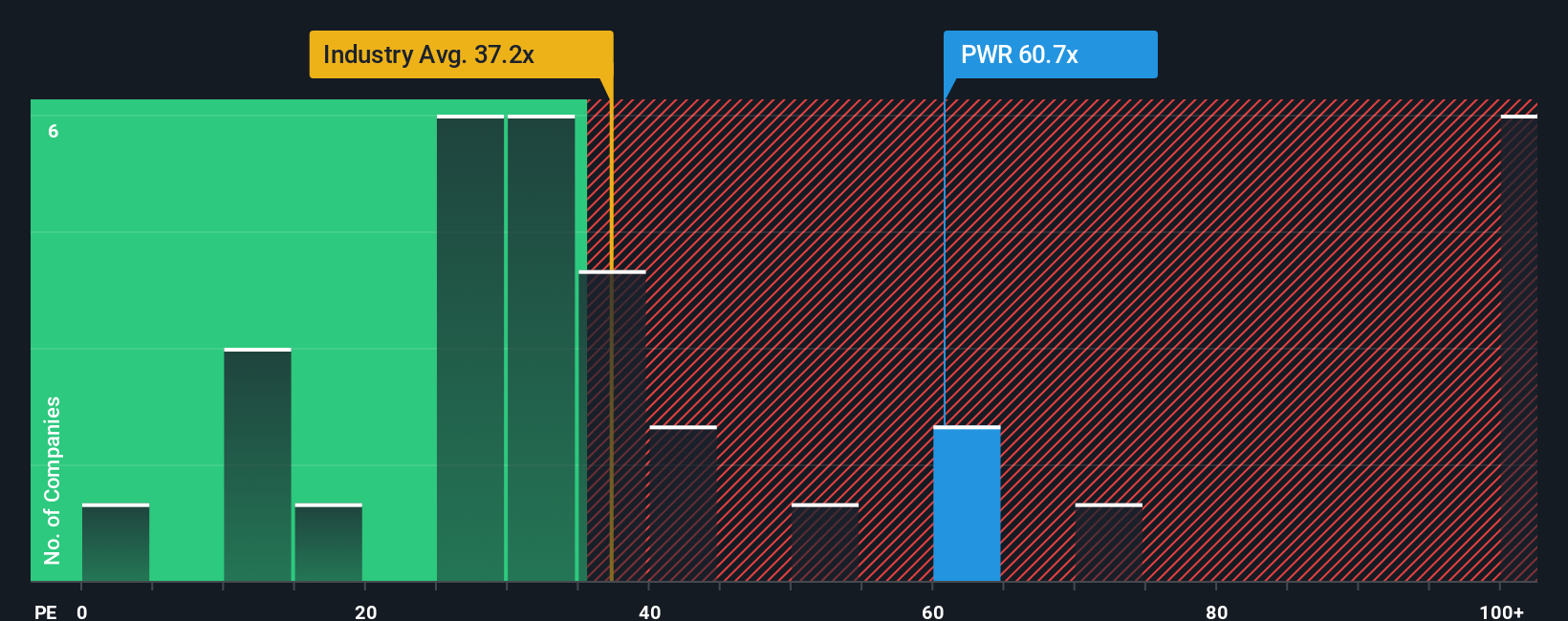

Quanta Services currently trades at a PE ratio of 62.5x. This is well above both the construction industry average of 32.7x and the peer group average of 33.3x, signaling a significant premium placed by the market on Quanta’s earnings quality and growth prospects.

Simply Wall St’s proprietary “Fair Ratio” is designed to set a more tailored benchmark than just a straightforward comparison with peers or the industry. It incorporates not only sector trends but also specific attributes like Quanta’s earnings growth, margins, size, and risk profile, suggesting a fair PE for Quanta of 40.6x. By blending company-specific growth, profitability, and risk factors with broader sector data, the Fair Ratio offers a more holistic view of valuation.

With a current PE of 62.5x compared to a fair multiple of 40.6x, Quanta Services appears to be trading well above what these combined fundamentals would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Quanta Services Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives let you connect your unique perspective on a company—your story—directly to the numbers by aligning your assumptions about future revenues, earnings, margins, and ultimately fair value. This approach links what you believe about a company’s future to dynamic financial forecasts, making it far easier to translate your ideas into clear investment decisions.

Narratives are not only intuitive, but also accessible through the Simply Wall St Community page, where millions of investors share and update their views. Here, you can create or explore different perspectives, compare your fair value estimate with the latest market price, and quickly decide if a stock is a buy, hold, or sell for you. Best of all, Narratives update automatically as new information such as earnings releases or major news comes out, keeping your view relevant in real time.

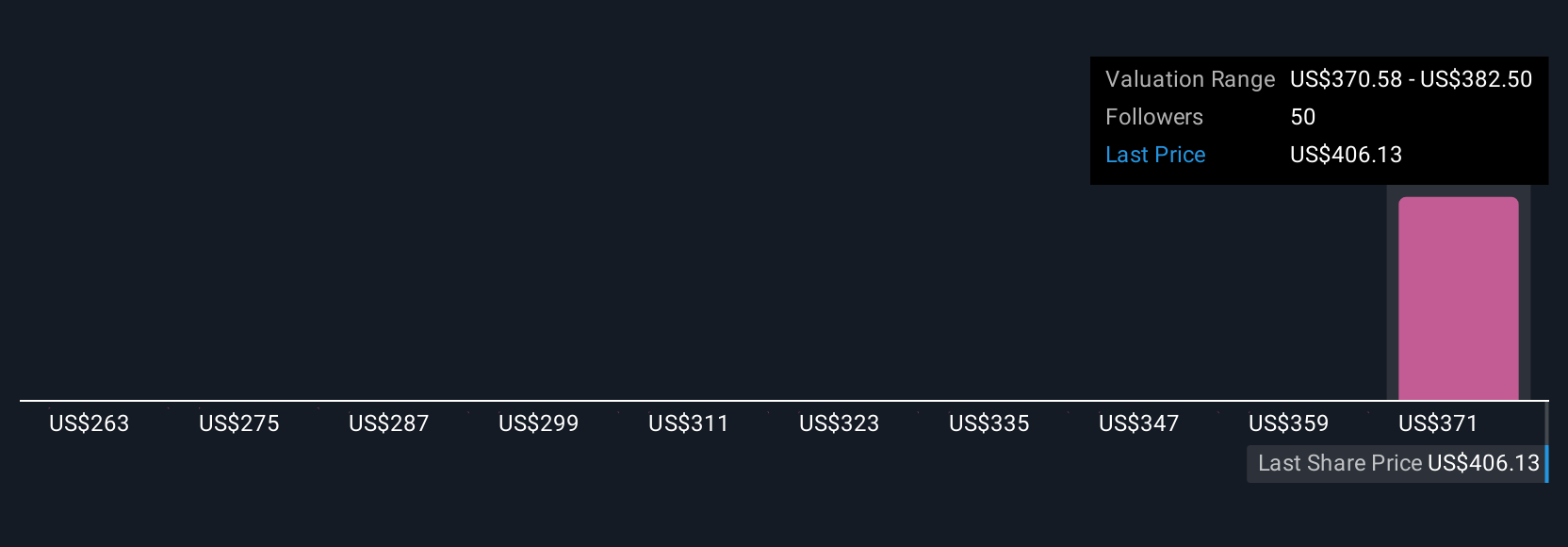

For Quanta Services, one investor might cite accelerating power grid demand, innovative acquisitions, and expanding project pipelines to justify a bullish Narrative and see fair value as high as $490 per share. Another could focus on labor cost risks and execution challenges, taking a more cautious view and setting fair value near $248. Narratives make these differences visible and actionable, empowering you to make confident, informed choices that reflect your personal outlook.

Do you think there's more to the story for Quanta Services? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PWR

Quanta Services

Offers infrastructure solutions for the electric and gas utility, renewable energy, communications, pipeline, and energy industries in the United States, Canada, Australia, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives