- United States

- /

- Construction

- /

- NYSE:PWR

Quanta Services (PWR): Assessing Valuation as Shares Steady Near Highs and Sector Trends Shift

Reviewed by Simply Wall St

See our latest analysis for Quanta Services.

After a series of new infrastructure awards and steady demand for utility services, Quanta Services’ share price has pushed close to all-time highs, delivering a robust 45.94% share price return year-to-date. Momentum remains strong, backed by a 19.29% gain over the last three months, and the company’s total shareholder return tells a compelling long-term story, rising 34.03% over the past year and more than quadrupling investors’ money across five years.

If you’re interested in other companies with momentum and a track record of insider support, now’s a great time to broaden your views and discover fast growing stocks with high insider ownership

With shares trading near all-time highs and only a slight discount to analyst price targets, investors may be wondering if Quanta Services’ impressive track record still leaves room for upside or if the market has already priced in its future growth.

Most Popular Narrative: 2.6% Undervalued

Compared to its last close at $460.43, the most popular narrative assigns Quanta Services a fair value of $472.80. This subtle premium suggests investors are weighing strong fundamentals and sector dynamics against high expectations.

Multi-year, large-scale utility and renewable project pipelines continue to expand due to both increasing policy tailwinds (e.g., IRA, infrastructure bills) and heightened power demand. This extends project visibility and enables Quanta to lock in longer-term, higher-value contracts, improving future earnings predictability and quality.

What fuels this verdict? Hint: a forward-looking blueprint where ambitious revenue growth and rising profitability push Quanta beyond traditional benchmarks. If you want the exact assumptions and why the profit multiple stands out compared to industry peers, read on to see how analysts justify this valuation premium.

Result: Fair Value of $472.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing labor shortages and potential regulatory delays could threaten Quanta’s growth trajectory if they impact major project timelines or margins.

Find out about the key risks to this Quanta Services narrative.

Another View: What Do Earnings Multiples Say?

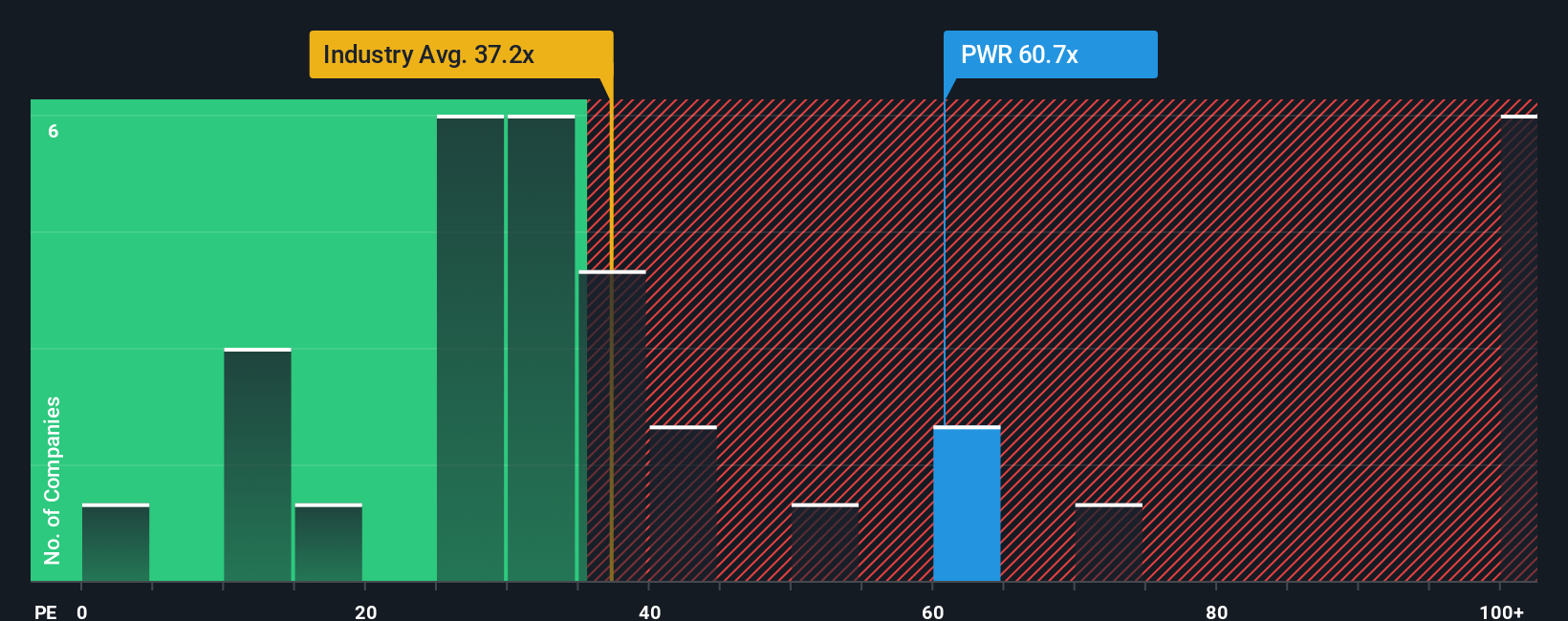

While the main narrative points to upside, a look at how Quanta Services is valued compared to earnings reveals a gap. Its price-to-earnings ratio is 67.4x, which stands well above the US Construction industry average of 33.8x, the peer average of 54.7x, and the market’s fair ratio of 40.5x. This premium means investors are paying much more for each dollar of earnings than peers or what the market generally expects, raising the bar for future performance. How comfortable should you be when the market stretches the multiples this far?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Quanta Services Narrative

If you’re keen to dig into the numbers or build your own case for Quanta Services, it only takes a few minutes to tailor your own perspective. Do it your way

A great starting point for your Quanta Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Strengthen your investment strategy and seize untapped opportunities by focusing on sectors and trends others might overlook. Don’t let these hidden gems pass you by. Use the Simply Wall Street Screener now to turn smart insights into action.

- Tap into huge cash flow potential by scanning for strong prospects with these 925 undervalued stocks based on cash flows and uncover stocks trading below their true worth.

- Unlock future growth by checking out these 25 AI penny stocks, where artificial intelligence powerhouses are reshaping industries and redefining what’s possible.

- Harvest passive income opportunities by reviewing these 15 dividend stocks with yields > 3% with consistently high yields for long-term rewards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PWR

Quanta Services

Offers infrastructure solutions for the electric and gas utility, renewable energy, communications, pipeline, and energy industries in the United States, Canada, Australia, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success