- United States

- /

- Construction

- /

- NYSE:PWR

Does Quanta Services’ 40% Rally Reflect Its Infrastructure Growth Potential in 2025?

Reviewed by Bailey Pemberton

If you’ve been watching Quanta Services, you’re in good company. This stock is catching a lot of attention after another year of impressive gains. With its share price closing recently at $441.82, Quanta has delivered a 40.0% return year-to-date and a significant 571.2% return over five years. Even over just the last 30 days, the stock is up 9.0%, showing that momentum is far from slowing. For anyone wondering if it’s time to buy in, hold tight, or take some profits, the real question is how much of this growth is already baked into the price.

Recent news around Quanta Services points to growing demand for infrastructure upgrades and the ongoing transition to renewable energy. Both of these areas are where the company is expanding its footprint. These big-picture themes have helped shape investor sentiment and are driving the perception that Quanta is positioned for continued success. At the same time, such enthusiasm may also be pushing up expectations and risk.

When we look at Quanta Services using a standard valuation scorecard, where a score of 6 indicates the company is undervalued across all six typical checks, Quanta currently sits at 0. Not a single metric suggests it is undervalued right now. But don’t make any snap decisions just yet. In the next section, we’ll dig into the details of each valuation method, and I’ll show you why the numbers only tell part of the story. Plus, I’ll reveal an even better way to unlock the real value behind the stock.

Quanta Services scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Quanta Services Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those sums back to today's dollars. This method offers a way to assess what the business is truly worth, based on its ability to generate free cash flow in the future.

For Quanta Services, the current Free Cash Flow is $1.4 Billion. Analyst forecasts project healthy growth, with Free Cash Flow expected to reach approximately $2.8 Billion by the end of 2029. While analysts provide solid estimates for the next five years, figures for subsequent years are based on Simply Wall St’s extrapolated data. Year by year, these projections indicate steady increases that support the case for Quanta’s ongoing operational strength.

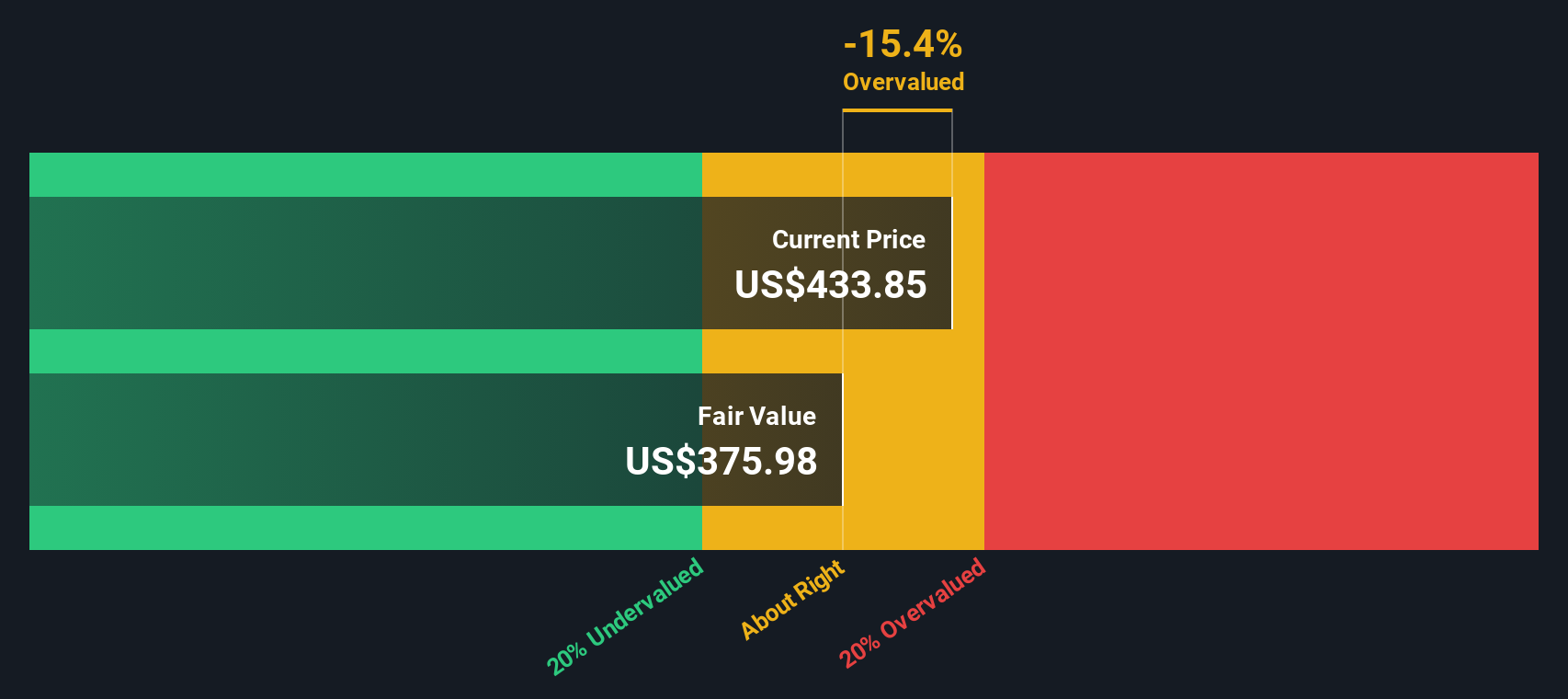

Taking these forecasts into account, the DCF model calculates an intrinsic value of $373.28 per share. With the recent share price closing at $441.82, this means the stock is trading about 18.4% higher than its intrinsic valuation. In other words, optimism around Quanta Services currently exceeds the fundamentals as calculated by this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Quanta Services may be overvalued by 18.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Quanta Services Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies like Quanta Services because it shows how much investors are willing to pay for each dollar of earnings. This is especially useful when a company is generating solid profits and provides a simple way to compare valuation to its own history, to its competitors, and to industry standards.

It is important to note that growth expectations and perceived risk play a major role in what constitutes a “normal” or “fair” PE ratio. Companies with higher growth prospects or lower risk can support a higher PE, while lower growth or greater uncertainty usually means investors will pay less for each dollar of earnings.

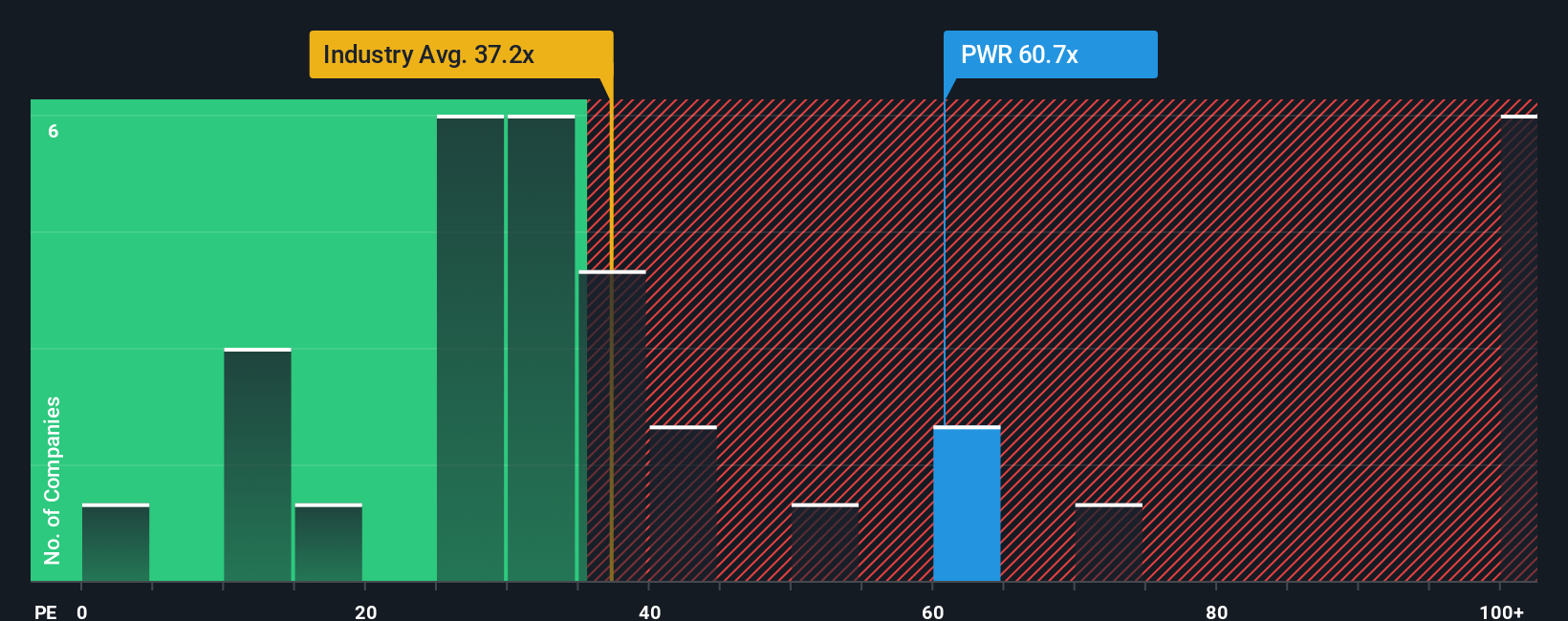

Right now, Quanta Services trades at a PE ratio of 67.7x. This is much higher than the Construction industry average of 35.3x and also above its peer group average of 39.9x. This might signal that the market is optimistic about the company’s future, or it could mean that the shares are priced for perfection.

This is where Simply Wall St’s proprietary “Fair Ratio” offers extra clarity. The Fair Ratio for Quanta Services is calculated as 39.0x, reflecting the company’s earnings growth outlook, margins, industry dynamics, size, and specific risks. Unlike a plain comparison with peers or the broader industry, this approach tailors the benchmark to the company’s unique position, giving a much more meaningful assessment of valuation.

Comparing the Fair Ratio of 39.0x to the current PE of 67.7x, Quanta Services is trading at a premium well above what fundamentals and company-specific factors suggest is fair. This implies the shares are currently overvalued by this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Quanta Services Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the unique story you build about a company like Quanta Services, connecting your perspective or investment thesis to the numbers by tying together projected revenue, earnings, and margin assumptions to arrive at a fair value.

Unlike traditional valuation methods that look only at fixed numbers, Narratives let you express why you believe a company will outperform, underperform, or move sideways, and then translate that story directly into a custom financial forecast and fair value estimate. This brings context and flexibility, making your investment approach much more dynamic and personalized.

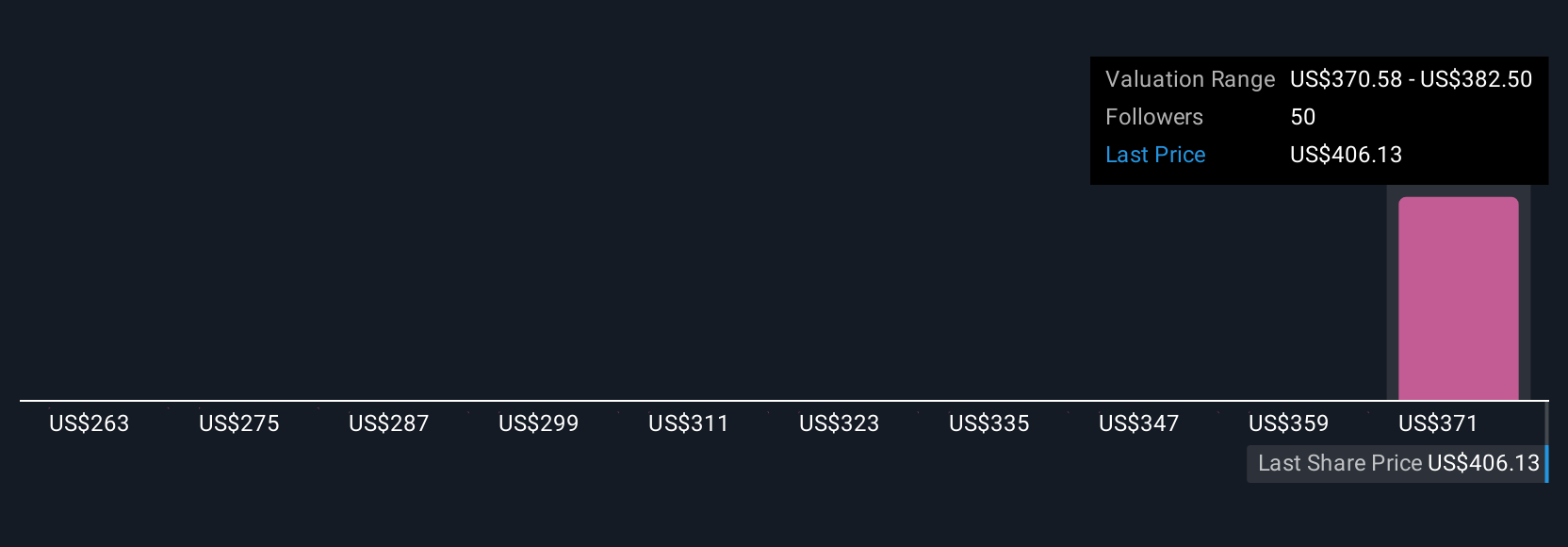

Narratives are incredibly accessible and easy to use on Simply Wall St’s Community page, where millions of investors share and compare their views. When you create or follow a Narrative, you can see the fair value calculated from those assumptions side by side with the current share price, making it clearer whether now might be a great time to buy, sell, or wait it out.

Best of all, Narratives update in real time as new information emerges, such as earnings releases or major industry news, ensuring that your assumptions and fair values are never out of date. For example, with Quanta Services, one investor’s Narrative could be very optimistic based on ongoing infrastructure demand, setting a fair value as high as $490.0. Another, more cautious Narrative could see a fair value around $248.0 if risks or execution concerns dominate their view.

Do you think there's more to the story for Quanta Services? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PWR

Quanta Services

Offers infrastructure solutions for the electric and gas utility, renewable energy, communications, pipeline, and energy industries in the United States, Canada, Australia, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives