- United States

- /

- Construction

- /

- NYSE:PWR

AEP Partnership Expansion Might Change The Case For Investing In Quanta Services (PWR)

Reviewed by Sasha Jovanovic

- Earlier this month, American Electric Power announced new long-term agreements with Quanta Services to deliver high-voltage transmission projects and expand domestic manufacturing of critical grid equipment as part of AEP's US$72 billion capital plan, with a focus on serving data centers and enhancing supply chain resilience.

- This longstanding partnership leverages AEP’s operational expertise and Quanta’s track record in large-scale project execution to address growing US grid demands, particularly in response to data center expansion and the broader energy transition.

- We'll now consider how Quanta's expanded role in grid modernization alongside AEP affects its overall investment outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Quanta Services Investment Narrative Recap

To be a shareholder in Quanta Services, you generally need to believe in the sustained growth of electricity infrastructure demand, particularly for transmission expansion driven by data centers and the energy transition. The latest AEP partnership should reinforce Quanta's backlog and its position as a top-tier grid solutions provider, but the major short-term catalyst, large-scale transmission awards, remains largely unchanged, while ongoing execution and regulatory risks persist.

The expanded alliance with American Electric Power stands out as particularly relevant, potentially enhancing Quanta’s ability to secure and deliver complex grid modernization projects. This agreement adds scale and supply chain strength, directly feeding into the broader catalyst of accelerating utility investments, yet it does not materially reduce project permitting or execution risks for Quanta right now.

Yet, despite these growth opportunities, investors should be aware that regulatory and permitting setbacks for key projects can still...

Read the full narrative on Quanta Services (it's free!)

Quanta Services' narrative projects $37.5 billion revenue and $1.7 billion earnings by 2028. This requires 12.9% yearly revenue growth and a $728 million earnings increase from $971.8 million today.

Uncover how Quanta Services' forecasts yield a $463.88 fair value, a 8% upside to its current price.

Exploring Other Perspectives

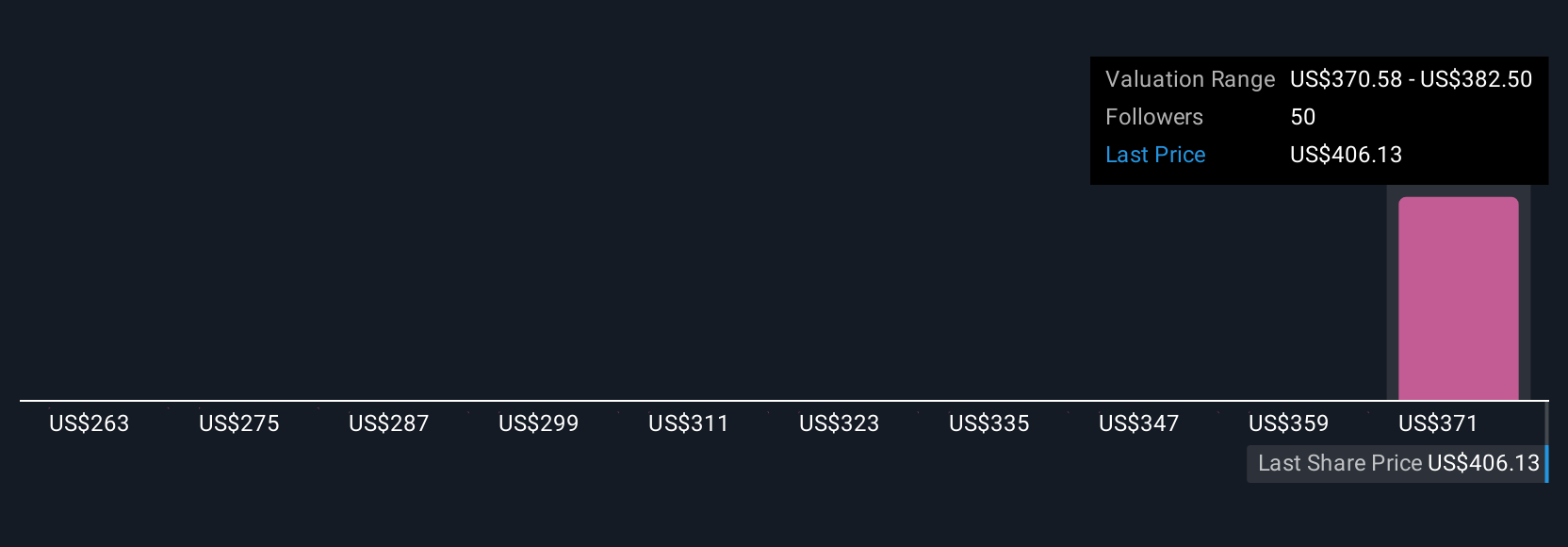

Simply Wall St Community members provided four fair value estimates for Quanta, ranging from US$263 to US$464 per share. Amid this wide spectrum, execution challenges from complex, large-scale projects remain a live issue with broader implications for future earnings reliability.

Explore 4 other fair value estimates on Quanta Services - why the stock might be worth 39% less than the current price!

Build Your Own Quanta Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quanta Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Quanta Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quanta Services' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PWR

Quanta Services

Offers infrastructure solutions for the electric and gas utility, renewable energy, communications, pipeline, and energy industries in the United States, Canada, Australia, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives