- United States

- /

- Machinery

- /

- NYSE:PRLB

How Proto Labs’ (PRLB) Earnings Beat and Executive Share Sale May Shape Advanced Manufacturing Growth

Reviewed by Sasha Jovanovic

- Proto Labs reported third-quarter 2025 earnings that exceeded market expectations, posting earnings per share of US$0.47 and revenue of US$135.4 million, both above forecasts.

- In addition to the earnings surprise, Chief Operating Officer Michael R. Kenison sold 3,048 shares after exercising options, a move frequently watched for insights into executive sentiment.

- We'll examine how Proto Labs’ strong quarterly performance and earnings beat influence its outlook for growth in advanced manufacturing.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Proto Labs Investment Narrative Recap

To be a Proto Labs shareholder, you need confidence in the company's ability to grow by meeting rising demand for advanced digital manufacturing, especially in highly regulated sectors like aerospace and medical devices. The recent third-quarter earnings beat reinforces optimism around its production-focused offerings, but does not materially change the central short-term catalyst: expansion in metal 3D printing. Key risks, such as ongoing softness in legacy prototyping and injection molding, remain highly relevant. Of the recent announcements, Proto Labs’ expanded U.S. manufacturing capacity and new certifications (ISO 13485 and AS9100D) are most relevant, directly supporting the company's drive to win more business in medical and aerospace markets. This expansion is central to their near-term growth strategy and should be watched closely as a test of demand for these high-requirement services. However, investors should also be aware that, in contrast, Proto Labs’ reliance on a concentrated group of large accounts could mean...

Read the full narrative on Proto Labs (it's free!)

Proto Labs' narrative projects $592.3 million in revenue and $33.7 million in earnings by 2028. This requires 5.2% yearly revenue growth and a $18.9 million increase in earnings from the current $14.8 million.

Uncover how Proto Labs' forecasts yield a $56.67 fair value, a 12% upside to its current price.

Exploring Other Perspectives

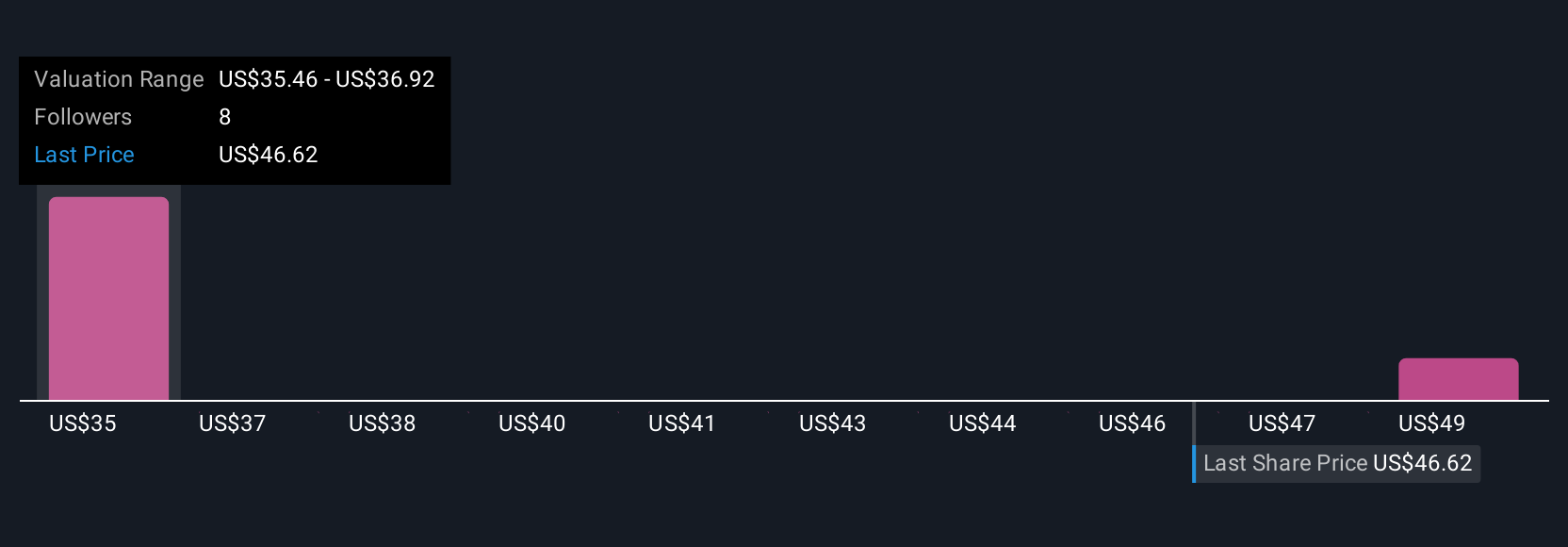

Two community fair value estimates for Proto Labs fall between US$43.33 and US$56.67 per share, echoing sharply different outlooks from the Simply Wall St Community. While some focus on advanced manufacturing as a growth driver, others note that persistent weakness in legacy services could influence future profitability, making it essential to weigh multiple viewpoints.

Explore 2 other fair value estimates on Proto Labs - why the stock might be worth as much as 12% more than the current price!

Build Your Own Proto Labs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Proto Labs research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Proto Labs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Proto Labs' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRLB

Proto Labs

Operates as a digital manufacturer of custom parts in the United States and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026