- United States

- /

- Construction

- /

- NYSE:PRIM

Primoris Services (PRIM): Valuation Check After S&P 1000 Index Inclusion and Recent Share Price Strength

Reviewed by Simply Wall St

Primoris Services (PRIM) just secured a spot in the S&P 1000, a move that can quietly reshape who owns the stock as index funds and institutional investors adjust their portfolios.

See our latest analysis for Primoris Services.

The index inclusion caps a powerful run, with the share price up strongly this year and supported by a multi year total shareholder return that signals momentum is still firmly in Primoris Services favor.

If this kind of re rating story has your attention, it might be worth seeing which other infrastructure linked names are catching bids and exploring fast growing stocks with high insider ownership.

With the stock up sharply and now trading near analyst targets, investors have to ask whether Primoris Services still offers mispriced value or if the market is already factoring in the next leg of growth.

Most Popular Narrative: 14% Undervalued

With Primoris Services last closing at $128.20 versus a narrative fair value of about $149, the current setup leans toward upside if the assumptions hold.

Surging demand from data center development, including $1.7 billion of potential contracts being pursued, is creating incremental, higher margin project opportunities across site prep, power generation, utility, and fiber network services, which is likely to lift future revenues and segment profitability.

Curious how steady mid single digit growth, rising margins, and a slightly lower future earnings multiple still point to upside from here? The narrative walks through the revenue build, margin path, and valuation bridge that underpin this higher fair value without assuming tech like growth. Want to see exactly how those moving parts stack up over the next few years?

Result: Fair Value of $149.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on large data center or renewable projects, along with renewed margin pressure in the Energy segment, could challenge the upside implied in this narrative.

Find out about the key risks to this Primoris Services narrative.

Another Angle on Value

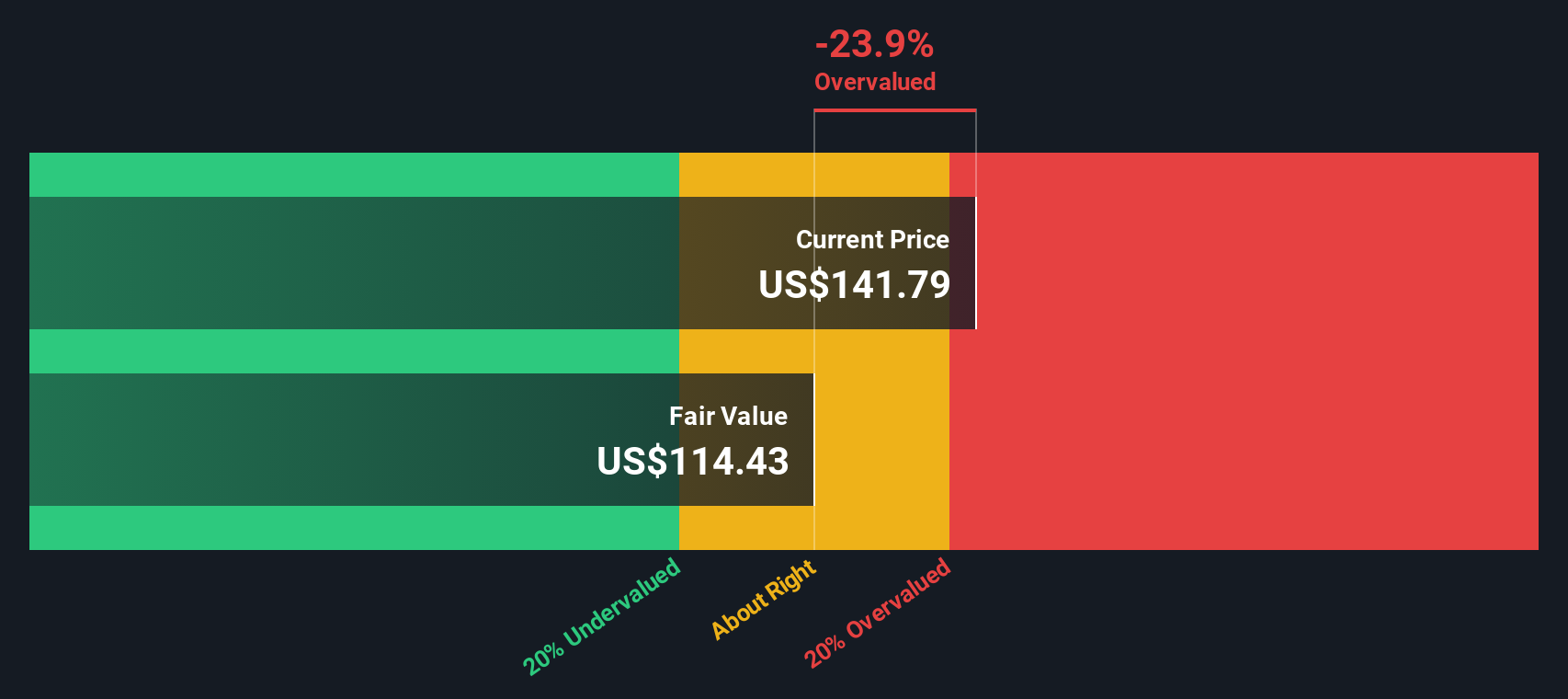

Our DCF model paints a more cautious picture, with fair value closer to $111 versus today’s $128, suggesting the shares might now be overvalued rather than cheap. If cash flows disappoint or multiples compress, is the recent rerating already a step too far?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Primoris Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Primoris Services Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your Primoris Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Turn your curiosity into action today by using the Simply Wall Street Screener to uncover fresh, data backed ideas that other investors could be missing.

- Target reliable cash generators by reviewing these 10 dividend stocks with yields > 3% that aim to keep income flowing even when markets turn volatile.

- Capitalize on structural tech shifts by scanning these 24 AI penny stocks poised to benefit from real world adoption of artificial intelligence.

- Position ahead of the next wave in computing by analyzing these 28 quantum computing stocks that may reshape entire industries over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRIM

Primoris Services

Provides infrastructure services primarily in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion