- United States

- /

- Construction

- /

- NYSE:PRIM

Primoris Services (PRIM): How Do Strong Earnings and Upgraded Outlook Shape Its Valuation?

Reviewed by Simply Wall St

Primoris Services (PRIM) reported strong third-quarter earnings with substantial year-over-year sales and net income growth. The company also boosted its full-year guidance. Investors are taking note of these positive financial updates.

See our latest analysis for Primoris Services.

Primoris Services’ upbeat earnings, a boost to this year’s outlook, and a newly declared dividend have helped reinforce investor confidence. After a strong run, the stock still shows momentum, with a year-to-date share price return of nearly 54% and a remarkable three-year total shareholder return of 467%. This suggests the long-term trend remains robust.

If these growth numbers have you thinking bigger, this is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares still delivering strong returns after an impressive run, the question now is whether Primoris Services is truly undervalued or if the market has already priced in the company’s future growth prospects.

Most Popular Narrative: 19.9% Undervalued

Primoris Services' fair value estimate stands at $147.30, noticeably above the last close of $118.04. This gap has caught the market’s attention and shapes debate about what’s possible ahead.

“Bullish analysts are raising price targets in response to strong execution and increased confidence in long-term growth across utility-scale solutions, renewables, and natural gas generation segments. Exposure to U.S.-based manufacturing and diversified end markets is seen as a competitive advantage, supporting steady cash flows and margin expansion.”

Curious why such a premium valuation is in play? Behind it are surprising assumptions about steady growth, rising margins, and sector-defining megatrends. But what is the real story behind those projections? Click through to uncover the numbers and logic driving this bullish target.

Result: Fair Value of $147.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, even with strong growth prospects, persistent margin headwinds in renewables or increased competition in data center contracts could present challenges to the bullish outlook.

Find out about the key risks to this Primoris Services narrative.

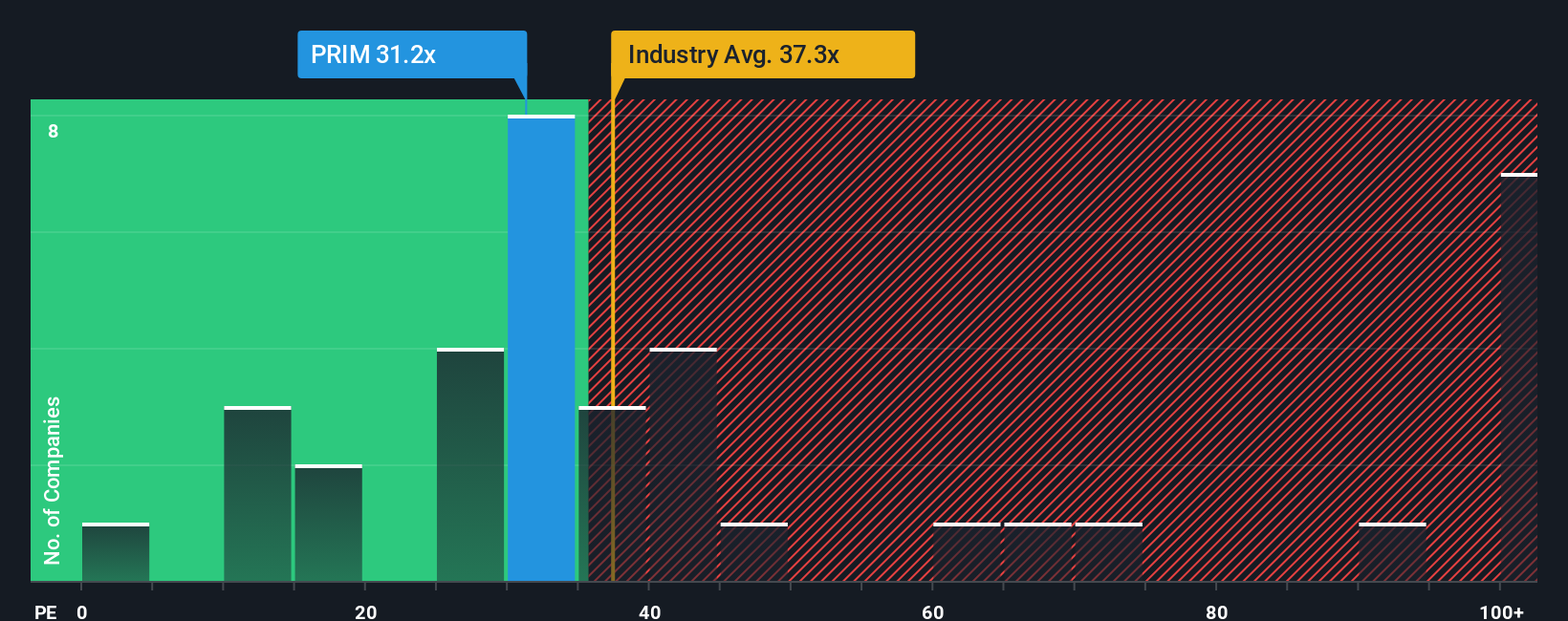

Another View: Price-to-Earnings Perspective

Taking a closer look at valuation through price-to-earnings, Primoris Services trades at 23x, noticeably lower than both the industry average of 32.7x and peers at 35.5x. The fair ratio is 26.9x, suggesting room for re-rating, but also highlighting the risk that market sentiment could shift. This apparent discount may present an opportunity, or it could indicate that the market is cautious for a reason.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Primoris Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Primoris Services Narrative

If you see the story differently or want to dive into the numbers on your own terms, you can craft your own perspective in just a few minutes with Do it your way.

A great starting point for your Primoris Services research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

No investor wins by standing still. See how far your portfolio can go by moving beyond the obvious and tapping into fresh, high-potential stock themes across the market.

- Unlock growth opportunities by checking out these 878 undervalued stocks based on cash flows to spot quality companies trading below their fair value before others catch on.

- Target steady income with these 16 dividend stocks with yields > 3%, which connects you to stocks offering attractive dividends above 3% so your returns keep working for you.

- Ride the AI innovation surge and get ahead of the curve by analyzing these 24 AI penny stocks, with options positioned at the cutting edge of artificial intelligence transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRIM

Primoris Services

Provides infrastructure services primarily in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives