- United States

- /

- Construction

- /

- NYSE:PRIM

Primoris Services (PRIM): Assessing Valuation Following Record Q3 Results and Revenue Surge

Reviewed by Simply Wall St

Primoris Services (PRIM) attracted attention after it reported a 32% increase in year-over-year revenue and delivered record third-quarter results, surpassing analyst expectations and outperforming other companies in its sector.

See our latest analysis for Primoris Services.

Primoris Services’ momentum has been impressive. After its record results, the share price has surged more than 64% year to date, reflecting renewed confidence in its growth prospects. The company’s long-term story is even stronger, with a 501.85% total shareholder return over the past three years highlighting persistent value creation for investors.

If the swift gains from Primoris have you rethinking your strategy, this is a prime opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares riding high after this earnings surge, the big question now is whether Primoris is still undervalued, or if investors have already priced in the next phase of its growth. Is there still a buying opportunity here, or has the market gotten ahead of itself?

Most Popular Narrative: 17.8% Undervalued

Primoris Services’ last close at $126.13 is well below the narrative’s fair value estimate of $153.36, signaling significant upside potential according to the broadest-followed outlook. That dynamic between market price and future narrative value sets the stage for the unfolding debate on what comes next.

Operational execution, improved productivity, and a favorable project mix in core segments (especially Utilities) are driving company-wide gross margin improvement and improved cash conversion. These factors structurally enhance Primoris's earnings and free cash flow profile.

Want to peek behind the curtain and see what’s fueling that aggressive fair value? The narrative’s assumptions hinge on rising profit margins, an earnings trajectory usually reserved for elite growth stories, and a profit multiple that could surprise even the bulls. Craving the exact playbook and bold math behind this projection? Take a closer look as hidden drivers await discovery.

Result: Fair Value of $153.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures and potential setbacks in securing key data center or renewables contracts could quickly challenge the optimistic outlook for Primoris Services.

Find out about the key risks to this Primoris Services narrative.

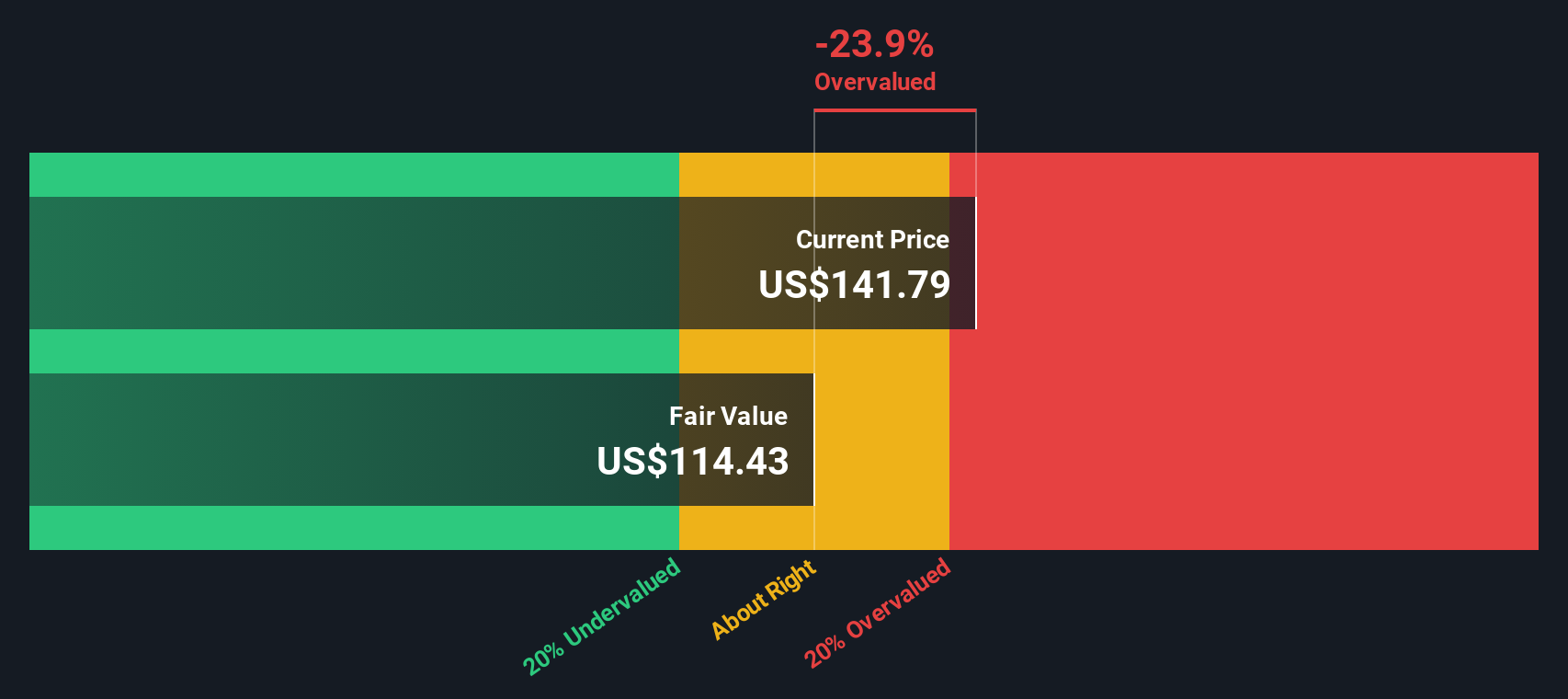

Another View: SWS DCF Model Raises Questions

While multiples suggest Primoris Services is attractively valued compared to peers, our DCF model offers a more reserved estimate of intrinsic value. In fact, the latest SWS DCF calculation indicates the current share price ($126.13) sits above its fair value of $110.49. This raises the question of whether the market may be overestimating the company's future cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Primoris Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Primoris Services Narrative

If you’re eager to challenge the consensus or dig into the numbers on your own terms, you can shape your own outlook in just a few minutes. Do it your way

A great starting point for your Primoris Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors keep their edge by tracking trends across markets. Check out handpicked opportunities that could complement your portfolio and boost your returns.

- Capture growth potential with these 27 quantum computing stocks, offering unique exposure to transformative innovation and the companies powering tomorrow’s technology breakthroughs.

- Secure steady income by tapping into these 15 dividend stocks with yields > 3%, connecting you with stocks that deliver consistent returns and attractive yield profiles.

- Expand your horizons with these 30 healthcare AI stocks, where you’ll find firms at the intersection of medicine and artificial intelligence, driving remarkable advancements in healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRIM

Primoris Services

Provides infrastructure services primarily in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success