- United States

- /

- Machinery

- /

- NYSE:PNR

The Bull Case For Pentair (PNR) Could Change Following CFO Transition and Record Earnings—Here’s What to Watch

Reviewed by Sasha Jovanovic

- Pentair announced the resignation of CFO Robert P. Fishman effective March 1, 2026, the appointment of Nicholas J. Brazis as his successor, and elevated Heather Hausmann to Executive Vice President, CIO, and CISO reporting directly to the CEO.

- Alongside executive changes, Pentair reported strong third quarter results, raised its full-year outlook, and continued its share buyback program, reflecting both operational momentum and ongoing efforts to strengthen its leadership team and digital capabilities.

- We'll examine how Pentair's record earnings and leadership transition could influence its investment narrative focused on growth and margin expansion.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Pentair Investment Narrative Recap

To be a Pentair shareholder right now, you need to believe in the company's ability to expand margins and grow through product innovation and infrastructure exposure, even as core residential pool demand remains under pressure. The latest executive changes, including the announcement of a new CFO and the elevation of tech leadership, do not appear to materially affect Pentair's primary near-term catalysts, momentum from margin expansion and industrial project growth, or its biggest current risk, which is continued weakness in residential pool volumes.

Among the recent announcements, Pentair's raised 2025 earnings and sales guidance stands out as the most relevant for investors. The company now expects full-year GAAP EPS of US$3.98 to US$4.03, which represents a 6 percent to 8 percent increase from last year, and sales growth of approximately 2 percent. This guidance reinforces the importance of ongoing margin initiatives and exposure to infrastructure spending as key drivers amid uncertainty in residential sectors.

But with all this optimism, investors should still keep in mind the potential impact of persistent pool equipment market softness on future revenue and...

Read the full narrative on Pentair (it's free!)

Pentair's outlook anticipates $4.6 billion in revenue and $943.8 million in earnings by 2028. This assumes a 3.7% annual revenue growth rate and a $334.4 million increase in earnings from the current $609.4 million.

Uncover how Pentair's forecasts yield a $120.28 fair value, a 9% upside to its current price.

Exploring Other Perspectives

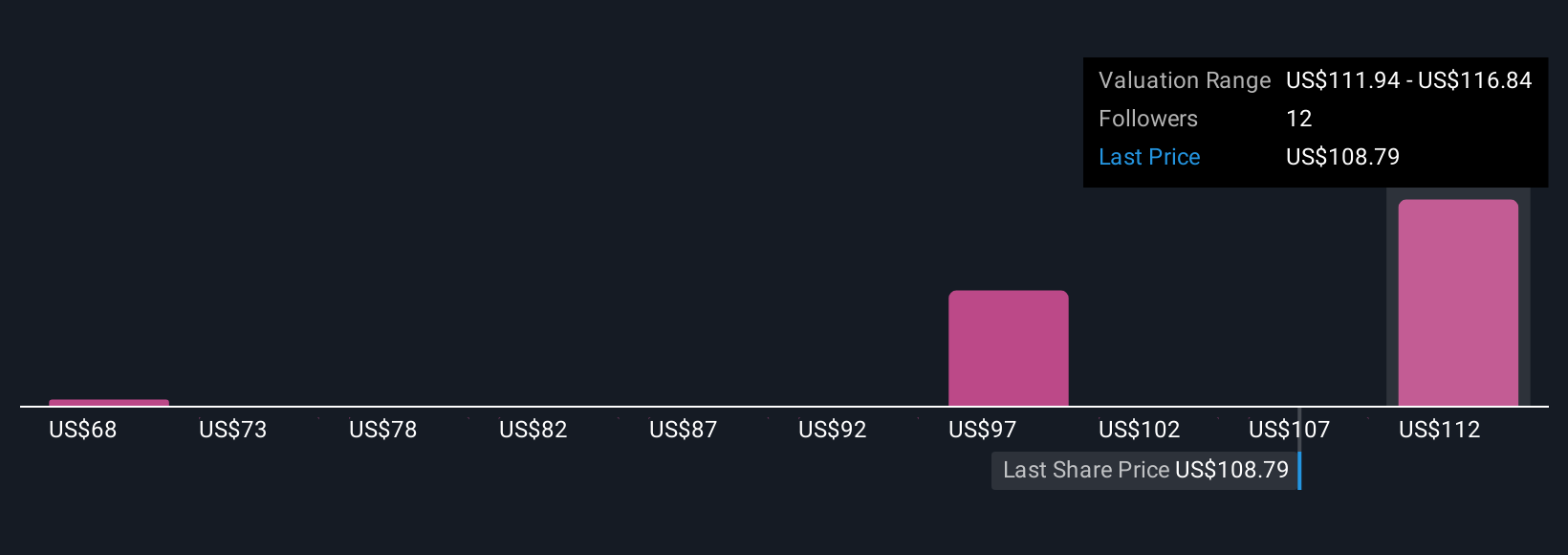

Three members of the Simply Wall St Community have set fair value for Pentair anywhere from US$67.78 to US$120.28 per share. As you review these varied views, remember that the company’s residential exposure still presents volatility for future growth.

Explore 3 other fair value estimates on Pentair - why the stock might be worth as much as 9% more than the current price!

Build Your Own Pentair Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pentair research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Pentair research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pentair's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNR

Pentair

Provides various water solutions in the United States, Western Europe, China, Eastern Europe, Latin America, the Middle East, Southeast Asia, Australia, Canada, and Japan.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives