- United States

- /

- Machinery

- /

- NYSE:PNR

Pentair (PNR): Assessing Valuation Following Solid Shareholder Returns and Portfolio Shifts

Reviewed by Kshitija Bhandaru

Pentair (PNR) has recently seen discussed activity among investors, sparking fresh conversations about the company’s growth potential. Its shares have delivered gains over the past year, which has helped keep Pentair on the radar for those monitoring capital goods stocks.

See our latest analysis for Pentair.

Momentum for Pentair has remained solid, as the company’s year-to-date share price return stands at 8.4%. Its recent upward trend reflects confidence in its growth prospects. While short-term moves have been modest, the real story is in Pentair’s longer-term trajectory. The company has delivered a 10.7% total shareholder return over the past year, with triple-digit gains for investors who have held on over several years.

If you’re considering what else is moving among capital goods stocks this year, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

But after such a strong run, is Pentair still trading at attractive levels? Or has its recent performance caused the market to fully price in the company’s future growth prospects?

Most Popular Narrative: 6.9% Undervalued

Pentair’s most popular narrative places its fair value estimate at $116.84, roughly 6.9% above the last close price of $108.79. This suggests that despite recent gains, there is still upside room based on analysts’ consensus projections.

Strategic portfolio optimization, including the divestiture of low-margin service assets and emphasis on higher-value segments (such as ICE and filtration), is expected to enhance overall business mix, improve operating margins, and deliver more stable earnings over time.

Pentair’s bullish narrative leans heavily on transformative portfolio moves and a margin story not typically seen in this sector. Want to see how ambitious growth, lasting margin expansion, and strategic bets power this valuation? The financial playbook driving these numbers may catch even long-time followers by surprise.

Result: Fair Value of $116.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in residential demand or failure to offset rising costs could quickly dampen Pentair’s positive outlook and growth momentum.

Find out about the key risks to this Pentair narrative.

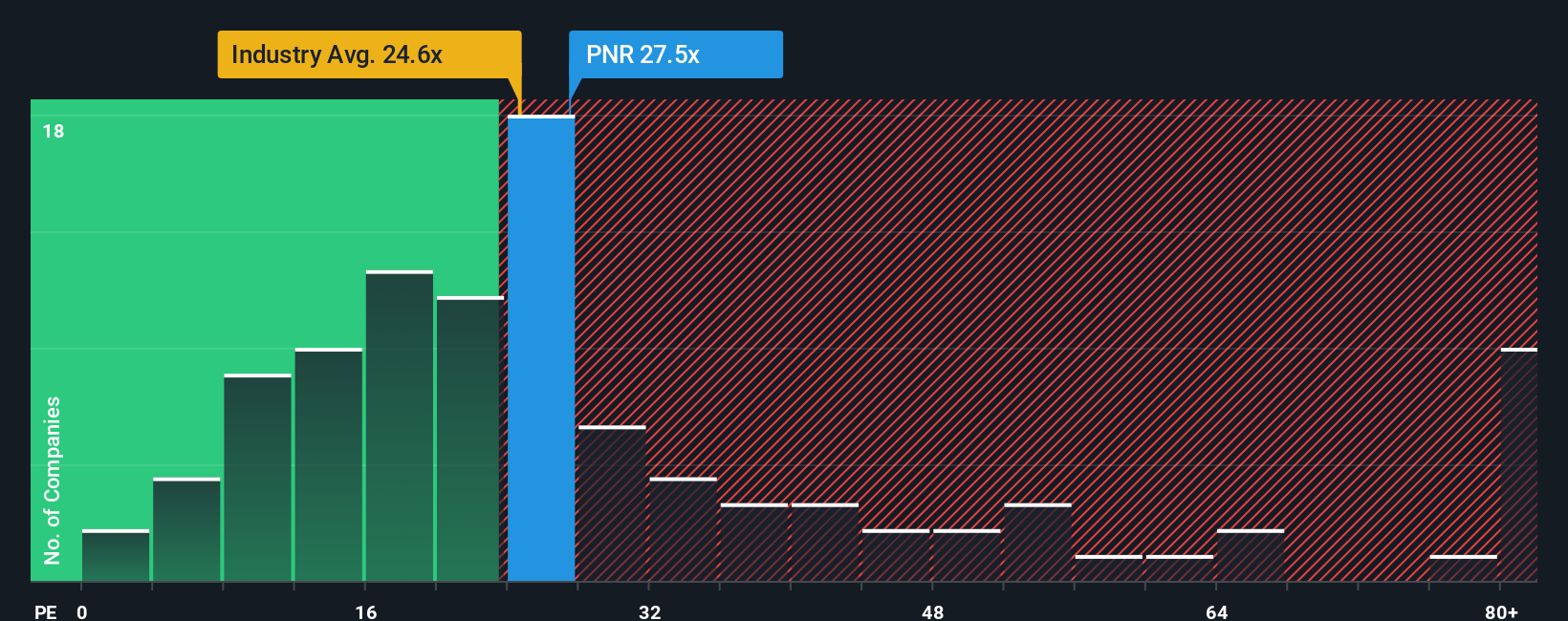

Another View: Valuation Using Market Ratios

Taking a step back, Pentair’s current price-to-earnings ratio is 29.3x. That is notably higher than the US Machinery industry average of 24.2x and also above its own fair ratio of 25.3x. The market could move toward this fair ratio. This suggests investors may be paying a premium for the stock today, which could limit future upside if expectations are not met. Does this premium make sense in light of future growth, or is there more risk priced in than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pentair Narrative

If you see things differently, or want to dig deeper and craft your own story from the data, you can build a custom Pentair narrative in just a few minutes, your way. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Pentair.

Looking for more investment ideas?

Don’t settle for a narrow watchlist when you could be uncovering tomorrow’s opportunities. Give yourself an edge by using targeted tools designed for smarter investing moves.

- Snap up potential bargains before the crowd by reviewing these 878 undervalued stocks based on cash flows that the market may be overlooking right now.

- Capitalize on the AI revolution by checking out these 24 AI penny stocks that are reshaping industries with real-world artificial intelligence solutions.

- Secure steady returns by evaluating these 18 dividend stocks with yields > 3% with attractive yields and reliable income streams above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNR

Pentair

Provides various water solutions in the United States, Western Europe, China, Eastern Europe, Latin America, the Middle East, Southeast Asia, Australia, Canada, and Japan.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives