- United States

- /

- Machinery

- /

- NYSE:PNR

A Fresh Look at Pentair’s (PNR) Valuation Following Record Results, Upgraded Guidance, and Strategic Moves

Reviewed by Simply Wall St

Pentair (PNR) just turned heads with record third-quarter results, revealing both sales and net income growth. In addition to an increased outlook for full-year earnings and sales, the company highlighted momentum from recent transformation initiatives.

See our latest analysis for Pentair.

Pentair’s series of upbeat developments, including record quarterly results, leadership moves, and continued buybacks, have all added fuel to growing investor optimism. The share price is up 9.3% year-to-date, with the one-year total shareholder return at 12.0% and a remarkable 166% total return over three years. This underscores momentum that is building behind both the business and investor confidence.

If you’re keeping an eye on strong performers and want to broaden your perspective, now is an ideal time to discover fast growing stocks with high insider ownership

Yet with recent gains and Wall Street showing optimism, the question now becomes whether Pentair’s current share price already reflects these strong results or if there is still a genuine buying opportunity ahead for investors.

Most Popular Narrative: 8.8% Undervalued

Pentair’s most popular narrative currently points to a fair value of $120.28, which is around 8.8% above the last close price of $109.73. That puts the focus squarely on what is driving analyst optimism beyond recent strong results.

Secular shifts toward stricter regulations on water quality and sustainability, alongside rising investments in ESG and resource-efficient water infrastructure, are increasing global demand for Pentair's advanced purification and filtration technologies. This supports future top-line and margin growth.

Want to know the hidden elements powering that premium? Analysts are banking on more than just the next quarter. Under the surface: aggressive forecasts, rising margins, and industry dynamics. What exactly are these bold assumptions? See the numbers behind this narrative’s price target.

Result: Fair Value of $120.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in residential demand or margin pressure from aggressive pricing could present challenges to the bullish view and hinder Pentair’s growth expectations.

Find out about the key risks to this Pentair narrative.

Another View: What Does the Price-To-Earnings Ratio Say?

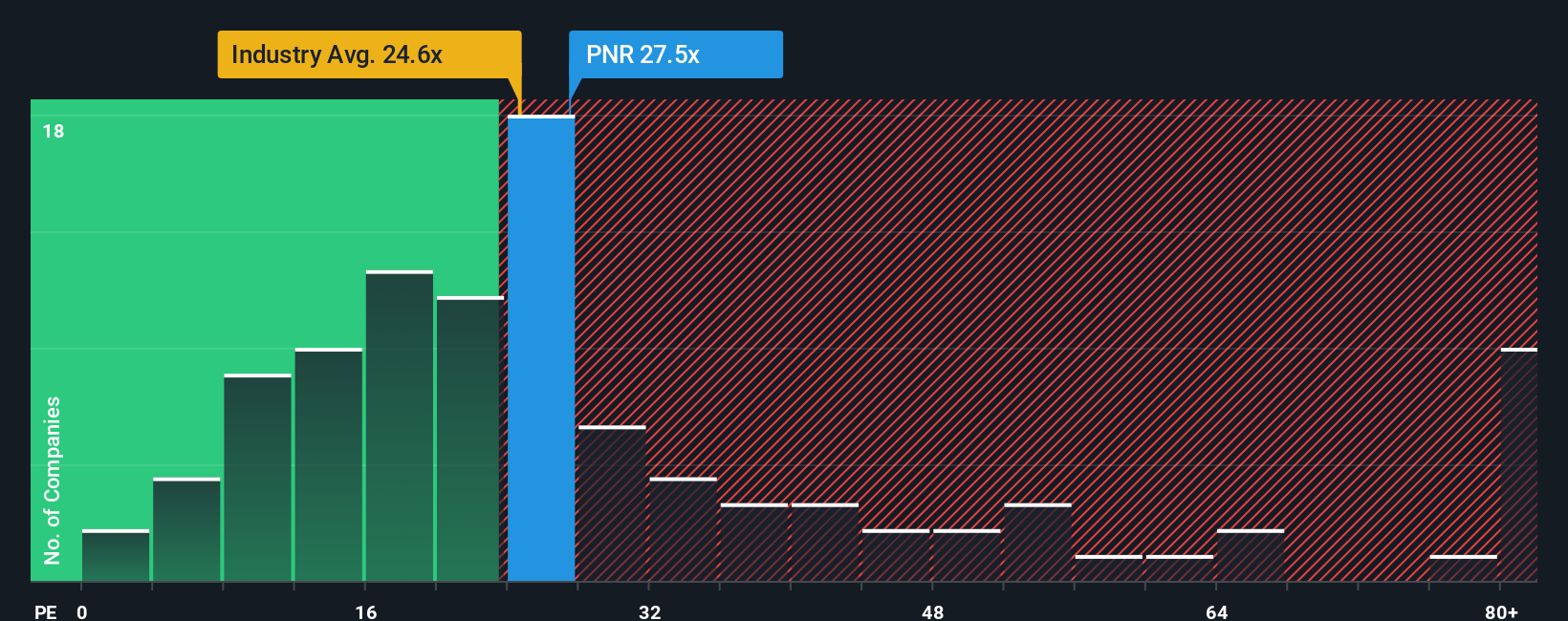

Looking through the lens of the price-to-earnings ratio, Pentair currently trades at 27.5x earnings, which is notably higher than both its peer average of 22.4x and the US Machinery industry average of 24.7x. It also sits above its estimated fair ratio of 25.3x. This suggests investors are paying a premium for Pentair’s perceived strengths, but also introduces valuation risk if market sentiment shifts. Is the confidence warranted, or could expectations be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pentair Narrative

If you have a different take on Pentair or want to dive deeper into the numbers yourself, you can easily build an independent view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Pentair.

Looking for more investment ideas?

Smart investors always stay a step ahead by searching for new opportunities. Don’t let the next winning stock slip by. Try these handpicked screeners today:

- Capitalize on steady income by checking out these 17 dividend stocks with yields > 3% with yields that stand above the crowd. This can help strengthen your portfolio’s foundation.

- Accelerate your growth potential by targeting these 27 AI penny stocks that are at the forefront of artificial intelligence innovation and shaping tomorrow’s tech landscape.

- Maximize value in your investments. Find overlooked companies using these 880 undervalued stocks based on cash flows based on strong cash flow fundamentals before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNR

Pentair

Provides various water solutions in the United States, Western Europe, China, Eastern Europe, Latin America, the Middle East, Southeast Asia, Australia, Canada, and Japan.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives