- United States

- /

- Machinery

- /

- NYSE:PNR

A Closer Look at Pentair (PNR) Valuation After Strong Q3 Earnings and Upbeat Analyst Outlook

Reviewed by Simply Wall St

See our latest analysis for Pentair.

Pentair’s strong third-quarter results have drawn a spotlight to its shares, but the momentum has been mixed. After a small dip on the latest earnings day, the company’s share price is up 6.3% year-to-date, while its 1-year total shareholder return stands at just 1.9%. However, long-term investors have enjoyed impressive gains, with a 150% total return over three years. Despite lagging the wider market recently, solid earnings growth and renewed analyst confidence suggest many believe the long-term story is still compelling.

If this kind of steady performance has you curious about broader opportunities, now's a smart time to explore fast growing stocks with high insider ownership.

Given these strong results and analyst upgrades, the key question now is whether Pentair’s solid fundamentals are still undervalued by the market or if the stock’s price already reflects its future growth prospects.Most Popular Narrative: 12.2% Undervalued

Pentair’s most popular narrative puts its fair value well above the recent closing price, suggesting analysts are betting on more upside. The main driver is a positive outlook for margins and growth, but let’s hear what underpins this optimism in their own words.

Strategic portfolio optimization, including the divestiture of low-margin service assets and emphasis on higher-value segments (such as ICE and filtration), is expected to enhance overall business mix, improve operating margins, and deliver more stable earnings over time. Continued operational transformation initiatives, such as margin expansion through complexity reduction, supply chain efficiencies, and digitalization, are projected to drive sustained margin improvement and free cash flow conversion, further strengthening Pentair's financial foundation for long-term growth.

Want to uncover the story behind these bullish numbers? The narrative teases bold margin expansion and a financial roadmap engineered for resilient growth. What is the secret sauce for that double-digit upside? Click through to see which assumptions on earnings, revenues, and profit multiples are fueling this high-conviction price target.

Result: Fair Value of $121.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in pool equipment sales and potential challenges in passing on higher prices could limit Pentair’s growth if demand does not rebound.

Find out about the key risks to this Pentair narrative.

Another View: What Do Earnings Multiples Suggest?

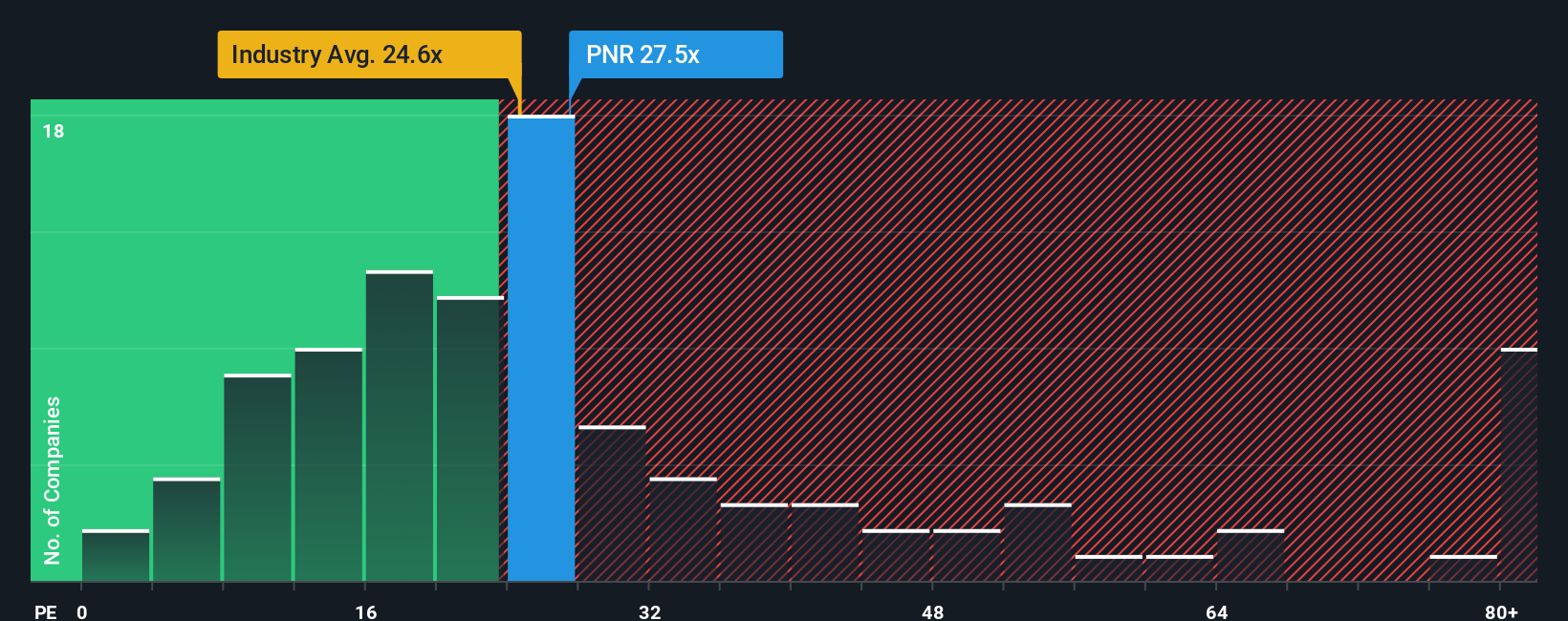

Taking a different angle, Pentair’s current price-to-earnings ratio stands at 27.2x. That is noticeably higher than both the industry average of 24.1x and its peer group at 23.2x. Even compared to its fair ratio of 25.6x, the stock looks pricey. Does this signal caution is warranted, or could strong growth justify today’s premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pentair Narrative

Not convinced by these narratives, or curious to investigate further on your own? You can easily dive into the data and craft your own perspective in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Pentair.

Looking for More Investment Ideas?

Smart investors know that the next breakthrough opportunity could be just a click away. Don’t limit yourself, set your sights on tomorrow’s winners right now.

- Uncover high yields and secure your income stream when you scan these 14 dividend stocks with yields > 3% delivering reliable payouts above 3%.

- Ride the next AI wave by tapping into growth with these 27 AI penny stocks showing serious innovation and real-world results.

- Position yourself for maximum upside by targeting these 881 undervalued stocks based on cash flows offering strong fundamentals the market may have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNR

Pentair

Provides various water solutions in the United States, Western Europe, China, Eastern Europe, Latin America, the Middle East, Southeast Asia, Australia, Canada, and Japan.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives