- United States

- /

- Machinery

- /

- NYSE:PLOW

Douglas Dynamics (PLOW) Margin Decline Undercuts Bullish Value Narrative Despite Attractive Valuation

Reviewed by Simply Wall St

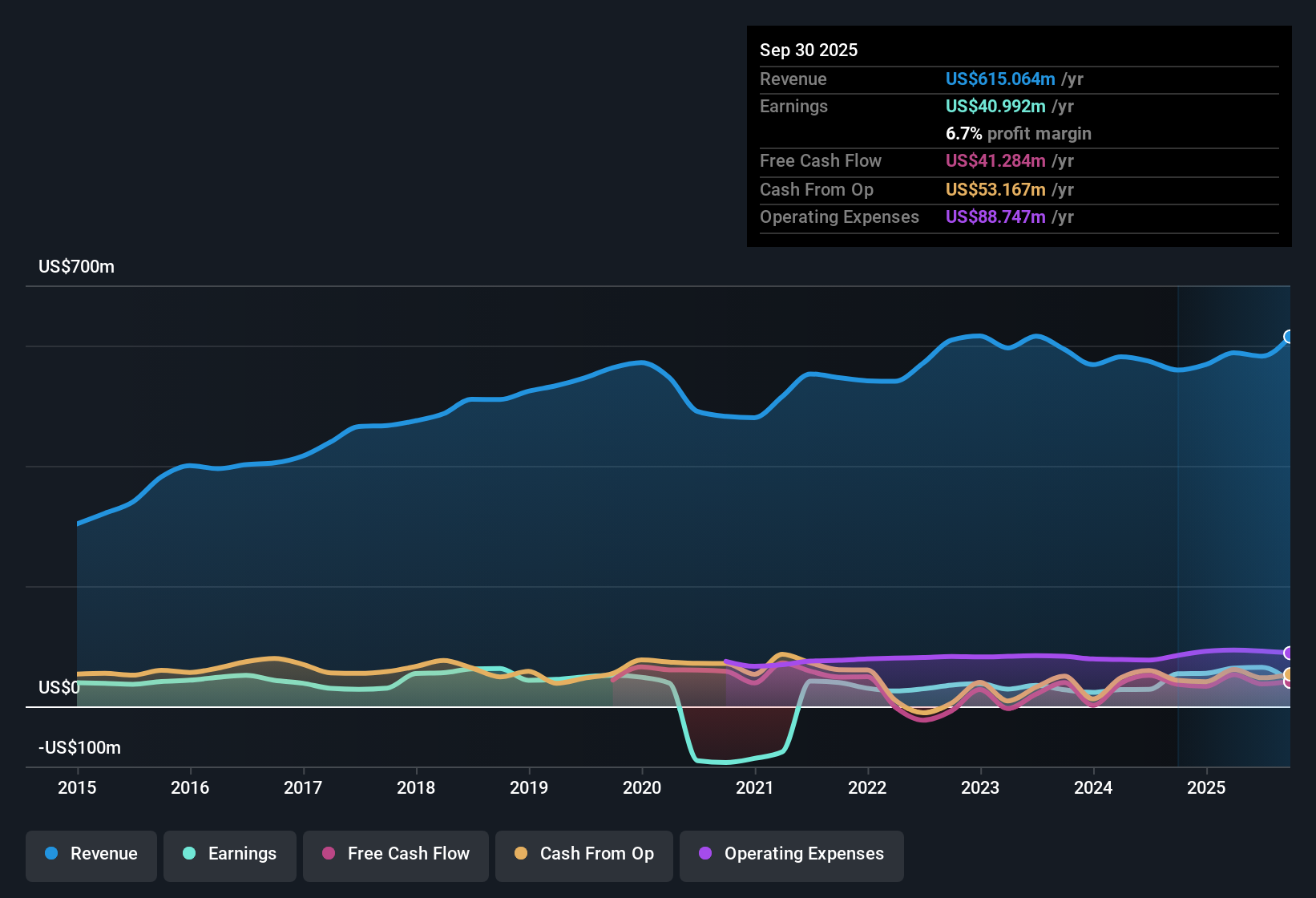

Douglas Dynamics (PLOW) posted a net profit margin of 6.6%, down from 9.7% last year, ending a five-year run of strong profitability gains that saw average annual earnings growth of 45.8%. Revenue is projected to rise by 6.5% annually, trailing the broader US market's 10.5% pace. Expected EPS growth of 14.7% also lags behind the 16% market forecast. Investors are likely to view these results as a sign of recent margin pressure. However, with shares trading below fair value and analyst targets, the stock still shows attractive value potential.

See our full analysis for Douglas Dynamics.Next, we will measure these numbers against the market's key narratives to see which stories hold up and where the data tells a different tale.

See what the community is saying about Douglas Dynamics

Profit Margin Trends Widen the Debate

- Profit margins are projected to fall from 11.2% today to 4.9% over the next three years, a steep decline that stands out even for a sector with cyclical swings.

- According to the analysts' consensus view, shrinking margins highlight the tension between Douglas Dynamics' past operating success and the structural risks ahead.

- Bears highlight that much of the long-term margin risk comes from concentrated exposure to winter weather and a customer base that is highly sensitive to economic shifts. This could turn recurring revenues volatile despite operational improvements.

- Analysts also argue that industry labor shortages and persistent cost pressures might keep the path to strong profitability rocky, even if automated technology and municipal expansion drive short-term efficiency gains.

PE Ratio Discount Signals Value Play

- With a current Price-to-Earnings ratio of 16.7x, Douglas Dynamics trades at a sizable discount to both its peer average of 25.3x and the wider US Machinery industry average of 23.9x.

- Analysts' consensus view sees this valuation gap as setting up a classic value-versus-quality debate.

- On one hand, the discount PE and price below the $37.75 analyst target reflect skepticism about whether the company can regain its former profit momentum as earnings are expected to shrink from $65.0 million to $39.1 million by 2028.

- On the other hand, the balance sheet has improved with leverage down to 2x, while the company’s dividend and track record for past earnings growth may attract income-focused investors even at lower profit levels.

Municipal Expansion and Backlog Fuel Resilience

- Douglas Dynamics has increased its municipal segment capacity by 10%, with a near-record backlog stretching into 2026, boosting visibility into stable recurring revenue.

- The analysts' consensus narrative notes that municipal and automation market growth provides an effective buffer against commercial demand softness and cyclical replacement cycles.

- Automated product innovation and diversified end-market exposure are becoming critical as snowbelt weather reliance grows riskier. Management’s focus on these segments stands out as a smart defensive move anchored in tangible growth levers.

- Still, analysts question whether these strategies are enough to offset risks like climate change and slow innovation in newer technologies, which could put long-term revenue durability to the test.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Douglas Dynamics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Share your insights and craft a unique narrative in just a few minutes. Do it your way

A great starting point for your Douglas Dynamics research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Douglas Dynamics faces challenges from narrowing profit margins, volatile demand, and forecasted earnings declines, which put its long-term stability at risk.

If steady performance is a priority, use stable growth stocks screener (2081 results) to zero in on companies with reliable earnings expansion and consistent results through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLOW

Douglas Dynamics

Operates as a manufacturer and upfitter of commercial work truck attachments and equipment in North America.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives