- United States

- /

- Machinery

- /

- NYSE:OSK

Does the Recent 12% Drop Signal Opportunity for Oshkosh in 2025?

Reviewed by Bailey Pemberton

- Thinking about Oshkosh stock and whether it’s great value right now? You’re not alone, and the numbers are worth a closer look.

- After climbing 28.7% year-to-date, Oshkosh’s price has pulled back noticeably with a 12.4% drop over the past week and an 8.4% decline in 30 days, sparking some big questions about what is driving investor sentiment.

- These moves come amid news highlighting Oshkosh’s contracts in specialty vehicles and changing defense sector demand. Market commentary around shifts in government spending and industry expansion is keeping the stock in focus for both bulls and bears.

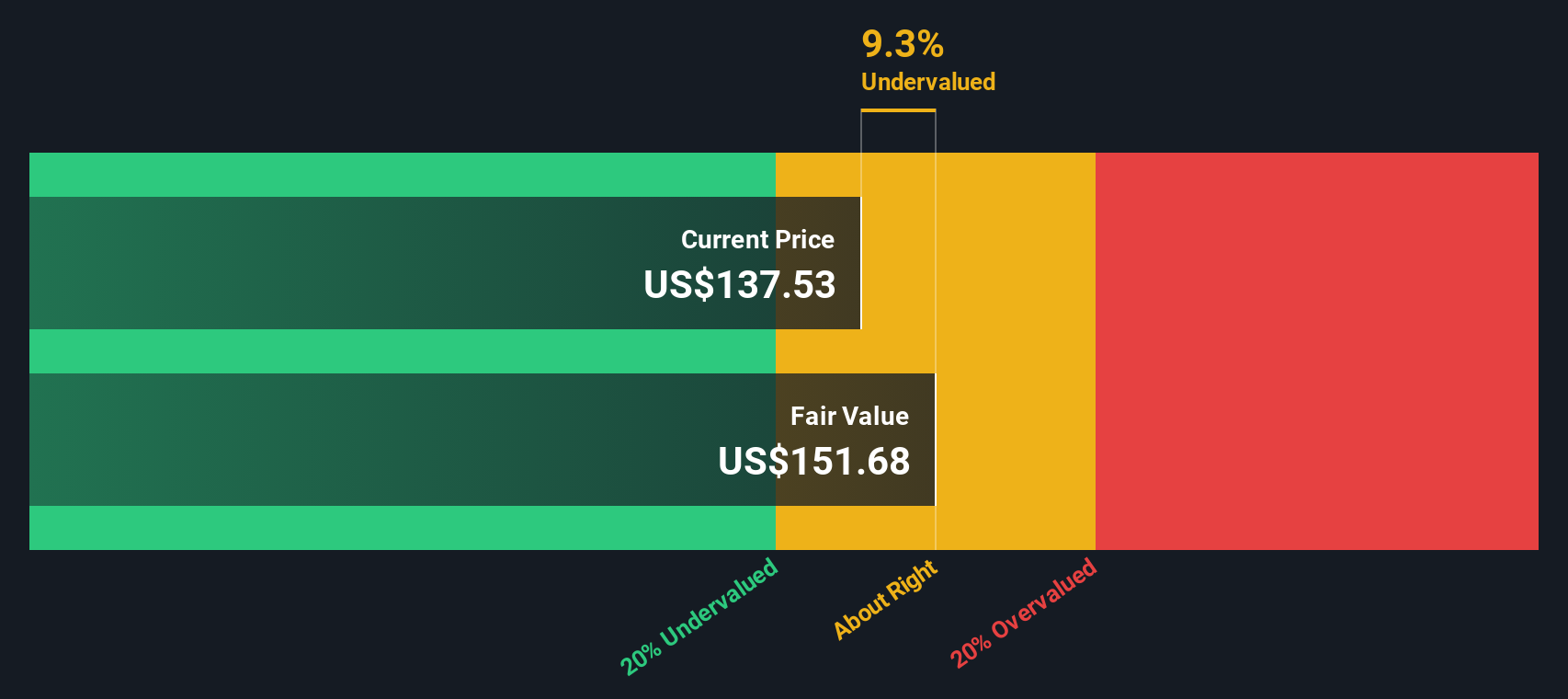

- The company currently scores a 6/6 on our undervaluation checks, a perfect score that calls for a careful look at how we value the business. Let’s examine the standard valuation methods and stay tuned for a fresh perspective on finding real value by the end of the article.

Find out why Oshkosh's 16.6% return over the last year is lagging behind its peers.

Approach 1: Oshkosh Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) method is a standard tool for valuation. It estimates the present value of a company by projecting its future cash flows and discounting them back to today’s dollars. This approach helps investors gauge what a business is intrinsically worth based on how much cash it is expected to generate.

For Oshkosh, the most recent Free Cash Flow stands at $683 million. Analyst estimates suggest that over the next five years, FCF will continue to grow, reaching $811 million by 2028. Beyond that, Simply Wall St projections extrapolate further growth, with free cash flow estimated at just under $1.2 billion by 2035. All cash flows are measured in US dollars.

Based on these projections, the DCF valuation model calculates Oshkosh’s intrinsic value at $251.44 per share, using a 2 Stage Free Cash Flow to Equity method. The model currently indicates the stock trades at a 52.1% discount compared to its calculated fair value. This suggests Oshkosh appears significantly undervalued by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Oshkosh is undervalued by 52.1%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

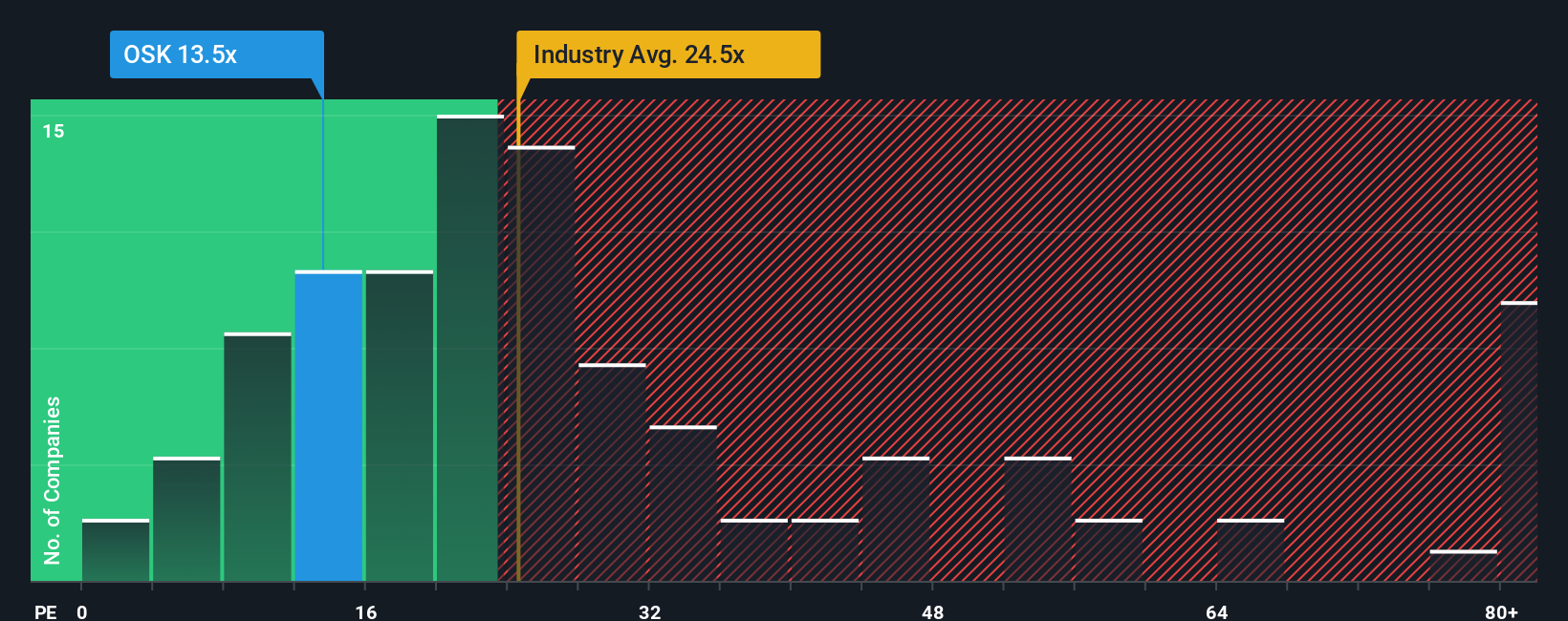

Approach 2: Oshkosh Price vs Earnings (PE Ratio)

For profitable companies like Oshkosh, the Price-to-Earnings (PE) ratio is often the go-to valuation measure. The PE ratio tells investors how much they are paying for each dollar of company earnings. This makes it especially relevant when steady profits are a core part of the business story.

What counts as a “normal” or “fair” PE ratio depends on factors like expected earnings growth and the risks tied to those earnings. Fast-growing or low-risk companies typically command higher ratios, while slower growers or those facing more uncertainty usually trade at lower multiples.

Oshkosh currently trades at an 11.4x PE ratio. This is notably below the Machinery industry average of 23.9x and below the average for its direct peers at 19.6x. On the surface, this might make Oshkosh look like a bargain.

However, instead of just comparing to industry or peers, Simply Wall St's proprietary “Fair Ratio” model digs deeper. This tailored multiple, set at 26.5x for Oshkosh, reflects not only industry norms but also the company’s specific earnings growth, risk profile, profit margins, and market cap. In this context, the Fair Ratio offers a more precise, company-specific view of what Oshkosh’s PE should be.

With the current PE multiple at 11.4x compared to a Fair Ratio of 26.5x, Oshkosh appears significantly undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

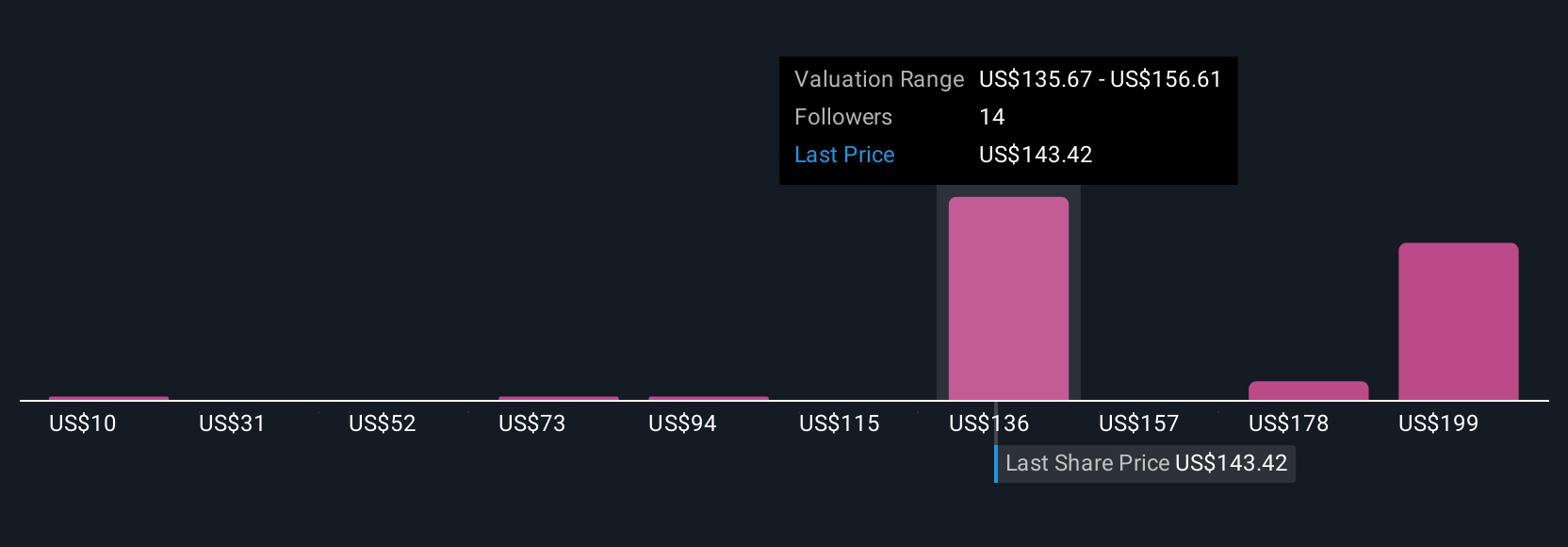

Upgrade Your Decision Making: Choose your Oshkosh Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story of what lies ahead for a company, connecting your unique perspective on Oshkosh’s business drivers and risks to a specific forecast and fair value.

Instead of relying solely on formulas or analyst consensus, a Narrative allows you to factor in your own assumptions about future revenue, profit margins, and valuation multiples. This approach makes investing more personal and intuitive. On Simply Wall St’s Community page, millions of investors use Narratives as a straightforward, accessible tool to explore, create, and share investment cases. Investors can see in real-time how their thesis translates into fair value compared to the current market price.

Because Narratives update automatically with new news or earnings results, your investment thesis stays fresh and relevant as conditions change. For example, some investors see Oshkosh’s expanding government contracts and tech innovation as justifying a price target as high as $188 per share, while others are more cautious, factoring in risks around tariffs and market cycles, and see fair value closer to $119 per share. Narratives let you quickly compare these stories and decide for yourself when a stock looks like a buy or a sell.

Do you think there's more to the story for Oshkosh? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSK

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives