- United States

- /

- Electrical

- /

- NYSE:NVT

How Investors Are Reacting To nVent Electric (NVT) Unveiling Modular Liquid Cooling for AI Data Centers

Reviewed by Sasha Jovanovic

- In November 2025, nVent Electric announced new modular data center liquid cooling solutions at SC25, including enhanced coolant distribution units, advanced manifolds, updated racks, and a comprehensive services program, developed in collaboration with industry partners like Siemens and Google’s Project Deschutes initiative.

- This move highlights nVent’s active role in shaping the infrastructure for hyperscale AI data centers and open-standard industry adoption, supporting future-proof capabilities and operational resilience.

- We'll assess how nVent’s push into modular liquid cooling for next-generation data centers impacts its long-term investment outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

nVent Electric Investment Narrative Recap

To be a shareholder in nVent Electric, you need to believe in the enduring demand for energy-efficient infrastructure across hyperscale data centers, utilities, and AI-focused sectors. The latest announcement of modular liquid cooling solutions further entrenches nVent’s position in next-generation data center infrastructure, potentially strengthening the company’s exposure to a major short-term growth catalyst, a surge in AI-related data center capital expenditures. However, this concentration remains a risk if investment trends in AI or data centers slow meaningfully; the news reinforces, but does not materially alter, that risk profile in the near term.

Among nVent’s recent developments, the collaboration with Siemens to develop a liquid cooling and power reference architecture stands out as most relevant. This partnership highlights nVent’s move toward standardization and ecosystem integration for hyperscale AI, reinforcing its role in the evolving data center value chain and directly supporting the catalysts tied to increased AI infrastructure spending.

But while bullish trends are clear, investors should also stay attuned to the risk of hyperscaler customers choosing to bring liquid cooling solutions in house, which could...

Read the full narrative on nVent Electric (it's free!)

nVent Electric's outlook anticipates $4.5 billion in revenue and $651.5 million in earnings by 2028. This scenario assumes an annual revenue growth rate of 10.4% and an earnings increase of $395.4 million from the current $256.1 million.

Uncover how nVent Electric's forecasts yield a $121.09 fair value, a 14% upside to its current price.

Exploring Other Perspectives

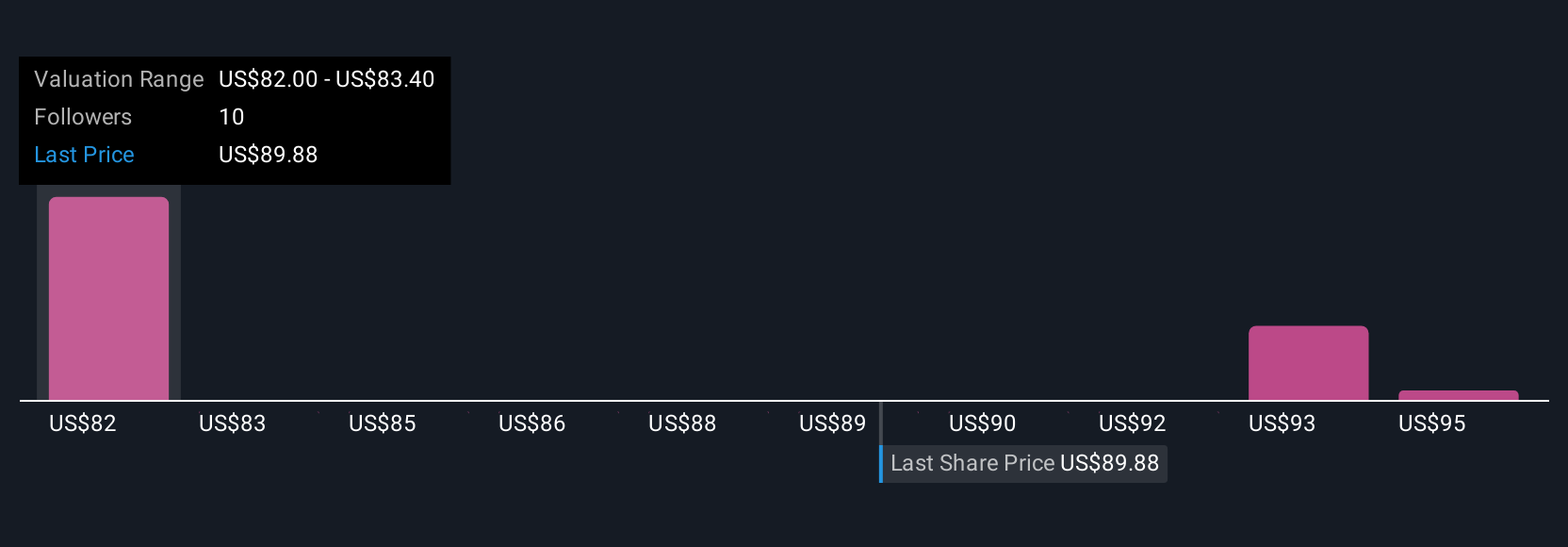

Five fair value estimates from the Simply Wall St Community range from US$73.37 to US$121.54. In contrast, concentrated exposure to AI infrastructure leaves the company’s outlook sensitive to swings in data center investment trends, explore several perspectives to form your own view.

Explore 5 other fair value estimates on nVent Electric - why the stock might be worth 31% less than the current price!

Build Your Own nVent Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nVent Electric research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free nVent Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nVent Electric's overall financial health at a glance.

No Opportunity In nVent Electric?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVT

nVent Electric

Designs, manufactures, markets, installs, and services electrical connection and protection solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success