- United States

- /

- Electrical

- /

- NYSE:NVT

A Fresh Look at nVent Electric’s (NVT) Valuation Following Major Data Center Expansion Moves

Reviewed by Simply Wall St

Most Popular Narrative: 2% Undervalued

The most widely followed narrative sees nVent Electric as currently undervalued by a small margin, with long-term catalysts still in play and moderate upside expected based on fundamental forecasts.

“The rapid acceleration in global electrification, digitalization, and the surge in AI-driven data center and power utility infrastructure is leading to record new orders and a backlog more than four times higher than a year ago. There is visibility into 2026 and beyond. This sets the stage for sustained revenue growth and increases the likelihood of multi-year topline outperformance.”

How does a booming technology wave and a massive backlog set nVent up for the future? The story behind this valuation involves bold projections for growth, margin expansion, and a forward-looking earnings target that challenges even some industry leaders. Curious which financial drivers are fueling this fair value call and how analyst assumptions set the pricing tone? Dive into the full breakdown for the numbers that could shape nVent’s next chapter.

Result: Fair Value of $98.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a slowdown in AI data center spending or difficulties integrating recent acquisitions could quickly challenge nVent Electric’s strong growth story.

Find out about the key risks to this nVent Electric narrative.Another View: How Does Market Price Stack Up?

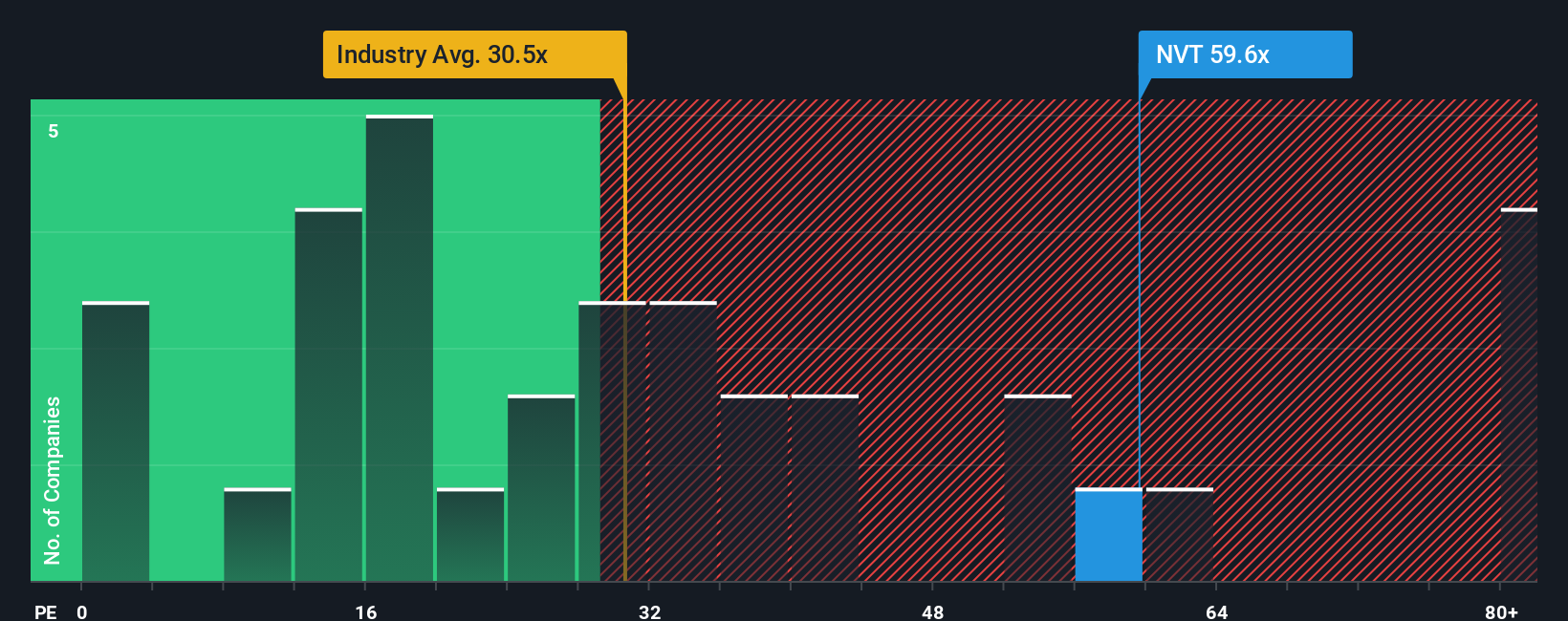

While analysts call nVent Electric undervalued based on future earnings potential, a closer look at its price-to-earnings ratio versus the industry average tells a different story. Could the market be overestimating its growth runway?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own nVent Electric Narrative

If you have a different perspective or want to dig into the numbers yourself, you can create your own narrative with just a few clicks. Do it your way.

A great starting point for your nVent Electric research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't settle for a single stock success when you could uncover tomorrow's standouts. The Simply Wall Street Screener unlocks fresh ways to power up your portfolio. Why miss out? Use these handpicked strategies to target growth, innovation, and financial strength right now:

- Jump ahead of the curve by tracking trailblazing companies in artificial intelligence and see which ones are setting trends with AI penny stocks.

- Boost your search for real value by pinpointing stocks with solid financials that the market may be underestimating, all thanks to undervalued stocks based on cash flows.

- Harvest the rewards of steady income and compounding growth by finding businesses offering impressive yields using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVT

nVent Electric

Designs, manufactures, markets, installs, and services electrical connection and protection solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives