- United States

- /

- Machinery

- /

- NYSE:MWA

How Strong Results and Leadership Changes at Mueller Water Products (MWA) Are Shaping Its Investment Story

Reviewed by Sasha Jovanovic

- Mueller Water Products recently reported robust quarterly and annual results, featuring higher revenues and earnings, while also confirming a CEO transition, a board change, and the completion of a significant share repurchase program under its original 2015 authorization.

- Despite operational outperformance, the release of weaker full-year guidance compared to peers highlighted lingering concerns about sector demand and near-term growth prospects.

- We'll explore how the combination of strong recent results and cautious guidance, alongside leadership changes, influences Mueller Water Products' investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Mueller Water Products Investment Narrative Recap

To be a Mueller Water Products shareholder, an investor needs to believe in the enduring need for U.S. water infrastructure upgrades and the company’s ability to grow alongside long-term replacement cycles. The latest earnings report showcased strong top and bottom line results, but softer guidance for 2026 highlighted near-term demand challenges as the biggest risk, while the company’s operational resilience remains a key catalyst; in this case, neither the buyback completion nor the announced leadership transition appears to significantly shift these priorities right now.

Among the recent announcements, the completion of the multi-year share repurchase program stands out. While this move reflects management’s confidence in the business and rewards for long-term holders, it does not materially alter the company's near-term demand risk or its exposure to broader macro factors like infrastructure funding and residential construction.

In contrast, investors should also be aware of how slow federal funding allocations could further limit revenue growth if…

Read the full narrative on Mueller Water Products (it's free!)

Mueller Water Products' outlook anticipates $1.6 billion in revenue and $320.8 million in earnings by 2028. This reflects a 4.1% annual revenue growth rate and an increase in earnings of $171.7 million from the current level of $149.1 million.

Uncover how Mueller Water Products' forecasts yield a $27.67 fair value, a 19% upside to its current price.

Exploring Other Perspectives

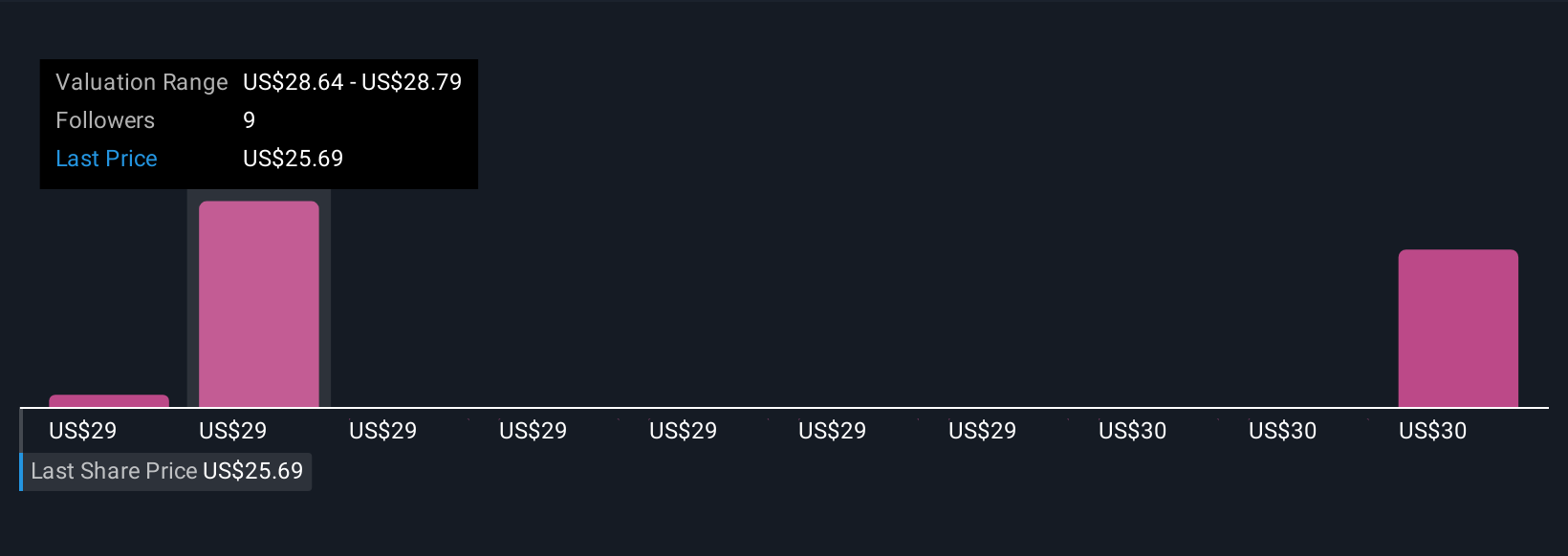

Three private investors in the Simply Wall St Community currently estimate Mueller’s fair value in a tight range from US$24.46 to US$27.67. As order growth relies on government infrastructure outlays, you may find wide differences in expectations for the company’s pace of expansion.

Explore 3 other fair value estimates on Mueller Water Products - why the stock might be worth as much as 19% more than the current price!

Build Your Own Mueller Water Products Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mueller Water Products research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mueller Water Products research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mueller Water Products' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MWA

Mueller Water Products

Manufactures and markets products and services for the transmission, distribution, and measurement of water used by municipalities, and the residential and non-residential construction industries in the United States, Israel, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives