- United States

- /

- Construction

- /

- NYSE:MTZ

Will Analyst Upgrades and Booming Revenue Shift MasTec’s (MTZ) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, a series of analyst upgrades and positive outlooks have emerged for MasTec, highlighting renewed optimism around the company's core business segments and momentum in its Telecom and Pipeline divisions. This wave of upward revisions follows the company's report of nearly 20% year-over-year revenue growth that surpassed market expectations.

- The latest analyst sentiment points to increasing confidence in MasTec's ability to execute on growth opportunities across North America's evolving infrastructure landscape.

- We'll now explore how this analyst-driven optimism, particularly around MasTec's improved Telecom and Pipeline performance, may influence its investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

MasTec Investment Narrative Recap

To be a shareholder in MasTec, you need conviction in the company's ability to harness ongoing investment cycles in North American infrastructure, communications, and energy. Recent analyst upgrades, driven by strong revenue growth and improved Telecom and Pipeline results, underscore growing confidence in MasTec’s execution. However, while positive sentiment may support near-term catalysts like backlog conversion and new project wins, risks remain, especially around the company's higher cost base should anticipated demand slow or projects be delayed.

Among the latest company announcements, MasTec’s recent quarterly report stands out: it posted nearly 20% year-over-year revenue growth, substantially exceeding market expectations and raising its full-year guidance. These results align directly with the enthusiasm shown by analysts after upgrades, reinforcing MasTec’s current growth narrative in core segments and offering evidence for the company’s momentum in key areas that analysts say are fundamental to its near-term catalysts.

In contrast, investors should also be aware that increased hiring and equipment spending could weigh on margins if project volume misses expectations...

Read the full narrative on MasTec (it's free!)

MasTec's outlook anticipates $17.2 billion in revenue and $730.8 million in earnings by 2028. This is based on a 9.6% annual revenue growth rate and an increase in earnings of $465.2 million from the current $265.6 million.

Uncover how MasTec's forecasts yield a $227.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

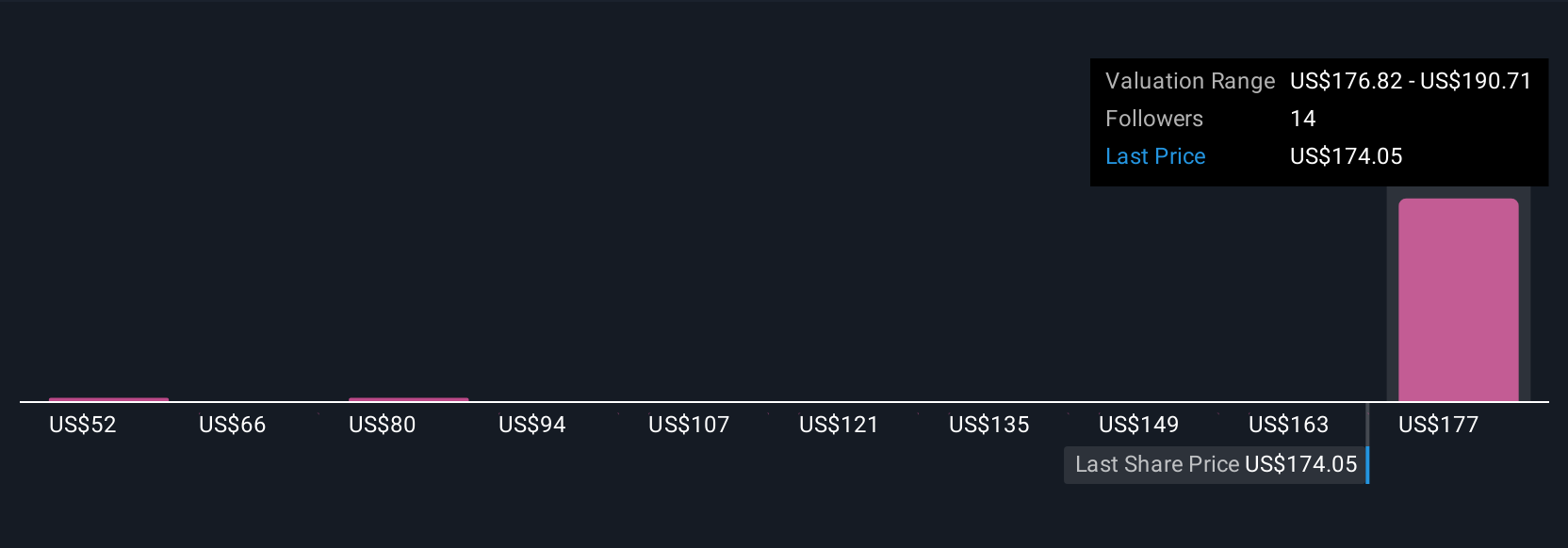

Four different fair value estimates from the Simply Wall St Community for MasTec range from US$145.34 to US$227.50. While market participants offer a wide range of views, the company’s rapid workforce and equipment expansion could prove pivotal as MasTec seeks to deliver on its infrastructure backlog.

Explore 4 other fair value estimates on MasTec - why the stock might be worth 30% less than the current price!

Build Your Own MasTec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MasTec research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MasTec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MasTec's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTZ

MasTec

An infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives