- United States

- /

- Construction

- /

- NYSE:MTZ

How Investors May Respond To MasTec (MTZ) Analyst Optimism Ahead of Anticipated Earnings Report

Reviewed by Sasha Jovanovic

- MasTec, a leading infrastructure construction company, recently gained attention ahead of its Thursday earnings report, following a period of strong revenue growth and outperformance relative to analyst expectations last quarter.

- This heightened anticipation was further supported as multiple major analysts reiterated their positive outlooks, reflecting growing confidence in MasTec's prospects across energy and communications sectors.

- With investor optimism driven by expectations for robust year-on-year growth and supportive analyst sentiment, we'll assess how these developments impact MasTec's investment narrative.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

MasTec Investment Narrative Recap

To be a shareholder in MasTec, you need to believe that the ongoing build-out of energy and communications infrastructure will continue fueling double-digit revenue and earnings growth. The upcoming earnings report has attracted investor focus, and while analyst optimism signals strong demand, the primary short-term catalyst remains execution on large projects, any stalling in end-market demand or project delays could still challenge margins in the near term, posing the main risk. Recent positive news, while encouraging, does not materially change these core factors.

Among MasTec’s latest announcements, the recent Q2 earnings report stands out, with both revenue and net income rising sharply year over year. These results align with expectations for sustained momentum and reinforce the view that MasTec's backlog in grid modernization and fiber expansion is translating into financial performance, the same factors analysts are watching closely heading into Q3 as a potential catalyst for continued outperformance.

However, in contrast to the upbeat sentiment, investors should also keep in mind the risk of project delays or cancellations by key customers, as...

Read the full narrative on MasTec (it's free!)

MasTec's narrative projects $17.2 billion revenue and $730.8 million earnings by 2028. This requires 9.6% yearly revenue growth and a $465.2 million earnings increase from $265.6 million.

Uncover how MasTec's forecasts yield a $227.50 fair value, a 7% upside to its current price.

Exploring Other Perspectives

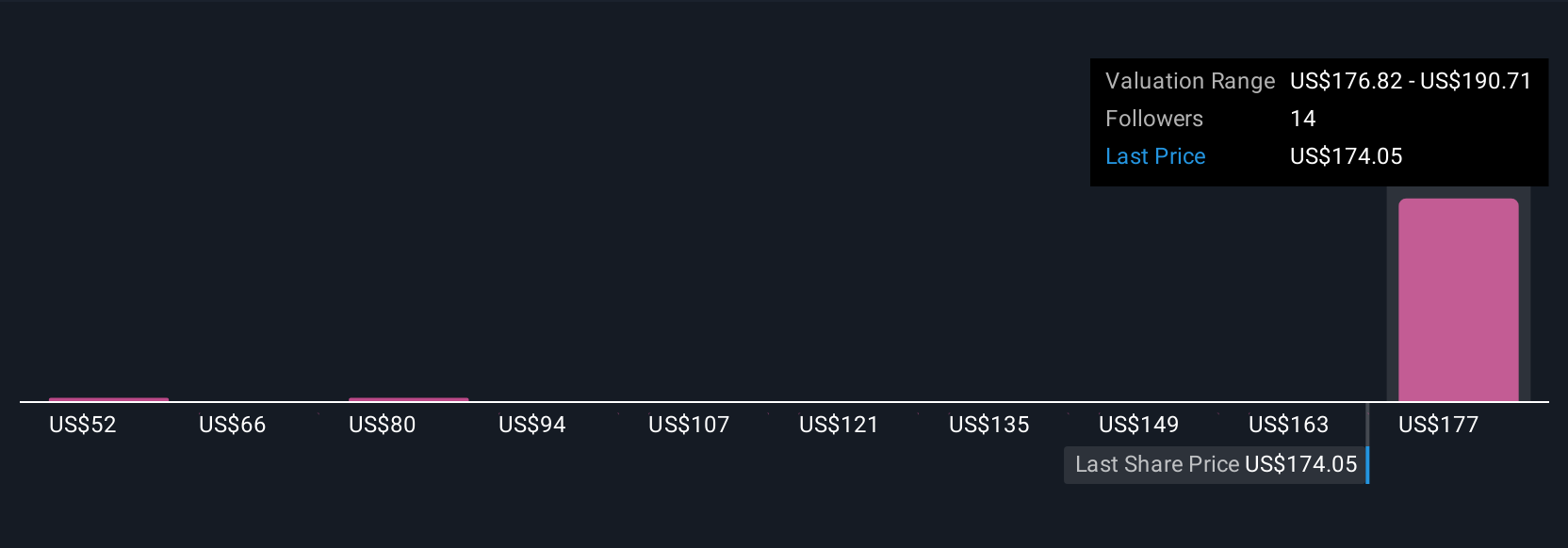

Four members of the Simply Wall St Community estimate MasTec’s fair value between US$145.34 and US$227.50 per share. While expectations for ongoing double-digit top-line growth remain high, opinions on the extent of upside potential continue to vary widely among market participants.

Explore 4 other fair value estimates on MasTec - why the stock might be worth as much as 7% more than the current price!

Build Your Own MasTec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MasTec research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MasTec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MasTec's overall financial health at a glance.

No Opportunity In MasTec?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTZ

MasTec

An infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives