- United States

- /

- Trade Distributors

- /

- NYSE:MSM

Will the Five-Year Extension of MSM's Credit Facility Reshape MSC Industrial Direct's Balance Sheet Flexibility?

Reviewed by Simply Wall St

- On July 16, 2025, MSC Industrial Direct amended its credit agreement, extending the maturity of its US$600 million revolving loan facility to July 16, 2030, updating financial covenants, and adding borrowing flexibility with a swingline sub-facility.

- This amendment signals a commitment to prudent balance sheet management and may increase the company's ability to support ongoing operational initiatives.

- We'll explore how this extension of the company's credit facility could influence MSC Industrial Direct's future operational and financial trajectory.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

MSC Industrial Direct Investment Narrative Recap

To be a shareholder in MSC Industrial Direct, you have to believe that the company can weather current soft demand, offset margin pressures from tariffs and costs, and reignite growth when conditions improve. While the amended credit agreement offers greater borrowing flexibility and signals a disciplined approach to capital management, it does not materially change the main short-term catalyst, which remains the company’s efforts to drive revenue growth amid contracting industrial activity; nor does it eliminate risks tied to tepid demand and execution on margin-improvement initiatives.

One of the most relevant recent announcements is the latest earnings report, which showed year-on-year declines in both sales and net income for the third quarter of fiscal 2025. This puts further focus on whether access to a larger, more flexible credit facility can help MSC accelerate investments in its revenue-driving programs and margin enhancements, or whether ongoing macroeconomic and execution risks will continue to weigh on near-term results.

Yet, as investors consider the upside, it’s important not to overlook how rising operating expenses could affect...

Read the full narrative on MSC Industrial Direct (it's free!)

MSC Industrial Direct's outlook anticipates $4.3 billion in revenue and $293.5 million in earnings by 2028. This is based on analysts forecasting 4.5% annual revenue growth, with earnings expected to increase by $95 million from the current $198.5 million.

Uncover how MSC Industrial Direct's forecasts yield a $88.84 fair value, in line with its current price.

Exploring Other Perspectives

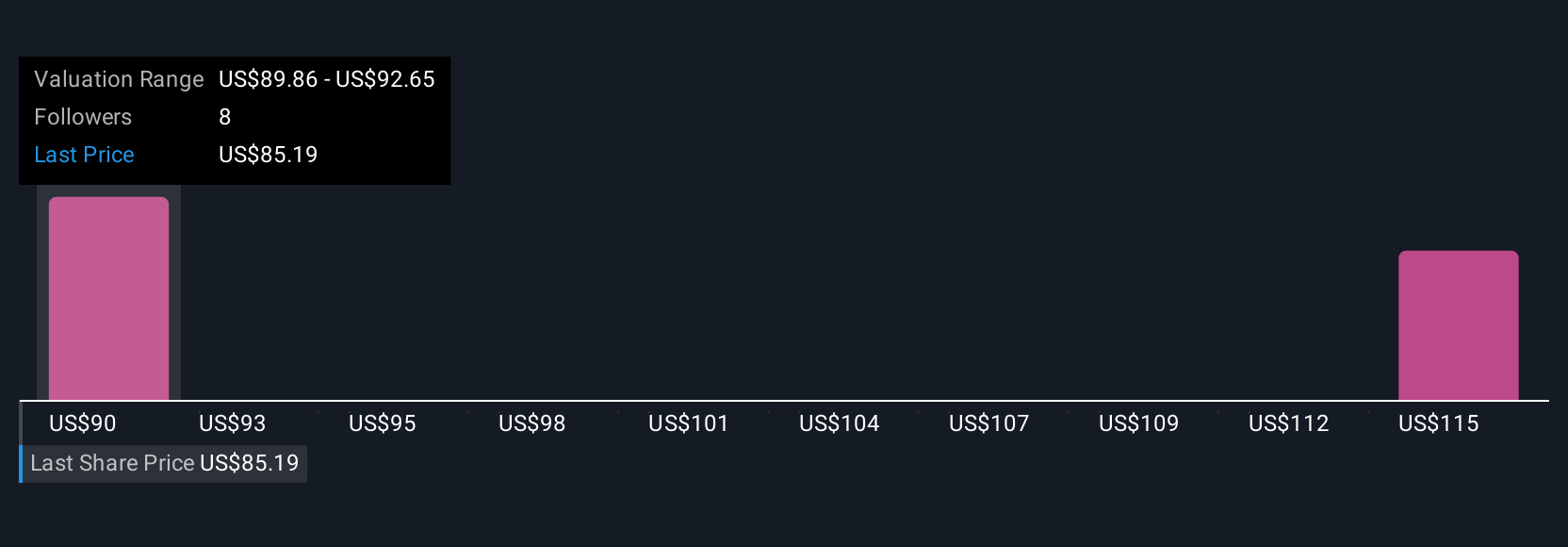

Simply Wall St Community members shared two fair value estimates for MSC Industrial Direct, ranging widely from US$88.84 to US$117.19 per share. With margin pressures still a key risk, these differing outlooks reflect how much opinions can vary, prompting you to review multiple viewpoints on the company’s path forward.

Explore 2 other fair value estimates on MSC Industrial Direct - why the stock might be worth just $88.84!

Build Your Own MSC Industrial Direct Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MSC Industrial Direct research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MSC Industrial Direct research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MSC Industrial Direct's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSM

MSC Industrial Direct

Engages in the distribution of metalworking and maintenance, repair, and operations (MRO) products and services in the United States, Canada, Mexico, the United Kingdom, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives